by Calculated Risk on 7/24/2013 10:00:00 AM

Wednesday, July 24, 2013

New Home Sales at 497,000 Annual Rate in June

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 497 thousand. This was up from 459 thousand SAAR in May (May sales were revised down from 476 thousand).

March sales were revised down from 451 thousand to 443 thousand, and April sales were revised down from 466 thousand to 453 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in June 2013 were at a seasonally adjusted annual rate of 497,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.3 percent above the revised May rate of 459,000 and is 38.1 percent above the June 2012 estimate of 360,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in June to 3.9 months from 4.2 months in May.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of June was 161,000. This represents a supply of 3.9 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is at a record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In June 2013 (red column), 48 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in June. The high for June was 115 thousand in 2005, and the low for June was 28 thousand in 2010 and 2011.

This was above expectations of 481,000 sales in June, and a solid report even with the downward revisions to previous months. I'll have more later today.

MBA: Mortgage Applications decrease slightly in Latest Weekly Survey

by Calculated Risk on 7/24/2013 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 1 percent from the previous week driven by a 12 percent drop in the Government Refinance index while the Conventional Refinance index rose by 2 percent. The Refinance Index is at the lowest level since July 2011. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

The refinance share of mortgage activity remained unchanged at 63 percent of total applications.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.58 percent from 4.68 percent, with points decreasing to 0.40 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

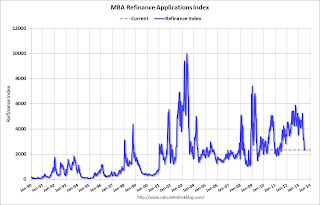

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4.5%, refinance activity has fallen sharply, decreasing in 10 of the last 11 weeks.

This index is down 55% over the last eleven weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 6% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year (but down over the last several weeks), and the 4-week average of the purchase index is up about 6% from a year ago.

Tuesday, July 23, 2013

Wednesday: New Home Sales

by Calculated Risk on 7/23/2013 09:17:00 PM

From the WSJ: Easing of Mortgage Curb Weighed

Concerned that tougher mortgage rules could hamper the housing recovery, regulators are preparing to relax a key plank of the rules proposed after the financial crisis.We need to see the final rules, but it is important that the interests of the mortgage lenders align - at least a little - with the interest of those who invest in mortgage backed securities.

The watchdogs, which include the Federal Reserve and Federal Deposit Insurance Corp., want to loosen a proposed requirement that banks retain a portion of the mortgage securities they sell to investors, according to people familiar with the situation.

The plan, which hasn't been finalized and could still change, would be a major U-turn for the regulators charged with fleshing out the Dodd-Frank financial-overhaul law passed three years ago.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash for July. The consensus is for an increase to 52.8 from 52.2 in June.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for an increase in sales to 481 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 476 thousand in May.

• During the day: the AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

DataQuick: Q2 California Foreclosure Starts up from Q1, Down 52.9% from Q2 2012

by Calculated Risk on 7/23/2013 05:24:00 PM

From DataQuick: California Foreclosure Starts Up From First Quarter

While up from the first quarter, the number of California homeowners entering the foreclosure process was at its second-lowest level in seven years last quarter, largely the result of a steep rise in home values, a real estate information service reported.

Lenders filed 25,747 Notices of Default (NoDs) during the April-to-June period. That was up 38.7 percent from 18,568 for the previous quarter, and down 52.9 percent from 54,615 for second-quarter 2012, according to San Diego-based DataQuick.

The 18,568 NoDs filed in the first quarter of this year marked the lowest quarterly total since fourth-quarter 2005, when 15,337 NoDs were recorded. In addition to less distress in the housing market pipeline, this year's remarkably low first-quarter number mainly reflected policy and regulatory changes.

NoD filings plummeted early this year as a package of new state foreclosure laws - the "Homeowner Bill of Rights" - took effect on January 1. In California and other states in recent years foreclosure activity has sometimes plunged temporarily after a new law kicks in and the industry takes time to adjust.

Setting aside this year's first quarter, last quarter's NoD tally was the lowest since second-quarter 2006, when 20,909 NoDs were recorded. California NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

"At this point in the cycle, it's fairly straightforward to see what's going on. Just do the math - it's not calculus, it's 4th grade arithmetic. A foreclosure only makes sense when the home is worth less than what is owed on it. As home values rise, fewer homeowners owe more on their homes than the homes are worth," said John Walsh, DataQuick president.

Click on graph for larger image.

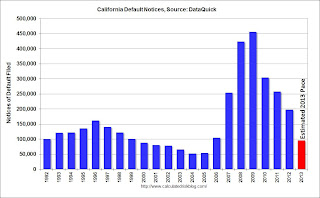

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. For 2013 (red), the bar is an estimated annual rate (since the California "Homeowner Bill of Rights" slowed foreclosure activity in Q1, the estimate rate is Q1 + 3 times Q2).

It looks like this will be the lowest year for foreclosure starts since 2005, and also below the levels in 1997 through 1999 when prices were rising following the much smaller housing bubble / bust in California.

ATA Trucking Index increases slightly in June

by Calculated Risk on 7/23/2013 02:51:00 PM

Here is a minor indicator that I follow that is at a new record high, from ATA: ATA Truck Tonnage Index Rose 0.1% in June

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index edged 0.1% higher in June after surging 2.1% in May. ... In June, the SA index equaled 125.9 (2000=100) versus 125.8 in May. June 2013 is the highest level on record. Compared with June 2012, the SA index surged 5.9%, which is robust, although below May’s 6.5% year-over-year gain. Year-to-date, compared with the same period in 2012, the tonnage index is up 4.7%.

“The fact that tonnage didn’t fall back after the 2.1% surge in May is quite remarkable,” ATA Chief Economist Bob Costello said. “While housing starts were down in June, tonnage was buoyed by other areas like auto production which was very strong in June and durable-goods output, which increased 0.5% during the month according to the Federal Reserve.”

emphasis added

Click on graph for larger image.

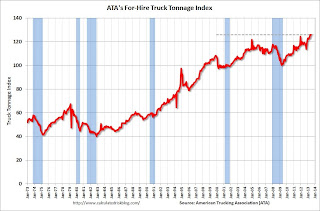

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is fairly noisy, but the index is at a record high and is up solidly year-over-year.