by Calculated Risk on 8/01/2013 03:03:00 PM

Thursday, August 01, 2013

U.S. Light Vehicle Sales decline to 15.6 million annual rate in July, Best July since 2006

Based on an estimate from WardsAuto, light vehicle sales were at a 15.61 million SAAR in July. That is up 11% from July 2012, and down 2% from the sales rate last month.

This was below the consensus forecast of 15.8 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 15.61 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

This is highest level for July auto sales since 2006.

After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another solid year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and had been a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 8% from 2012.

Construction Spending declined in June, Public Construction Spending at Lowest Level since 2006

by Calculated Risk on 8/01/2013 11:54:00 AM

The Census Bureau reported that overall construction spending declined in June:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2013 was estimated at a seasonally adjusted annual rate of $883.9 billion, 0.6 percent below the revised May estimate of $889.4 billion. The June figure is 3.3 percent above the June 2012 estimate of $855.8 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $622.8 billion, 0.4 percent below the revised May estimate of $625.4 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $261.1 billion, 1.1 percent below the revised May estimate of $264.0 billion.

Click on graph for larger image.

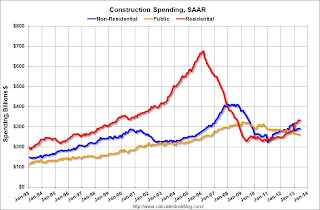

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 51% below the peak in early 2006, and up 45% from the post-bubble low.

Non-residential spending is 30% below the peak in January 2008, and up about 29% from the recent low.

Public construction spending is now 20% below the peak in March 2009 and at the lowest level since 2006.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 23%. Non-residential spending is up slightly year-over-year. Public spending is down 9.3% year-over-year.

A few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. I expect private non-residential to start to increase later this year.

3) Public construction spending decreased in June. Public spending has declined to 2006 levels (not adjusted for inflation) and has been a drag on the economy for 4 years. In real terms, public construction spending has declined to 2001 levels.

The good news going forward is 1) private residential construction spending is still very low and will probably continue to increase over the next few years, 2) Private non-residential spending appears about to increase (see forecast from American Institute of Architects, and 3) public construction spending is probably close to a bottom.

ISM Manufacturing index increases in July to 55.4

by Calculated Risk on 8/01/2013 10:00:00 AM

The ISM manufacturing index indicated faster expansion in July. The PMI was at 55.4% in July, up from 50.9% in June. The employment index was at 54.4%, up from 48.7%, and the new orders index was at 58.3%, up from 51.9% in June.

From the Institute for Supply Management: July 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in July for the second consecutive month, and the overall economy grew for the 50th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 55.4 percent, an increase of 4.5 percentage points from June's reading of 50.9 percent. June's PMI™ reading, the highest of the year, indicates expansion in the manufacturing sector for the second consecutive month. The New Orders Index increased in July by 6.4 percentage points to 58.3 percent, and the Production Index increased by 11.6 percentage points to 65 percent. The Employment Index registered 54.4 percent, an increase of 5.7 percentage points compared to June's reading of 48.7 percent. The Prices Index registered 49 percent, decreasing 3.5 percentage points from June, indicating that overall raw materials prices decreased from last month. Comments from the panel generally indicate stable demand and slowly improving business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 53.1% and suggests manufacturing expanded at a faster pace in July.

Weekly Initial Unemployment Claims decline to 326,000

by Calculated Risk on 8/01/2013 08:30:00 AM

The DOL reports:

In the week ending July 27, the advance figure for seasonally adjusted initial claims was 326,000, a decrease of 19,000 from the previous week's revised figure of 345,000. The 4-week moving average was 341,250, a decrease of 4,500 from the previous week's revised average of 345,750.

The previous week was revised up from 343,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 341,250.

The 4-week average has mostly moved sideways over the last few months, and is near the low for the year. Claims were below to the 345,000 consensus forecast.

Wednesday, July 31, 2013

Thursday: Vehicle Sales, Unemployment Claims, ISM Mfg Index, Construction Spending

by Calculated Risk on 7/31/2013 08:29:00 PM

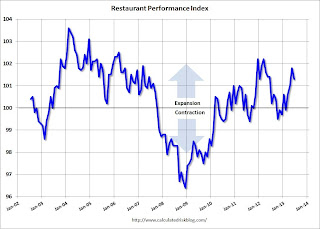

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

From the National Restaurant Association: Despite June Decline, Restaurant Performance Index Remains Steadily Positive

As a result of positive sales and traffic and an optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) remained in expansion territory in June. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.3 in June, down 0.5 percent from May’s level of 101.8. Despite the decline, June represented the fourth consecutive month that the RPI exceeded the 100 level, which signifies expansion in the index of key industry indicators.

“Although the overall RPI dipped somewhat in June, it remained in positive territory as restaurant operators continued to report gains in both sales and customer traffic,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, restaurant operators remain generally optimistic about the business environment in the months ahead, with the Expectations Index holding steady at a 12-month high.”

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.3 in June from 101.8 in May. (above 100 indicates expansion).

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for an increase to 345 thousand from 343 thousand last week.

• All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 15.8 million SAAR in July (Seasonally Adjusted Annual Rate) from 15.9 million SAAR in June.

• At 9:00 AM, The Markit US PMI Manufacturing Index for July. The consensus is for the index to increase to 53.1 from 51.9 in June.

• At 10:00 AM, the ISM Manufacturing Index for July. The consensus is for an increase to 53.1 from 50.9 in June. Based on the regional surveys, an increase in July seems likely. The ISM manufacturing index indicated expansion in June at 50.9%. The employment index was at 48.7%, and the new orders index was at 51.9%.

• Also at 10:00 AM, Construction Spending for June. The consensus is for a 0.4% increase in construction spending.