by Calculated Risk on 6/14/2013 02:00:00 PM

Friday, June 14, 2013

Housing bubble: The "Wealth" is Gone, but the Debt Remains

From Floyd Norris at the NY Times: Despite Recovery, Younger Households Are Slower to Make Gains

THE total wealth of American households has recovered from the financial crisis and Great Recession, according to the Federal Reserve Board. But ... many Americans, particularly younger adults who took on heavy debt to acquire homes before the housing bubble collapsed, are lagging.

...

During the housing boom, said William R. Emmons, the chief economist of the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis, “exactly the people you would think need to act conservatively were doing the opposite.” Homeownership rates, and mortgage debt levels, rose for younger households, as well as for less educated and minority ones. Those groups suffered more during the crisis, he said, and have been slower to recover.

Mr. Emmons compiled average wealth figures for different groups from the triennial surveys ... older households are down just 3 percent on average, while those headed by middle-age people are down about 10 percent. But the decline is nearly 40 percent for the younger group.

During the housing boom, households ended up with more of their wealth in real estate than before, and mortgage debt rose to record levels relative to the size of the economy. The proportion of wealth in homes is now back to close to the level of the 1990s, but the debt levels remain high by historical standards.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph based on the Fed's Flow of Funds report shows household real estate assets and mortgage debt as a percent of GDP.

As Norris noted, the bubble wealth is gone, but the debt remains (still high on a historical basis). This was especially hard on younger households since they bought during the housing bubble.

Preliminary June Consumer Sentiment decreases to 82.7

by Calculated Risk on 6/14/2013 09:55:00 AM

Click on graph for larger image.

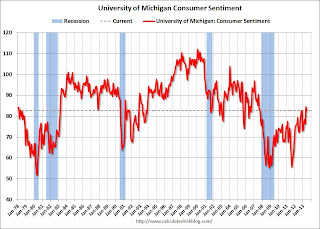

The preliminary Reuters / University of Michigan consumer sentiment index for June decreased to 82.7 from the May reading of 84.5.

This was below the consensus forecast of 84.5 and reverses some of the large increase last month. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Fed: Industrial Production unchanged in May

by Calculated Risk on 6/14/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in May after having decreased 0.4 percent in April. In May, manufacturing production rose 0.1 percent after falling in each of the previous two months, and the output at mines increased 0.7 percent. The gains in manufacturing and mining were offset by a decrease of 1.8 percent in the output of utilities. At 98.7 percent of its 2007 average, total industrial production in May was 1.6 percent above its year-earlier level. The rate of capacity utilization for total industry edged down 0.1 percentage point to 77.6 percent, a rate 0.2 percentage point below its level of a year earlier and 2.6 percentage points below its long-run (1972–2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.6% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was essentially unchanged in May at 98.7 . This is 17.8% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.2% increase in Industrial Production in April, and for Capacity Utilization to increases to 77.9%. Most of the weakness in industrial production was due to a sharp decline in the output of utilities.

Thursday, June 13, 2013

Friday: Industrial Production, PPI, Consumer Sentiment

by Calculated Risk on 6/13/2013 07:36:00 PM

From Victoria McGrane at the WSJ: Fed's Bond-Buying Wild Card: Inflation Expectations

"It is no longer clear that inflation expectations are so stable," Jan Hatzius, chief economist at Goldman Sachs Group Inc., said in an interview. Market-based measures of inflation expectations are now on "the low side of comfortable." In a note to clients June 10, he predicted that expectations of lower inflation are likely to make Fed officials less willing to pull back on the bond-buying programs out of fear it could destabilize those expectations about future inflation.If there is a concern about inflation, it is that inflation is below the Fed's target (those predicting hyperinflation have consistently been wrong). With the unemployment rate at 7.6% and inflation falling, it is very unlikely the Fed will reduce their monthly asset purchases any time soon.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for four key measures of inflation for April: median CPI, trimmed-mean CPI, core CPI and core PCE. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.6%, and the CPI less food and energy rose 1.7%. On the graph, Core PCE is for March - core PCE for April was at 1.1% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 1.0% annualized, and core CPI increased 0.6% annualized. Core PCE for April increased 0.1% annualized.

Friday economic releases:

• At 8:30 AM, the Producer Price Index for May will be released. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 84.5, unchanged from May.

WSJ: "Fed Likely to Push Back on Market Expectations of Rate Increase"

by Calculated Risk on 6/13/2013 04:13:00 PM

Jon Hilsenrath at the WSJ writes: Analysis: Fed Likely to Push Back on Market Expectations of Rate Increase

“The market is saying, ‘The fundamental economic outlook really hasn’t changed much, but we are getting more worried about Fed policy,’” says Jan Hatzius, chief economist at Goldman Sachs.Actually the Fed has said they'd hold interest rates low until at least 6.5%. Here is the FOMC wording:

Since last December the Fed has been promising to keep short-term interest rates near zero until the jobless rate reaches 6.5%, as long as inflation doesn’t take off. Most forecasters don’t see the jobless rate reaching that threshold until mid-2015.

[T]he Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.Back to Hilsenrath:

At the same time, however, the Fed is talking about pulling back on its $85 billion-per-month bond-buying program. The chatter about pulling back the bond program has pushed up a wide range of interest rates and appears to have investors second-guessing the Fed’s broader commitment to keeping rates low.It is possible the Fed will start tapering bond purchases in September, although, right now I think it will be towards the end of the year or in 2014. And I think the FOMC means it when the say a "considerable" amount time will pass between the end of QE3 and raising rates. So market expectations are probably wrong.

This is exactly what the Fed doesn’t want. Officials see bond buying as added fuel they are providing to a limp economy. Once the economy is strong enough to live without the added fuel, they still expect to keep rates low to ensure the economy keeps moving forward.

It’s a point Chairman Ben Bernanke has sought to emphasize before. The Fed, he said in his March press conference and again at testimony to Congress last month, expects a “considerable” amount of time to pass between ending the bond-buying program and raising short-term rates.

He seems likely to press that point at his press conference next week, given that the markets are telling him they don’t believe it.

Note: A few years ago, market expectations at each point were that the Fed was going to raise rates in six months - always six months, and that incorrect expectation was one of the reasons the Fed worked to improve their communications and eventually added a statement in January 2012 about keeping rates low until at least 2014. They revised their statement again and added thresholds for raising rates. It is pretty clear the Fed Funds rate will be low for a considerable time, and market expectations appear wrong again.