by Calculated Risk on 6/02/2013 11:38:00 AM

Sunday, June 02, 2013

Brent, Cushing and $3.50 per gallon Gasoline

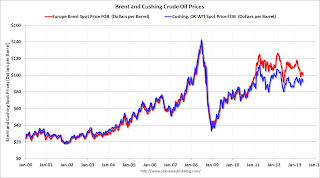

Oil prices have been declining. West Texas Intermediate (WTI) crude oil (quoted in terms of delivery in Cushing, Oklahoma) has fallen to $91.97 per barrel according to Bloomberg. Prices for Brent crude has fallen to $100.39 per barrel.

However national gasoline prices have only declined to $3.64 per gallon according to gasbuddy.com (graph at bottom).

For the last few years there have been some capacity issues at Cushing (see Jim Hamilton's post Prices of gasoline and crude oil for a discussion of the issues).

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the divergence between Brent and Cushing starting in 2011. As Hamilton noted:

[A]n increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.Recently the spread has been closing. At one point Brent was selling for about 25% more than WTI (even though they are comparable quality). Now the difference is under to 10%. (note: $100.39 per barrel for Brent, and $91.97 per barrel for WTI is about 9% difference).

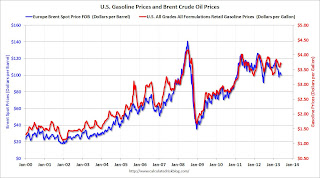

The second graph compares Cushing (WTI) crude oil prices (left axis) with U.S. gasoline prices (right axis).

The second graph compares Cushing (WTI) crude oil prices (left axis) with U.S. gasoline prices (right axis).Gasoline tracked WTI crude oil pretty well (with some noise), until 2011. Then - with the capacity issues at Cushing - gasoline prices have been much higher than the previous relationship just based on WTI.

As Hamilton noted:

The average retail price of gasoline in the United States historically has tracked the price of crude oil pretty closely, with each $1/barrel increase in the price of crude oil showing up as a 2.5-cent increase in the retail price of a gallon of gasoline. But the fact that the U.S. can sell refined petroleum markets at the world price means that for purposes of using that rule of thumb today, you'd want to look at the price of Brent rather than the price of WTI.

The third graph compares Brent crude oil prices (left axis) with U.S. gasoline prices (right axis).

The third graph compares Brent crude oil prices (left axis) with U.S. gasoline prices (right axis).This has been a much closer relationship over the last few years than for WTI and gasoline prices.

Right now - until the spread between WTI and Brent disappears - we need to continue to use Brent to estimate gasoline prices. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.35 per gallon. That is almost 30 cents below the current level according to Gasbuddy.com. There are probably some seasonal factors not included in the calculator, but if crude oil prices stay at the current level, we should expect national gasoline prices to fall below $3.50 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, June 01, 2013

Zillow: Case-Shiller House Price Index expected to show over 12% year-over-year increase in April

by Calculated Risk on 6/01/2013 03:28:00 PM

The Case-Shiller house price indexes for April will be released Tuesday, June 25th. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Zillow makes a strong argument that the Case-Shiller index is currently overstating national house price appreciation.

Zillow: April Case-Shiller Composite To Show Annual Appreciation Above 12%

Buckle up, folks. If you thought the Case-Shiller numbers ... for March were eye-popping, just wait until next month. Our updated forecast indicates that the April 20-City Composite Case-Shiller Home Price Index (non-seasonally adjusted [NSA]) will rise 12.1 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will increase 11.4 percent from year-ago levels. The seasonally adjusted (SA) month-over-month change from March to April will be 1.7 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA).The following table shows the Zillow forecast for the April Case-Shiller index.

...

As we’ve described , the Case-Shiller indices are giving an inflated sense of national home value appreciation because they are biased toward the large, coastal metros currently seeing such enormous home value gains, and because they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. In contrast, the ZHVI does not include foreclosure resales and shows home values for April 2013 up 5.2 percent from year-ago levels. We expect home value appreciation to continue to moderate in 2013, rising only 4 percent between April 2013 and April 2014. Further details on our forecast of home values can be found here, and more on Zillow’s full April 2013 report can be found here.

To forecast the Case-Shiller indices, we use the March Case-Shiller index level, as well as the April Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with April foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow April Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Apr 2012 | 148.44 | 151.51 | 135.98 | 138.90 |

| Case-Shiller (last month) | Mar 2013 | 161.48 | 165.06 | 148.65 | 151.71 |

| Zillow Forecast | YoY | 11.4% | 11.4% | 12.1% | 12.1% |

| MoM | 2.4% | 1.7% | 2.5% | 1.7% | |

| Zillow Forecasts1 | 165.4 | 168.3 | 152.4 | 155.0 | |

| Current Post Bubble Low | 146.46 | 149.59 | 134.07 | 136.83 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Mar-12 | |

| Above Post Bubble Low | 12.9% | 12.5% | 13.7% | 13.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Schedule for Week of June 2nd

by Calculated Risk on 6/01/2013 11:21:00 AM

The key report this week is the May employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, auto sales also on Monday, the Trade Balance report on Tuesday, and the ISM service index on Wednesday.

Also, the Federal Reserve will release the Q1 Flow of Funds report on Thursday.

9:00 AM: The Markit US PMI Manufacturing Index for May. The consensus is for the index to be unchanged at 52.1.

10:00 AM ET: ISM Manufacturing Index for May. The consensus is for an increase to 51.0 from 50.7 in April. Based on the regional surveys, a reading at or below 50 is possible.

10:00 AM ET: ISM Manufacturing Index for May. The consensus is for an increase to 51.0 from 50.7 in April. Based on the regional surveys, a reading at or below 50 is possible.Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in April at 50.7%. The employment index was at 50.2%, and the new orders index was at 52.3%.

10:00 AM: Construction Spending for April. The consensus is for a 1.0% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 15.2 million SAAR in May (Seasonally Adjusted Annual Rate) from 14.9 million SAAR in April.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 15.2 million SAAR in May (Seasonally Adjusted Annual Rate) from 14.9 million SAAR in April.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. Exports declined slightly in March, and imports declined even more, so the deficit declined.

The consensus is for the U.S. trade deficit to increase to $41.2 billion in April from $38.8 billion in March.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 171,000 payroll jobs added in May.

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for a reading of 53.8, up from 53.1 in April. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 1.4% increase in orders.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 345 thousand from 354 thousand last week.

10:00 AM: Trulia Price Rent Monitors for May. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for May. The consensus is for an increase of 167,000 non-farm payroll jobs in May; the economy added 165,000 non-farm payroll jobs in April.

The consensus is for the unemployment rate to be unchanged at 7.5% in May.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through April.

The economy has added 6.8 million private sector jobs since employment bottomed in February 2010 (6.2 million total jobs added including all the public sector layoffs).

The economy has added 6.8 million private sector jobs since employment bottomed in February 2010 (6.2 million total jobs added including all the public sector layoffs).There are still 2.0 million fewer private sector jobs now than when the recession started in 2007.

3:00 PM: Consumer Credit for April from the Federal Reserve. The consensus is for credit to increase $14.0 billion in April.

Unofficial Problem Bank list declines to 761 Institutions

by Calculated Risk on 6/01/2013 08:04:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 31, 2013.

Changes and comments from surferdude808:

As expected, the FDIC released quarterly industry results for the first quarter on Wednesday and its enforcement action activity through April 2013 on Friday. Also, the FDIC closed a bank today. These actions contributed to many changes to the Unofficial Problem Bank List. In all, there were eight removals and two additions, which leave the list with 761 institutions with assets of $277.3 billion. A year ago, the list held 927 institutions with assets of $355.7 billion.

After the changes this week, assets declined by $6.5 billion. However, $4.9 billion of the decline came from asset shrinkage during the first quarter. For the month of May, the list declined by 14 institutions and assets by $8.0 billion. The month included five additions, four failures, four unassisted mergers, and 11 action terminations. Since March 2012, the 11 action terminations match the lowest total posted in October 2012. Along with industry quarterly results, the FDIC released the Official Problem Bank count of 612 institutions with assets of $213.3 billion. We anticipated the difference between the two lists to come in at 150 institutions, which was close to the actual difference of 149. The difference peaked at 185 in the second quarter of 2012.

Removals include the failed Banks of Wisconsin, Kenosha, WI ($134 million). The FDIC terminated actions against First Mariner Bank, Baltimore, MD ($1.3 billion Ticker: FMAR); Cornerstone Community Bank, Saint Petersburg, FL ($230 million); BANKWEST, Rockford, MN ($105 million); Bank of South Texas, McAllen, TX ($78 million); Metro Phoenix Bank, Phoenix, AZ ($76 million); Midwest Community Bank, Plainville, KS ($72 million); and First State Bank, Wilmot, SD ($38 million).

The two additions this week were Enterprise Bank of South Carolina, Ehrhardt, SC ($404 million) and North Milwaukee State Bank, Milwaukee, WI ($90 million).

There is nothing new to report on the status of Capitol Bancorp's banking subsidiaries, particularly 1st Commerce Bank, North Las Vegas ($24 million), which is subject to a sealed hearing on the ability of the Nevada Department of Business and Industry's Financial Institutions Division to terminate its banking charter. We will continue to monitor the status next week.

Friday, May 31, 2013

Friday Rock Blogging

by Calculated Risk on 5/31/2013 10:10:00 PM

With a huge hat tip to Tanta, here is a video she posted years ago.

Hmmm ... "Top ramen tastes a lot better when you eat it off a granite counter top" ...