by Calculated Risk on 6/21/2013 02:10:00 PM

Friday, June 21, 2013

Is Bernanke pulling a Trichet?

Former European Central Bank (ECB) President Jean Claude Trichet has been widely criticized for pushing to raise rates near the end of his term, even though the euro zone was headed for another recession (an obvious blunder). Clearly Trichet had a bias towards tightening, even though the data suggested otherwise.

Some people are wondering if Fed Chairman Ben Bernanke has one eye on the calendar too ...

From Tim Duy: It's About The Calendar

Key words: "calendar objectives." Bullard clearly felt the mood in the room was something to the effect of "We know the data is soft, but we want out of this program by the middle of next year, so we are going to lay out a program to do just that."However Jon Hilsenrath at the WSJ thinks Analysis: Markets Might Be Misreading Fed’s Messages

In light of Bullard's dissent, the market's reaction should be perfectly clear. I have seen some twitter chatter to the effect of market participants didn't understand what Federal Reserve Chairman Ben Bernanke was saying, that his message was really dovish, that interest rates would be nailed to the zero bound in 2015, that the policy was data dependent, etc. Market participants obviously didn't have that interpretation.

...

The Fed changed the game this week. Bernanke made clear the Fed wants out of quantitative easing. While everything is data dependent, the weight has shifted. The objective of ending quantitative now carries as much if not more weight than the data. Market participants need to adjust the prices of risk assets accordingly.

Bottom Line: I think the question is not how good the data needs to be to convince the Fed to taper. The question is how bad it needs to be to convince them not to taper. And I think it needs to be pretty bad.

Despite the Fed’s efforts to signal it wouldn’t apply the brakes any time soon, the market reacted sharply. Investors appear to have been caught off guard by the specific timetable Mr. Bernanke laid out and the central bank’s optimism about the 2014 growth outlook.My view is the Fed will be data driven - as opposed to calendar driven - and will only taper in December if there is a clear pickup in the economy during the 2nd half.

BLS: State unemployment rates were "little changed" in May

by Calculated Risk on 6/21/2013 11:31:00 AM

From the BLS: Regional and state unemployment rates were little changed in May

Regional and state unemployment rates were little changed in May. Twenty-five states had unemployment rate decreases, 17 states had increases, and 8 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in May, 9.5 percent. The next highest rates were in Illinois and Mississippi, 9.1 percent each. North Dakota again had the lowest jobless rate, 3.2 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only three states: Nevada, Illinois, and Mississippi. This is the fewest states with 9% unemployment since 2008.

For some of the sand states (largest real estate bubble states), the improvement has been significant. The unemployment rate in California has declined from 10.7% in May 2012 to 8.6% in May 2013. The unemployment rate in Florida has declined from 8.8% in May 2012 to 7.1% in May 2013. For Arizona, the unemployment rate has declined from 8.4% to 7.8%, and for Nevada from 11.5% to 9.5%.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently only three states have an unemployment rate above 9% (purple), fifteen states above 8% (light blue), and 24 states above 7% (blue).

More Thoughts on QE3 Taper Timing

by Calculated Risk on 6/21/2013 10:01:00 AM

Yesterday I posted Four Charts to Track Timing for QE3 Tapering. I will update those charts as data is released.

The table below lists the four remaining FOMC meetings this year and the key data that will be available at each meeting.

Following the September and December meetings, the FOMC will release updated quarterly projections and the meeting will be followed by a press conference. It seems more likely that the Fed will announce tapering at a meeting with a press conference.

As the four charts indicated, economic growth (and inflation) would have to pick up for the Fed to announce the tapering of asset purchase at the December meeting. To start tapering at an earlier meeting, economic growth would have to increase significantly.

To taper at the July meeting, the advance estimate of Q2 GDP would probably have to be well above 3%, May PCE prices increasing at a much faster pace, and the May unemployment rate at 7.5% or below. Even then, I think most FOMC members would want to wait for more data.

There is a slight chance of tapering starting in September. There is a press conference following the meeting, and updated quarterly projections will be released. If the unemployment rate for July and August average below 7.4%, and PCE prices were increasing - it is possible the Fed could announce tapering.

The most likely meeting for announcing tapering this year is in December. By then the 2nd estimate of Q3 GDP will be available (plus some better forecasts for Q4). The November employment report will be available (and the FOMC will have a good idea if the unemployment rate will be around 7.2% in Q4), and PCE prices through October will be available (we will have evidence if the decline in inflation is "transitory".

Note: The December press conference will probably be the final press conference for Ben Bernanke as Fed chairman.

My current view is tapering will start in December or in the first half of 2014.

| FOMC Meetings in 2013 | ||

|---|---|---|

| Date | Press Conference | Key Data |

| July 30-31, 2013 | No | June employment, Q2 Advance GDP, May PCE Prices |

| Sept 17-18, 2013 | Yes | July & Aug Employment, 2nd Estimate Q2 GDP, June & July PCE Prices |

| Oct 29-30, 2013 | No | Sep Employment, Q3 Advance GDP, August PCE Prices |

| Dec 17-18, 2013 | Yes | Oct & Nov Employment, 2nd Estimate Q3 GDP, Sept & Oct PCE Prices |

Thursday, June 20, 2013

Two more articles on QE3

by Calculated Risk on 6/20/2013 10:06:00 PM

From Merrill Lynch:

Fed Chairman Bernanke expects to start tapering before year-end, provided momentum continues in the labor market. Bernanke has clarified his reaction function and, as a result, we are changing our Fed call: we now expect the Fed to announce tapering in December with the first rate hike to begin in summer 2015. Soft inflation in the near-term will not dissuade the Fed from tapering, but we think the Fed will want to see inflation make steady progress toward its 2% target to begin rate hikes.From Neil Irwin at the WaPo: This is why global markets are freaking out

emphasis added

This isn’t a crisis like the ones that struck the United States starting in 2008 or Europe in 2010. Rather, it is a byproduct of the world’s central banks, having intervened on vast scale to deal with the economic travails of the last several years, introducing uncertainty and even a little chaos as they start to contemplate how and when the era of easy money might end.Friday economic releases:

...

One saving grace for the United States: If the market swings really do undermine U.S. growth, then the Fed, as Bernanke said repeatedly in his news conference, will move that much more gingerly in removing its help for the economy. Indeed, just Thursday, investors’ expectations for inflation over the next few years fell 0.1 percentage point, to 1.75 percent, the lowest since last July. Because the Fed aims for inflation of 2 percent, that would suggest there is more room for the central bank to pump money into the economy without sparking an outburst of higher prices.

In effect, with the Fed starting to think about an exit from an era of easy money, it will be a great test of just how resilient this economic recovery really is. If the whole thing — the rises in stock prices, in corporate earnings, in the housing market, even in job growth — is driven solely by the flood of money, or whether five years of zero-interest rates and trillions of dollars in bond purchases have succeeded at getting a more resilient economic engine for the United States up and running.

• At 10:00 AM ET, the Regional and State Employment and Unemployment report (Monthly) for May 2013

Four Charts to Track Timing for QE3 Tapering

by Calculated Risk on 6/20/2013 04:26:00 PM

Yesterday Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."Here are four graphs that we can use to track if the incoming data is "broadly consistent" with the FOMC projections.

Click on graph for larger image.

Click on graph for larger image.The first graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first quarter was consistent with the FOMC projections (red), however it appears the second quarter will be below the FOMC forecast - if so, then GDP will have to pickup in the 2nd half of 2013.

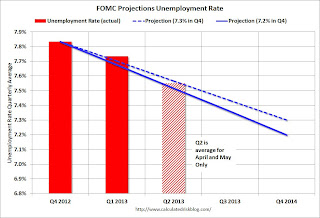

The second graph is for unemployment rate.

The second graph is for unemployment rate.The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We only have data through May, but so far the unemployment rate is tracking the forecast. However most of the decline in the unemployment rate has been due to a decline in the participation rate from 63.6% to 63.4%. It the participation rate stays level for the remainder of 2013, then job growth will have to pickup to meet the FOMC projections.

The third graph is for PCE prices.

The third graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through April, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup.

The second graph is for core PCE prices.

The second graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through April, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy. (September tapering is less likely, but not impossible - but the pickup would have to be significant).