by Calculated Risk on 5/27/2013 06:23:00 PM

Monday, May 27, 2013

May Vehicle Sales forecast to be at or above 15 million SAAR

Note: The automakers will report May vehicle sales on Monday, June 3rd (next Monday). Here are a few forecasts:

From J.D. Power: J.D. Power and LMC Automotive Report: May New-Vehicle Retail Selling Rate Expected to be 1 Million Units Stronger than a Year Ago

Total light-vehicle sales in May 2013 are expected to increase to 1,439,400, up 8 percent from May 2012 [forecast is 15.2 million Seasonally Adjusted Annual Rate, SAAR]. Fleet sales have generally been weaker than expected in 2013, but continue to average nearly 21 percent of total sales. Fleet sales in May 2013 are projected to reach 281,000 units, representing less than 20 percent of total sales.From TrueCar: May 2013 New Car Sales Expected to Be Up Almost Nine Percent According to TrueCar; May 2013 SAAR at 15.2M, Highest May SAAR

...

Strong demand for full-size pickups is also helping to keep industry average transaction prices at record levels. The average transaction price for all new vehicles thus far in May is $28,921, the highest ever for the month of May and 3 percent higher than May 2012.

For May 2013, new light vehicle sales in the U.S. (including fleet) is expected to be 1,435,495 units, up 8.5 percent from May 2012 and up 12.1 percent from April 2013 (on an unadjusted basis).From Kelley Blue Book: New-car Sales To Improve 6 Percent In May With Help From Memorial Day Weekend Sale Events

The May 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.2 million new car sales, up from 14.9 April 2013 and up from 13.9 million in May 2012.

New-car sales will hit 15.0 million seasonally adjusted annual rate (SAAR) in May, which is an expected 6 percent year-over-year improvement, according to Kelley Blue Book ...Note: There were 1.33 million light vehicle sales in May 2012 or a 13.9 million SAAR. This year sales will probably be around 1.44 million with the same number of selling days - up about 8% from May 2012.

"Growth in the truck segment has been driven by a jump in new-home construction, relatively affordable gas prices and high inventory levels," said [Alec Gutierrez, senior market analyst of automotive insights for Kelley Blue Book.]

Two key points: 1) sales growth will slow in 2013, and 2) it appears auto sales were solid in May (no signs of a consumer slowdown).

Based on the first four months of 2013, it appears auto sales will increase again this year, but not double digit growth like the last few years. This suggests auto sales will contribute less to GDP growth this year than in the previous three years.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.2 | 5.3% |

| 1Sales rate for first four months of 2013. | ||

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 5/27/2013 11:41:00 AM

Last month I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush).

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a better comparison might be to look at the percentage change, but this gives an overall view of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama has just started his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The employment recovery during Mr. G.W. Bush's first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush, with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton and 14,688,000 under President Reagan.

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. A few months into Mr. Obama's second term, there are now 2,582,000 more private sector jobs than when he took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 739,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level.

Sunday, May 26, 2013

Gasoline Prices: Down slightly from last year on Memorial Day

by Calculated Risk on 5/26/2013 03:59:00 PM

According to Gasbuddy.com (see graph at bottom), gasoline prices are down slightly over the last few days to a national average of $3.66 per gallon. One year ago for the week of Memorial Day, prices were at $3.67 per gallon, and for the same week two years ago prices were $3.85 per gallon.

| Memorial Day | Weekly Average Gasoline Price |

|---|---|

| 28-May-07 | $3.25 |

| 26-May-08 | $3.99 |

| 25-May-09 | $2.57 |

| 31-May-10 | $2.78 |

| 30-May-11 | $3.85 |

| 28-May-12 | $3.67 |

| 27-May-13 | $3.66 |

According to Bloomberg, WTI oil is at $94.15 per barrel, and Brent is at $102.64 per barrel. Last year on Memorial Day, Brent was at $107.86 per barrel, and two years ago Brent was at $114.85.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.40 per gallon. That is about 26 cents below the current level according to Gasbuddy.com, however I think there is a seasonal factor that isn't included in the calculator.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

States: Mo Money Mo Problems

by Calculated Risk on 5/26/2013 10:15:00 AM

From the NY Times: California Faces a New Quandary, Too Much Money

After years of grueling battles over state budget deficits and spending cuts, California has a new challenge on its hand: too much money. An unexpected surplus is fueling an argument over how the state should respond to its turn of good fortune.A few comments:

The amount is a matter of debate, but by any measure significant: between $1.2 billion, projected by Gov. Jerry Brown, and $4.4 billion, the estimate of the Legislature’s independent financial analyst.

...

At least seven other states — among them Connecticut, Utah and Wisconsin — have reported budget surpluses in recent weeks, setting the stage for legislative battles that, if not as wrenching as the ones over cuts, promise to be no less pitched. Lawmakers are debating whether the new money should be used to restore programs cut during the recession, finance tax cuts or put into a rainy-day fund for future needs.

1) At the least, this means that the fiscal drag at the state and local levels is mostly over. This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

However the drag from state and local governments has continued. The drag from state and local governments has been a relentless drag on the economy. Just ending this drag will be a positive for the economy. Note: In real terms, state and local government spending is back to early 2001 levels.

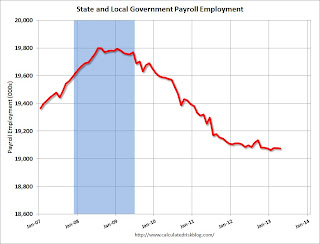

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) State and local employment is unchanged so far in 2013.

Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

2) The article notes three possibilities for the small surpluses: "restore programs cut during the recession, finance tax cuts or put into a rainy-day fund". With the surpluses just starting, I think tax cuts should be off the table (they are too hard to reverse if revenue falters). My suggestion would be to pay down debt (rainy-day fund) and cautiously restore some cuts.

3) Last November, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”Nice to see it is happening in other states too.

Saturday, May 25, 2013

How to Calculate Q2 Personal Consumption Expenditure (PCE) Growth

by Calculated Risk on 5/25/2013 05:05:00 PM

In the schedule for the coming week, I mentioned that the consensus is for personal consumption expenditures (PCE) to be unchanged in April compared to March. Does this mean PCE might not grow in Q2?

First, we don't know the actual number for April yet - and we don't know about May and June - but even if PCE were flat for all three months compared to March, quarterly PCE would grow 1.3% in Q2. This is because quarterly PCE is calculated as an average of the current quarter divided by the average for the previous quarter (seasonally adjusted and annualized).

The following table shows how this works. For Q4 2012, PCE averaged $9,663.8 SAAR (Seasonally Adjusted Annual Rate, billions, 2005 dollars). For Q1 2013, PCE averaged $9,740.0.

If we divided $9,740.0 by $9,663.8 we get 1.007885. Then annualize (take to the fourth power) and subtract 1, and the growth rate is 3.2% (just what the BEA reported for PCE growth in Q1).

If we do the same calculation for Q2, even if PCE is flat for all three months in Q2 (April, May and June), PCE will grow by 1.3% in Q2.

| Q2 Personal Consumption Expenditure (PCE) Growth | ||||

|---|---|---|---|---|

| Quarter | Month | Real PCE, SAAR 2005 dollars (Billions) | Qtr Average | Qtr Growth Rate |

| Oct-12 | $9,629.5 | |||

| Q4 | Nov-12 | $9,673.0 | $9,663.8 | |

| Dec-12 | $9,689.0 | |||

| Jan-13 | $9,708.7 | |||

| Q1 | Feb-13 | $9,740.3 | $9,740.0 | 3.2% |

| Mar-13 | $9,771.1 | |||

| Apr-13 | $9,771.11 | |||

| Q2 | May-13 | $9,771.1 | 1.3% | |

| Jun-13 | ||||

| 1Consensus forecast for April 2013 | ||||

If instead we just compare April to January, PCE would be growing at a 2.6% annual rate in Q2. This is one of the reasons several analysts have recently upgraded their forecasts for Q2 GDP. It appears likely that PCE growth will be above 2% in Q2. Of course government spending - especially Federal government spending - will probably remain a drag on GDP in Q2 (there has been record shrinkage of the public sector over the last several years).

The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Since PCE grew at just under a 4% annualized rate in February and March (and quarterly PCE is an average for the quarter), if PCE is flat in April, May and June, PCE already has some growth built in for Q2 compared to Q1.