by Calculated Risk on 7/05/2013 08:52:00 AM

Friday, July 05, 2013

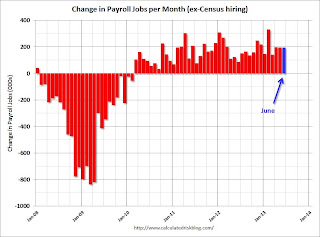

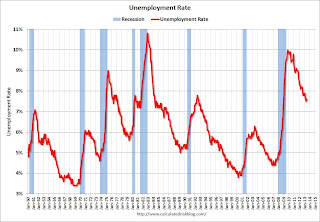

June Employment Report: 195,000 Jobs, 7.6% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 195,000 in June, and the unemployment rate was unchanged at 7.6 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was above expectations of 161,000 payroll jobs added. Employment for April and May were also revised higher.

...

The change in total nonfarm payroll employment for April was revised from +149,000 to +199,000, and the change for May was revised from +175,000 to +195,000. With these revisions, employment gains in April and May combined were 70,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate was unchanged in June at 7.6%.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased to 63.5% in June (blue line) from 63.4% in May. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio increased in June to 58.7% (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was above expectations and was a solid report including the upward revisions to April and May. I'll have much more later ...

Thursday, July 04, 2013

Friday: Jobs

by Calculated Risk on 7/04/2013 08:36:00 PM

First, the employment situation release tomorrow for June is the initial estimate. Since January 2011, there have been 29 monthly employment releases through May 2013, and 21 have been revised up so far. Since it looks like the annual revision (based on state level data) will be up again this year, I expect almost all of the revisions for the last year to be up with the final counting. So one key tomorrow will be to look at the revisions for April and May (reported as 149 and 175 thousand respectively in the last release).

Another key will be the unemployment rate. The current Fed forecast is for the unemployment rate to decline to the 7.2% to 7.3% range in Q4 2013 from just over a 7.8% average in Q4 of 2012. Of course the participation rate is important too (at 63.4% in May). Although the participation rate is expected to continue to decline over the next decade due to demographics, some bounce back (or at least stability) would be expected this year if the labor market is improving. We'd like to see the unemployment rate decline in June without a decline in the participation rate.

Also a reminder from the BLS on seasonal adjustments in the June report:

[I]n the household survey, the large number of youth entering the labor force each June is likely to obscure any other changes that have taken place relative to May, making it difficult to determine if the level of economic activity has risen or declined. Similarly, in the establishment survey, payroll employment in education declines by about 20 percent at the end of the spring term and later rises with the start of the fall term, obscuring the underlying employment trends in the industry. Because seasonal employment changes at the end and beginning of the school year can be estimated, the statistics can be adjusted to make underlying employment patterns more discernable.Last year the BLS reported 1.33 million teens (16 to 19 years old) joined the labor force Not Seasonally Adjusted (NSA), but that was expected - and seasonally adjusted to just an increase of 93 thousand. This year a fairly large number of teens (409 thousand) joined the labor force in May (more than expected), so the June number will probably be a little lower. This is important because teens have a high unemployment rate - and the early entry this year (like happened in 2008) could have pushed up the overall unemployment rate in May.

Friday:

• At 8:30 AM ET, the Employment Report for June will be released. The consensus is for an increase of 161,000 non-farm payroll jobs in June following the 175,000 non-farm payroll jobs in May. The consensus is for the unemployment rate to decrease to 7.5% in June from 7.6% in May.

Some Employment Statistics

by Calculated Risk on 7/04/2013 03:46:00 PM

The key report for this week will be the June employment situation report to be released on Friday.

The following table summarizes some of the labor statistics and compares the current situation (May 2013) with the employment situation when the recession started (December 2007) - and also the worst numbers during the recession.

Even though the noninstitutional population has increased by over 12 million, the labor force has only increased by 1.7 million since December 2007. This decline in the participation rate has been a key topic, and some of the decline in participation was due to demographics - and some due to economic weakness.

Nonfarm payrolls are up 6.3 million from the trough, but still 2.35 million below the December 2007 levels. Private payrolls are up 6.9 million from the depth of the recession, but still 1.8 million below the pre-recession level.

And the unemployment rate has fallen about halfway back to the pre-recession level.

However the numbers of unemployed, part-time for economic reasons, marginally attached, and long term unemployed have not improved as much. Whereas the headline unemployment rate is about halfway back to the pre-recession level, the U-6 unemployment rate is less than 40% of the way back to the pre-recession level.

This is a reminder we need to look at more than just payroll jobs and the unemployment rate. There are still millions of workers unemployed or underemployed - and this says nothing about weak wage growth. There is still a long way to go.

| Employment Statistics (Thousands or Percent)1 | |||

|---|---|---|---|

| May-13 | Dec-07 | Worst | |

| Civilian noninstitutional population (16 and over) | 245,363 | 233,156 | --- |

| Civilian labor force | 155,658 | 153,936 | --- |

| Total nonfarm Payroll | 135,637 | 137,983 | 129,320 |

| Private Payroll | 113,789 | 115,606 | 106,850 |

| Unemployment Rate | 7.6% | 5.0% | 10.0% |

| Unemployed | 11,760 | 7,664 | 15,382 |

| Part-Time for Economic Reasons | 7,904 | 4,638 | 9,103 |

| Marginally Attached to Labor Force2 | 2,164 | 1,395 | 2,809 |

| Discouraged Workers2 | 780 | 363 | 1,318 |

| U-6 Unemployment rate3 | 13.8% | 8.8% | 17.1% |

| Unemployed for 27 Weeks & over | 4,357 | 1,327 | 6,704 |

1 The payroll numbers are from the Current Employment Statistics (establishment survey), and the remaining numbers are from the Current Population Survey (household survey).

2 BLS: "Discouraged workers are a subset of persons marginally attached to the labor force. The marginally attached are those persons not in the labor force who want and are available for work, and who have looked for a job sometime in the prior 12 months, but were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. Among the marginally attached, discouraged workers were not currently looking for work specifically because they believed no jobs were available for them or there were none for which they would qualify."

3 BLS: "Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers"

ECB's Draghi: "ECB interest rates to remain at present or lower levels for an extended period of time"

by Calculated Risk on 7/04/2013 10:34:00 AM

From David Keohane at FT Alphaville: Forward guidance is contagious and the ECB has caught it

From a very dovish Mario Draghi’s press conference following the European Central Bank’s decision to keep its key rates on hold ...And from the WSJ: ECB Chief Gives Rate Forecast

Looking ahead, our monetary policy stance will remain accommodative for as long as necessary. The Governing Council expects the key ECB interest rates ... to remain at present or lower levels for an extended period of time. This expectation is based on the overall subdued outlook for inflation extending into the medium term, given the broad-based weakness in the real economy and subdued monetary dynamics. In the period ahead, we will monitor all incoming information on economic and monetary developments and assess any impact on the outlook for price stability ...This feels really rather significant.

It is a radical departure from the policy the ECB has followed ever since it started operations in 1999, under which it never pre-committed to any level of rates in advance.

...

Earlier in the day, the Bank of England had also broken with its usual practice, issuing a forward-looking statement that, likewise, appeared aimed at damping expectations of future interest rate increases. Mr. Draghi said it was a "coincidence" that the two things had happened on the same day.

Mr. Draghi drew attention to the fact that the council had been unanimous on giving its new guidance, implying that even hawkish members such as Germany's Jens Weidmann had consented to what was a powerfully dovish signal.

Wednesday, July 03, 2013

Trulia: Asking Home Prices increased in June

by Calculated Risk on 7/03/2013 09:19:00 PM

This was released earlier today: Trulia Reports Asking Home Prices Up 10.7 Percent Year-over-year Nationally as Mortgage Rates Rise

Nationally, asking home prices rose 10.7 percent year-over-year (Y-o-Y) in June. Even excluding foreclosures, prices jumped 11.4 percent Y-o-Y, signaling that the current rise in prices is not primarily driven by the shift away from foreclosure to non-distressed homes for sale. However, asking prices will eventually slow down as mortgage rates rise, inventory expands, and investor demand falls.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

Nationally, asking home prices bottomed in February 2012 – but the turnaround has been uneven. Prices first rebounded two years ago in San Jose, Phoenix, Denver, Miami, and a few other housing markets where job growth or bargain buying started boosting prices earlier. Meanwhile, prices continued to fall in several East Coast and Midwest markets until three to six months ago. Now with the housing recovery in full swing, asking prices rose in 99 of the 100 largest metros.

Marking its biggest Y-o-Y increase since January, rents rose 2.8 percent Y-o-Y nationally in June. Rents climbed most in Houston, Miami, and Tampa-St. Petersburg, but fell where asking prices are up more than 30 percent: Las Vegas, Oakland, and Sacramento. In fact, home prices outpaced rents in 22 of the 25 largest rental markets. Only in Houston, New York, and Philadelphia did rents rise faster than home prices.

“Rising home prices have swept the country,” said Jed Kolko, Trulia’s Chief Economist. “Local markets that suffered most during the housing crisis are seeing the biggest price rebounds today. Now even markets that escaped the worst of the bust, like Chicago and Baltimore, are seeing prices climb. However, these runaway price gains won’t last: both rising mortgage rates and slowly growing inventories should start tapping the brakes on home prices, preventing them from rising back into bubble territory.”

emphasis added

More from Kolko: Asking Home Prices Not Cooling Off – Yet