by Calculated Risk on 6/05/2013 08:15:00 AM

Wednesday, June 05, 2013

ADP: Private Employment increased 135,000 in May

Private sector employment increased by 135,000 jobs from April to May, according to the May ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. April’s job gains were revised downward to 113,000 from 119,000.This was below the consensus forecast for 171,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 167,000 payroll jobs in May, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market continues to expand, but growth has slowed since the beginning of the year. The slowdown is evident across all industries and all but the largest companies. Manufacturers are reducing payrolls. The softer job market this spring is largely due to significant fiscal drag from tax increases and government spending cuts."

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Refinance Applications decline sharply as Mortgage Rates Increase above 4%

by Calculated Risk on 6/05/2013 07:43:00 AM

From the MBA: Mortgage Applications Decrease as Rates Jump in Latest MBA Weekly Survey

The Refinance Index decreased 15 percent from the previous week and is at its lowest level since the end of November 2011. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.07 percent, the highest rate since April 2012, from 3.90 percent, with points decreasing to 0.35 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This was the largest single-week increase in this rate since the week ending July 1, 2011.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates moving above 4%, refinance activity has fallen sharply.

This index is down almost 40% over the last four weeks, and this is the lowest level since November 2011.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.

Tuesday, June 04, 2013

Wednesday: ADP Employment, ISM Service Index, Fed's Beige Book

by Calculated Risk on 6/04/2013 07:25:00 PM

The earliest report tomorrow - the weekly mortgage survey from the Mortgage Bankers Association - is expected to show 30 year mortgage rates at or above 4%. Neil Irwin at the WaPo asks: Will higher mortgage rates kill the housing market? Maybe not!

[R]ising mortgage rates, if they’re rising for good reasons, could actually be net positives for the housing market if they result from more people having jobs and being confident in their prospects.I'm not a fan of "affordability" indexes, but I don't think an increase in mortgage rates will hurt the recovery for residential investment (mostly new home sales). However an increase in rates will sharply reduce refinance activity - something we are already seeing.

This gets at one of the realities of the housing market and interest rates: It doesn’t just matter whether mortgage rates are rising, but why they’re rising.

Stronger economic growth makes homebuying more attractive, as people are more confident in their jobs and incomes (Goldman estimates that a 1 percentage point in real GDP growth translates to 1.8 percentage points in annual home price appreciation). Higher inflation can make homebuying more desirable, as you are buying a large asset whose value should rise with inflation while taking on a debt that has a fixed interest rate (Goldman estimates that a 1 percentage point increase in inflation translates to an 0.9 percent rise in home prices).

That being the case, as long as home prices remain below the level where affordability is out of reach, and so long as mortgage rates are rising because the economy is on the mend, the housing market should be able to withstand the blow.

Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. Expect 30 year mortgage rates at or above 4%, and another sharp decline in refinance activity.

• At 8:15 AM, the ADP Employment Report for May will be released. This report is for private payrolls only (no government). The consensus is for 171,000 payroll jobs added in May.

• At 10:00 AM, the ISM non-Manufacturing Index for May. The consensus is for a reading of 53.8, up from 53.1 in April. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 1.4% increase in orders.

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. In the previous Beige Book, in early April, the report noted "economic activity expanded at a moderate pace".

Lawler: Single Family Homes Built/Sold in 2012: “Back to Bigger,” But on Very Low Volumes

by Calculated Risk on 6/04/2013 02:48:00 PM

Census released its estimates for the characteristics of single-family homes completed and sold in 2012.

CR Note: from the release:

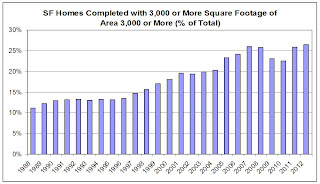

Of the 483,000 single-family homes completed in 2012:From Lawler: Here is a chart showing the % of SF homes completed with square feet of floor area of 3,000 or more.

• 432,000 had air-conditioning.

• 63,000 had two or fewer bedrooms and 198,000 had four bedrooms or more.

• 34,000 had one and one-half bathrooms or less, whereas 145,000 homes had three or more bathrooms.

• 142,000 had a full or partial basement, while 78,000 had a crawl space, and 263,000 had a slab or other type of foundation.

• 266,000 had two or more stories.

• 278,000 had a warm-air furnace and 183,000 had a heat pump as the primary heating system.

• 285,000 heating systems were powered by gas and 189,000 were powered by electricity.

The average single-family house completed was 2,505 square feet.

Click on graph for larger image.

There has been a long-term upward trend in the average and median square footage of SF homes built in the US, though “size” has had a bit of a cyclical component as well – generally rising more rapidly during strong markets, and more slowly during “soft” markets. The “dip” in 2009-10 may also have reflected a temporary increase in building targeted at first-time home buyers related to the home buyer tax credits, while the recent rebound reflects the post-tax-credit weakness in first-time home buyer demand.

Of course, the recent increase in the share of “large” SF homes built has been on very low overall volumes.

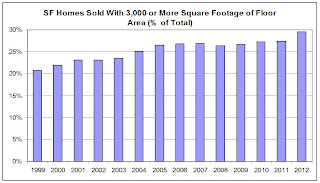

Census also released estimates of the characteristics of new SF homes sold (total SF completions include not just homes built for sale, but also owner- and contractor-built homes, as well as a small number of SF homes built for rent. These characteristics reflect SF homes sold based on contract signing/earnest money exchange, and not completions, and the square footage data only go back to 1999.

Here is a chart showing the % of new SF homes sold that had four or more bedrooms, with data going back to 1978.

And here is a chart showing the number of new SF homes sold with four or more bedrooms.

Existing Home Inventory is up 15.2% year-to-date on June 4th

by Calculated Risk on 6/04/2013 12:21:00 PM

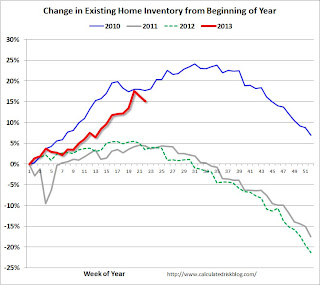

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 15.2%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.3% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.