by Calculated Risk on 6/04/2013 09:46:00 AM

Tuesday, June 04, 2013

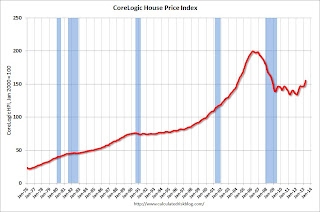

CoreLogic: House Prices up 12.1% Year-over-year in April

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Report Shows Home Prices Rise by 12.1 Percent Year Over Year in April

Home prices nationwide, including distressed sales, increased 12.1 percent on a year-over-year basis in April 2013 compared to April 2012. This change represents the biggest year-over-year increase since February 2006 and the 14th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 3.2 percent in April 2013 compared to March 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 11.9 percent in April 2013 compared to April 2012. On a month-over-month basis, excluding distressed sales, home prices increased 3 percent in April 2013 compared to March 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that May 2013 home prices, including distressed sales, are expected to rise by 12.5 percent on a year-over-year basis from May 2012 and rise by 2.7 percent on a month-over-month basis from April 2013. Excluding distressed sales, May 2013 home prices are poised to rise 13.2 percent year over year from May 2012 and by 3.1 percent month over month from April 2013.

...

“House price growth continues to surprise to the upside with an impressive 12.1 percent gain year over year in April,” said Dr. Mark Fleming, chief economist for CoreLogic. “Increasing demand for new and existing homes, coupled with low inventory, has created a virtuous cycle for price gains, most clearly seen in the Western states with year-over-year gains of 20 percent or more.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 3.2% in April, and is up 12.1% over the last year. This index is not seasonally adjusted, and this is usually the strongest time of the year for price increases.

The index is off 22% from the peak - and is up 15.9% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for fourteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for fourteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

This was another very strong month-to-month increase. At some point more inventory will come on the market and slow the price increases. Note: CoreLogic notes that prices are up year-over-year in all 50 states excluding distressed sales.

Trade Deficit increased in April to $40.3 Billion

by Calculated Risk on 6/04/2013 08:46:00 AM

The Department of Commerce reported:

[T]otal April exports of $187.4 billion and imports of $227.7 billion resulted in a goods and services deficit of $40.3 billion, up from $37.1 billion in March, revised. April exports were $2.2 billion more than March exports of $185.2 billion. April imports were $5.4 billion more than March imports of $222.3 billion..The trade deficit was lower than the consensus forecast of $41.2 billion.

The first graph shows the monthly U.S. exports and imports in dollars through April 2013.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in April. Imports rebounded from the decline in March that was partially due to the timing of the Chinese New Year.

Exports are 13% above the pre-recession peak and up 2% compared to April 2012; imports are 2% below the pre-recession peak, and down 1% compared to April 2012 (mostly moving sideways).

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.Oil averaged $97.82 in April, up from $96.95 per barrel in March, but down from $109.69 in April 2012. Oil import prices should decline in May.

The trade deficit with the euro area was $10.0 billion in April, up from $7.8 billion in April 2012.

The trade deficit with China decreased to $24.1 billion in April, down from $24.5 billion in April 2012. Most of the trade deficit is related to China.

Monday, June 03, 2013

Tuesday: Trade Deficit

by Calculated Risk on 6/03/2013 10:06:00 PM

An interesting article on investor buying from Nathaniel Popper at the NY Times Dealbook: Behind the Rise in House Prices, Wall Street Buyers

Large investment firms have spent billions of dollars over the last year buying homes in some of the nation’s most depressed markets. The influx has been so great, and the resulting price gains so big, that ordinary buyers are feeling squeezed out. Some are already wondering if prices will slump anew if the big money stops flowing.Investor buying has played a key role, but I don't expect investors to start selling in bulk (although the buying will probably slow down). Most of these large investors are planning on holding the properties for some time, but you never know ...

...

Blackstone ... has bought some 26,000 homes in nine states. Colony Capital, a Los Angeles-based investment firm, is spending $250 million each month and already owns 10,000 properties. ... Most of the firms are renting out the homes, with the possibility of unloading them at a profit when prices rise far enough.

While these investors have not touched many healthy real estate markets, they are among the biggest buyers in struggling areas of the country where housing prices have been increasing the fastest. Those gains, in turn, have been at the leading edge of rising home prices nationwide.

Tuesday economic releases:

• At 8:30 AM ET, Trade Balance report for April from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $41.2 billion in April from $38.8 billion in March.

Fannie Mae, Freddie Mac: Mortgage Serious Delinquency rates declined in April, Lowest since early 2009

by Calculated Risk on 6/03/2013 06:11:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in April to 2.93% from 3.02% in March. The serious delinquency rate is down from 3.63% in April 2012, and this is the lowest level since January 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in April to 2.91% from 3.03% in March. Freddie's rate is down from 3.51% in April 2012, and this is the lowest level since June 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until late 2016 or 2017.

U.S. Light Vehicle Sales increased to 15.3 million annual rate in May

by Calculated Risk on 6/03/2013 03:10:00 PM

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.31 million SAAR in May. That is up 10% from May 2012, and up 3% from the sales rate last month.

This was slightly above the consensus forecast of 15.2 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 15.31 million SAAR from AutoData).

Click on graph for larger image.

Click on graph for larger image.

This was the near the post-recession high for auto sales.

After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry even if sales move mostly sideways for the rest of 2013.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and had been a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 5% from 2012.