by Calculated Risk on 6/13/2013 12:28:00 PM

Thursday, June 13, 2013

Freddie Mac: "Mortgage Rates on Six Week Streak Higher"

From Freddie Mac today: Mortgage Rates on Six Week Streak Higher

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates climbing higher amid a solid employment report for May. Since beginning their climb last month, the 30-year fixed-rate mortgage has increased over half a percentage point. ...This graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

30-year fixed-rate mortgage (FRM) averaged 3.98 percent with an average 0.7 point for the week ending June 13, 2013, up from last week when it averaged 3.91 percent. Last year at this time, the 30-year FRM averaged 3.71 percent.

15-year FRM this week averaged 3.10 percent with an average 0.7 point, up from last week when it averaged 3.03 percent. A year ago at this time, the 15-year FRM averaged 2.98 percent.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.18% and 30 year mortgage rates are at 3.98% (according to Freddie Mac). Based on the relationship from the graph, if the ten year yield stays in this range, 30 year mortgage rates might move up to 4.1% or so in the Freddie Mac survey.

Note: The yellow markers are for the last three years with the ten year yield below 3%. A trend line through the yellow markers only is a little lower, but still close to 4% at the current 10 year Treasury yield.

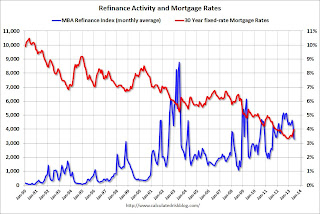

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 36% over the last 5 weeks) and will probably decline significantly if rates stay at this level.

Weekly Initial Unemployment Claims decline to 334,000

by Calculated Risk on 6/13/2013 09:15:00 AM

Catching up ... the DOL reports:

In the week ending June 8, the advance figure for seasonally adjusted initial claims was 334,000, a decrease of 12,000 from the previous week's unrevised figure of 346,000. The 4-week moving average was 345,250, a decrease of 7,250 from the previous week's unrevised average of 352,500.The previous week was unrevised at 346,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 345,250.

Claims was below the 350,000 consensus forecast.

Retail Sales increased 0.6% in May

by Calculated Risk on 6/13/2013 08:30:00 AM

On a monthly basis, retail sales increased 0.6% from April to May (seasonally adjusted), and sales were up 4.3% from May 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $421.1 billion, an increase of 0.6 percent from the previous month, and 4.3 percent above May 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 27.1% from the bottom, and now 11.4% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 0.3%. Retail sales ex-gasoline increased 0.6%.

Excluding gasoline, retail sales are up 24.3% from the bottom, and now 11.9% above the pre-recession peak (not inflation adjusted).

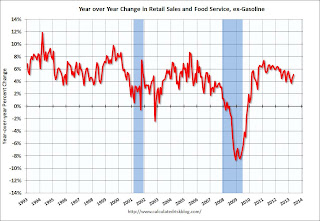

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.1% on a YoY basis (4.3% for all retail sales).

This was slightly above the consensus forecast of 0.5% increase in retail sales mostly due to strong auto sales.

Wednesday, June 12, 2013

Thursday: Retail Sales, Weekly Unemployment Claims

by Calculated Risk on 6/12/2013 07:26:00 PM

First, here is a price index for commercial real estate that I follow. From CoStar: Commercial Real Estate Prices Shake Off Effects of First Quarter Seasonal Slowdown with Strong Showing in April

COMMERCIAL REAL ESTATE PRICE RECOVERY REGAINED MOMENTUM IN APRIL: As the effects of the first quarter seasonal slowdown in investment activity subsided, commercial real estate prices advanced across the board in April 2013. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the equal-weighted U.S. Composite Index and the value-weighted U.S. Composite Index—each posted solid monthly gains in April of 1.9% and 1.1%, respectively, which reflects improvement in market fundamentals across the major CRE property types. The two components of the equal-weighted U.S. Composite Index (the Investment Grade and General Commercial indices) also made substantial gains in April 2013, signifying an extension of the recovery in commercial property pricing to more secondary property types and markets.

...

DISTRESS SALES FALL TO LOWEST LEVEL SINCE 2008: The percentage of commercial property selling at distressed prices tumbled to 13.2% in April 2013, 64% lower than the peak level observed in March 2011. This reduction in distressed deal volume has supported higher, more consistent pricing and enhanced market liquidity by giving buyers greater confidence to do deals.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 40.9% from the bottom (showing the demand for higher end properties) and up 10.8% year-over-year. However the Equal-Weighted index is only up 8.0% from the bottom, and up 6.3% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Thursday economic releases:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for an increase to 350 thousand from 346 thousand last week.

• Also at 8:30 AM, Retail sales for May will be released. The consensus is for retail sales to increase 0.5% in May, and to increase 0.4% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.3% increase in inventories.

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in May

by Calculated Risk on 6/12/2013 04:44:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in May.

Look at the two columns in the table for Total "Distressed" Share. In almost every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales in all of these cities. Also there has been a shift from foreclosures to short sales. In all of these areas - except Minneapolis- short sales now out number foreclosures.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| May-13 | May-12 | May-13 | May-12 | May-13 | May-12 | Apr-13 | Apr-12 | |

| Las Vegas | 31.8% | 32.6% | 10.3% | 34.7% | 42.1% | 67.3% | 57.9% | 54.4% |

| Reno | 27.0% | 39.0% | 7.0% | 22.0% | 34.0% | 61.0% | ||

| Phoenix | 12.3% | 26.6% | 9.7% | 16.9% | 22.0% | 43.4% | 38.9% | 46.3% |

| Sacramento | 22.5% | 30.1% | 7.5% | 28.1% | 30.0% | 58.2% | 33.6% | 31.5% |

| Minneapolis | 6.8% | 10.6% | 20.1% | 28.8% | 26.9% | 39.4% | 18.7% | 20.1% |

| Mid-Atlantic (MRIS) | 8.2% | 11.8% | 7.2% | 10.2% | 15.5% | 22.1% | 16.7% | 17.2% |

| So. California* | 17.7% | 24.3% | 10.8% | 26.9% | 28.5% | 51.2% | 31.9% | 32.1% |

| Hampton Roads | 26.3% | 26.3% | ||||||

| Memphis* | 21.5% | 30.5% | ||||||

| Birmingham AL | 21.0% | 27.3% | ||||||

| *share of existing home sales, based on property records | ||||||||