by Calculated Risk on 8/01/2013 11:54:00 AM

Thursday, August 01, 2013

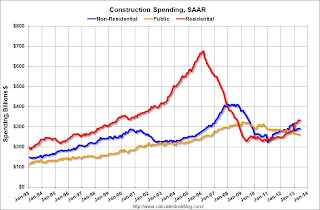

Construction Spending declined in June, Public Construction Spending at Lowest Level since 2006

The Census Bureau reported that overall construction spending declined in June:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2013 was estimated at a seasonally adjusted annual rate of $883.9 billion, 0.6 percent below the revised May estimate of $889.4 billion. The June figure is 3.3 percent above the June 2012 estimate of $855.8 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $622.8 billion, 0.4 percent below the revised May estimate of $625.4 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $261.1 billion, 1.1 percent below the revised May estimate of $264.0 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 51% below the peak in early 2006, and up 45% from the post-bubble low.

Non-residential spending is 30% below the peak in January 2008, and up about 29% from the recent low.

Public construction spending is now 20% below the peak in March 2009 and at the lowest level since 2006.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 23%. Non-residential spending is up slightly year-over-year. Public spending is down 9.3% year-over-year.

A few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. I expect private non-residential to start to increase later this year.

3) Public construction spending decreased in June. Public spending has declined to 2006 levels (not adjusted for inflation) and has been a drag on the economy for 4 years. In real terms, public construction spending has declined to 2001 levels.

The good news going forward is 1) private residential construction spending is still very low and will probably continue to increase over the next few years, 2) Private non-residential spending appears about to increase (see forecast from American Institute of Architects, and 3) public construction spending is probably close to a bottom.