by Calculated Risk on 7/18/2013 07:58:00 PM

Thursday, July 18, 2013

Research: Labor force participation rate expected to stay flat through 2015

I've written frequently about the participation rate (the percent of the civilian noninstitutional population in the labor force). A few posts: Understanding the Decline in the Participation Rate, Update: Further Discussion on Labor Force Participation Rate, Merrill Lynch on Labor Force Participation Rate, Labor Force Participation Rate Research

The participation rate was expected to decline for structural reasons even before the great recession started (baby boomers retiring, younger Americans staying in school longer, etc.). A key question is how much of the recent decline in the participation rate was due to long term trends, and how much was cyclical (economic weakness)?

Here is some research from Macroeconomic Advisers: Where’s Labor Force Participation Heading?

• Fifty-five percent of the recent decline in the participation rate is due to structural factors that, on balance, will continue to exert downward pressure on participation through 2015.CR Note: A significant portion of the decline in the unemployment rate from 10.0% in October 2009 to 7.6% in June 2013 was related to a decline in the participation rate from 65.0% in Oct 2009 to 63.5% in June 2013. If the participation rate had held steady, the unemployment rate would be 9.7% (assuming an increase in the participation rate with the same employment level).

• The other forty-five percent is cyclical and will gradually abate. However, the cyclical decline in participation has been larger and more persistent than in past cycles due to the unusually large increase in the average duration of unemployment during this cyclical episode.

• Going forward, the cyclical rebound in participation will roughly offset the continuing downward push of structural forces. Consequently, we project that in 2015, when the FOMC will be contemplating the first increase in the federal funds rate, the participation rate will be 63.4%, the same as in the second quarter of this year.

That projection for the participation rate implies that monthly changes in household employment averaging about 114,000 will be sufficient to stabilize the unemployment rate through 2015. Anything faster will push the unemployment rate down. To reach the FOMC’s threshold unemployment rate of 6.5% in the second quarter of 2015, as shown in our forecast, requires monthly changes in household employment averaging roughly 170,000 over the next 24 months, consistent with our forecast that monthly changes in establishment employment will average roughly 190,000 over that same period.

Now the participation rate is forecast to mostly move sideways - or maybe even increase a little in the short term - so we probably shouldn't expect a decline in the participation rate to help push down the unemployment rate over the next year or two. Instead, and decline in the unemployment rate will probably because of an increase in employment.

Longer term the participation rate will probably continue to decline until 2030 or 2040. I expect the rate to fall from the current 63.4% to around 60% in 2030 based on recent trends and demographics.

Detroit Files for Bankruptcy

by Calculated Risk on 7/18/2013 05:02:00 PM

From the WSJ: Detroit Files for Chapter 9 Bankruptcy

The city of Detroit filed for federal bankruptcy protection on Thursday afternoon ... the country's largest-ever municipal bankruptcy case.The prediction of “hundreds of billions” of dollars in municipal bond defaults in 2011 never happened, however this one has been in the works for some time. A shrinking population makes the situation very difficult.

...

The financial outlook has never been bleaker for the Motor City, which has shrunk from its peak of nearly two million people in 1950 to 700,000 today.

...

Most at risk under the bankruptcy case is the city's $11 billion in unsecured debt. That includes almost $6 billion in health and other benefits for retirees; more than $3 billion for retiree pensions; and about $530 million in general-obligation bonds.

More from Brad Plummer at the WaPo: Detroit just filed for bankruptcy. Here’s how it got there.

To get a better sense of just how Detroit got into such dire straits, it’s worth browsing through the city’s official “Proposals for Creditors” from June and a separate May report on the city’s finances. Emergency manager Kevyn Orr laid out all the problems and economic headwinds facing Detroit ...

Freddie Mac: 30 Year Mortgage Rates Decline to 4.37% in Latest Weekly Survey

by Calculated Risk on 7/18/2013 12:49:00 PM

From Freddie Mac today: Mortgage Rates Cool Off

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates easing along with market concerns over the Federal Reserve's bond purchase program ...

30-year fixed-rate mortgage (FRM) averaged 4.37 percent with an average 0.7 point for the week ending July 18, 2013, down from last week when it averaged 4.51 percent. Last year at this time, the 30-year FRM averaged 3.53 percent.

15-year FRM this week averaged 3.41 percent with an average 0.7 point, down from last week when it averaged 3.53 percent. A year ago at this time, the 15-year FRM averaged 2.83 percent.

Click on graph for larger image.

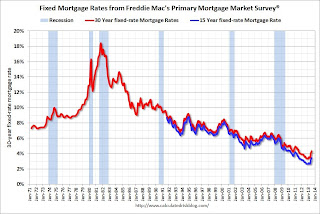

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up from 3.35% in early May, and 15 year mortgage rates are up from 2.56% over the last 2 months.

The Freddie Mac survey started in 1971.

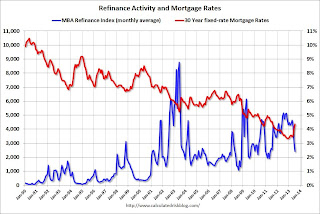

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down 55% over the last 10 weeks) and will continue to decline if rates stay at this level.

Philly Fed Manufacturing Survey indicates Solid Expansion in July

by Calculated Risk on 7/18/2013 10:00:00 AM

From the Philly Fed: July Manufacturing Survey

Manufacturing firms responding to the July Business Outlook Survey indicated that regional manufacturing conditions improved this month. All of the survey’s broadest current indicators were positive, and most showed improvement from last month. The surveyʹs indicators of future activity also showed a notable rise, suggesting that firms expect a pickup in business over the next six months.This was above the consensus forecast of a reading of 9.0 for July. Earlier in the week, the Empire State manufacturing survey also indicated faster expansion in July.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 12.5 in June to 19.8, its highest reading since March 2011.

Labor market conditions showed a notable improvement this month. The current employment index, at 7.7, registered its first positive reading in four months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys turned positive in June, and increased further in July. This suggests a further rebound in the ISM report for July.

Weekly Initial Unemployment Claims decline to 334,000

by Calculated Risk on 7/18/2013 08:30:00 AM

The DOL reports:

In the week ending July 13, the advance figure for seasonally adjusted initial claims was 334,000, a decrease of 24,000 from the previous week's revised figure of 358,000. The 4-week moving average was 346,000, a decrease of 5,250 from the previous week's revised average of 351,250.The previous week was revised down from 360,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 346,000.

The 4-week average has mostly moved sideways over the last few months. Claims were below the 344,000 consensus forecast.