by Calculated Risk on 6/24/2013 12:30:00 PM

Monday, June 24, 2013

LPS: House Price Index increased 1.5% in April, Up 8.1% year-over-year

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses April closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: LPS' April HPI Report: Home Prices Up 1.5 Percent from March, 8.1 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on April 2013 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 18.2% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 47.7% from the peak in Las Vegas, 39.6% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and at a new peak in Austin, Dallas and Denver! (Also, on the state level, new peaks for the Colorado and Texas).

Note: Case-Shiller for April will be released tomorrow.

Dallas Fed: Regional Manufacturing Activity "surges" in June

by Calculated Risk on 6/24/2013 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Surges and Outlook Improves

Texas factory activity increased sharply in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose six points to 17.1, posting its highest reading in more than two years.This was above expectations of a reading of 0.0 for the general business activity index. This is the 3rd regional Fed report for June and all were above expectations and indicated expansion.

Notably stronger manufacturing activity was reflected in other survey measures as well. The new orders index climbed to 13 in June, a level not seen since July 2011. The capacity utilization index rose to a two-year high, jumping from 6.4 to 15.3. The shipments index advanced 12 points to 15.4.

Perceptions of broader business conditions rebounded strongly in June. The general business activity index rose to 6.5 after posting negative readings in April and May. The company outlook index soared 20 points to 13.3, reaching its highest level in 16 months.

Labor market indicators reflected steady labor demand and longer workweeks. The employment index was zero in June, suggesting no change in employment levels. The hours worked index moved up to 4.8 after four months in negative territory.

emphasis added

Chicago Fed: "Economic Activity slightly improved in May"

by Calculated Risk on 6/24/2013 08:38:00 AM

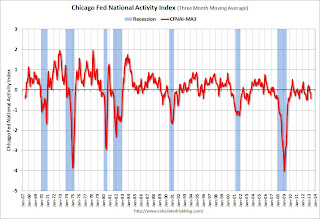

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity slightly improved in May

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to –0.30 in May from –0.52 in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.43 in May from –0.13 in April, marking its third consecutive reading below zero and its lowest level since October 2012. May’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in May (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, June 23, 2013

Monday: Dallas Fed Mfg Survey, Chicago Fed National Activity Index

by Calculated Risk on 6/23/2013 10:04:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:30 AM ET, the Dallas Fed Manufacturing Survey for June. The consensus is a reading of 0, up from minus 10.5 in May (below zero is expansion).

Weekend:

• Schedule for Week of June 23rd

The Asian markets are red tonight with the Nikkei down 0.1%, and Shanghai Composite down 1.1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 5 and DOW futures are down 40 (fair value).

Oil prices have moved down recently with WTI futures at $93.59 per barrel and Brent at $100.59 per barrel.

Real Estate: Pocket Listings in a Tight Market

by Calculated Risk on 6/23/2013 06:10:00 PM

From Alejandro Lazo at the LA Times: Motivated home buyers skip the bidding wars

[A]gents like Mathys are resorting to reconnaissance and back-channel networks to find homes that haven't yet hit the market. They're cold-calling homeowners with offers and targeting specific neighborhoods with direct mail. Some come bearing bizarre gifts in return for a listing. One agent offered a seller the use of his exotic car; one of his clients offered free dogs.Pocket listings (kept in the agent's "pocket") are always popular with agents in a tight market. This way the agent can get both sides of the commission (or share with someone in their office - or an agent they know who will return the favor). Other agents and buyers hate pocket listings because they never get a chance at buying the property - and it is usually best for the seller to actually have the property listed and see other offers.

And they're chasing so-called pocket listings, homes privately marketed among those in the know. The low-profile nature of the listings makes them hard to quantify. But agents and other real estate experts say they've become common in the booming Southland market, where the median home price shot up nearly 25% in the last year.

Mathys — a 10-year veteran who, with his partner Tracie Kersten, specializes in high-end San Diego properties — said he'd never before seen the market this tight or felt the need to get this creative.

emphasis added