by Calculated Risk on 1/30/2013 10:01:00 AM

Wednesday, January 30, 2013

Comments on Q4 GDP and Investment

The Q4 GDP report was negative, with a 0.1% annualized decline in real GDP, and lower than the expected 1.0% annualized increase. Final demand increased in Q4 as personal consumption expenditures (PCE) increased at a 2.2% annual rate (up from 1.6% in Q3), and residential investment increased at a 15.3% annual rate (up from 13.5% in Q3).

Investment in equipment and software rebounded in Q4 (increased at 12.4% annualized rate), and investment in non-residential structures was slightly negative.

The slight decline in GDP was related to changes in private inventories (subtracted 1.27 percentage points), less Federal Government spending (subtracted 1.25 percentage points), and a negative contribution from trade (subtracted 0.25 percentage points).

Overall this was a weak report, but with some underlying positives (the increase in PCE and private fixed investment). I expect the payroll tax increase to slow PCE growth in the first half of 2013 - and for additional government austerity - but I think the economy will continue to grow this year.

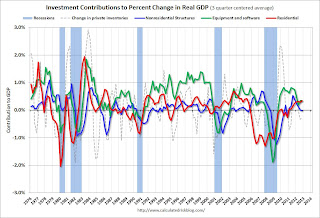

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q4 for the seventh consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment increased solidly in Q4, after decreasing in Q3. This followed twelve consecutive quarters with a positive contribution.

The contribution from nonresidential investment in structures was slightly negative in Q4. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 7 quarters (through Q4 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 7 quarters (through Q4 2012).

However the drag from state and local governments is ongoing, although the drag in Q4 was small. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline in state and local government spending has been relentless and unprecedented. The good news is the drag appears to be ending.

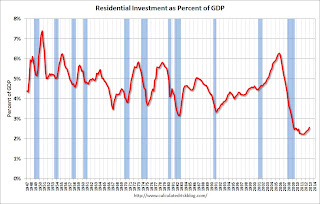

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

In 2011, the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

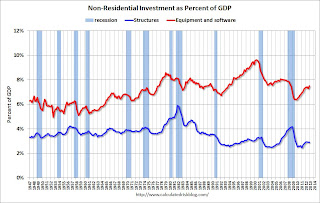

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014 (with the usual caveats about Europe and policy errors in the US).

Real GDP decreased 0.1% Annualized in Q4

by Calculated Risk on 1/30/2013 08:39:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 0.1 percent in the fourth quarter of 2012 (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.1 percentPersonal consumption expenditures (PCE) increased at a 2.2% annualized rate, and residential investment increased 15.3%, equipment and software increased 12.4%. That is a solid increase in fixed investment.

The increase in real GDP in the second quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, private inventory investment, and residential fixed investment that were partly offset by a negative contribution from state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The decrease in real GDP in the fourth quarter primarily reflected negative contributions from private inventory investment, federal government spending, and exports that were partly offset by positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased.

"Change in private inventories" subtracted 1.27 percentage points from GDP in Q4, and the Federal government subtracted 1.25 percentage points (mostly a sharp decrease in defense spending).

This was below expectations, but the internals were decent with PCE and private investment increasing (domestic demand). I'll have more on GDP later ...

ADP: Private Employment increased 192,000 in January

by Calculated Risk on 1/30/2013 08:20:00 AM

Private sector employment increased by 192,000 jobs from December to January, according to the January ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. The December 2012 report, which reported job gains of 215,000, was revised downward by 30,000 to 185,000 jobs.This was above the consensus forecast for 172,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 155,000 payroll jobs in January, on a seasonally adjusted (SA) basis.

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is slowly, but steadily, improving. Monthly job gains appear to have accelerated from near 150,000 to closer to 175,000. Construction is finally kicking into gear and more than offsetting the weakness in manufacturing. The recent gains may be overstating any improvement, particularly in the context of recent revivals in growth at the start of the past three years, but the gains are encouraging nonetheless.”

Note: ADP hasn't been very useful in predicting the BLS report.

Tuesday, January 29, 2013

Wednesday: Q4 GDP, FOMC Announcement, ADP Employment

by Calculated Risk on 1/29/2013 07:16:00 PM

Doug Short provides a preview on GDP: WSJ Economists' GDP Forecasts: 1.6% for Q4 2012 and 1.7 in Q1 2013

A big economic announcement this week will be tomorrow's Advance Estimate for Q4 GDP from the Bureau of Economic Analysis. The final number for Q3 GDP was 3.1%. The general consensus is that Q4 will show a significant decline in this broad measure of the economy. Investing.com weighs in at 1.8%. According to Briefing.com, the consensus for Q4 is 1.0%. However, Briefing.com's own estimate, I should point out, is considerably lower at 0.1%.From Merrill Lynch:

The first release of Q4 GDP is likely to show that growth weakened at the end of 2012. We forecast GDP growth of 1.0%, down from the 3.1% pace in Q3. However, much of the slowdown owes to a contraction in inventories and widening in the trade deficit; domestic final sales should hold close to 2.0%. As such, we advise smoothing through the two quarters to gauge the underlying trend of the economy.As always, the details will matter.

We expect a decent gain in consumer spending of 2.3% and a solid increase in residential investment of 17%. ... The healthy gain in residential investment reflects the turn in homebuilding and greater renovation spending. We also expect equipment and software investment to increase after declining in Q3. On the downside, the trade deficit is likely to widen due to a sharp drop in exports. The biggest drag, however, will come from a sharp contraction in inventories.

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January will be released. This report is for private payrolls only (no government). The consensus is for 172,000 payroll jobs added in January. Even with the new methodology, the report still hasn't been that useful in predicting the BLS report.

• At 8:30 AM, the Q4 GDP report will be released. This is the advance (first) release from the BEA. The consensus is that real GDP increased 1.0% annualized in Q4.

• Around 11:15 AM, the FOMC Meeting Announcement will be released. No significant changes are expected,

Earlier on House Prices:

• Case-Shiller: House Prices increased 5.5% year-over-year in November

• Comment on House Prices, Real House Prices, and Price-to-Rent Ratio

• All Current House Price Graphs

Lawler on Housing Vacancy Survey

by Calculated Risk on 1/29/2013 03:50:00 PM

CR Note: This is wonkish, but important for those using the HVS. An excerpt from economist Tom Lawler: Housing Vacancy Survey: Vacancy Rates “Mixed” on Quarter, Down from Year Ago; Reported Homeownership Rate Lowest Since 1996 (and “True” Homeownership Even Lower!)

The Census Bureau released the “Residential Vacancies and Homeownership” Report for Q4/2012, which is based on the “Housing Vacancy Survey” supplement to the Current Population Survey. The HVS results have not been consistent with the results from the last two decennial Censuses, with the HVS significantly overstating housing vacancy rates and homeownership rates – with the HVS/Census “gap” growing from 2000 to 2010.

According to the Q4 HVS results, the US rental vacancy rate last quarter was 8.7%, up from 8.6% in the previous quarter but down from 9.4% in Q4/11; the HVS homeowner vacancy rate last quarter ws 1.9%, unchanged from the previous quarter but down from 2.3% in Q4/11; and the US homeownership rate last quarter was 65.4%, down from 65.5% in the previous quarter and 66.0% in Q4/11. Last quarter’s HVS-based homeownership rate estimate was the lowest for a fourth quarter since 1996, and the “actual” homeownership rate last quarter was almost certainly lower.

As highlighted in the “sources and accuracy” page of the CPS/HVS, the HVS results for many key measures vary dramatically from decennial Census results.

| 1990 | 2000 | 2010 | |

|---|---|---|---|

| Rental Vacancy Rate | |||

| HVS first half | 7.2% | 7.9% | 10.6% |

| Census (April 1) | 8.5% | 6.8% | 9.2% |

| HVS - Census | -1.3% | 1.1% | 1.4% |

| Homeowner Vacancy Rate | |||

| HVS first half | 1.7% | 1.5% | 2.6% |

| Census (April 1) | 2.1% | 1.7% | 2.4% |

| HVS - Census | -0.4% | -0.2% | 0.2% |

| Homeownership Rate | |||

| HVS first half | 63.9% | 67.2% | 67.0% |

| Census (April 1) | 64.2% | 66.2% | 65.1% |

| HVS - Census | -0.3% | 1.0% | 1.9% |

While it is generally agreed that the HVS does not provide an accurate picture of the US housing market, and Census analysts are “concerned” about the growing “gap” between the HVS and the decennial Census, to the best of my knowledge no work has been done on identifying whether the HVS inaccuracies are related to sampling errors, non-sampling errors, or both.

The HVS report includes “estimates” of the US housing stock by occupancy and vacancy status, but its estimates for the total housing stock are based on housing stock estimates from the Population Division of Census, which are “benchmarked” to decennial Census results. Stated another way, the HVS assumes that the decennial Census estimates of the housing stock are accurate, but also implicitly assumes that the decennial Census estimates of the number of occupied units – total and by tenure – and the number of vacant units – total and by vacancy status – are “bogus.”

Here is the table on the US housing stock from today’s HVS report.

Click on table for larger image.

Click on table for larger image.It is worth noting that the 90% confidence interval shown in the HVS report are measures of “sampling variability,” and assume that the sample used is an unbiased sample of the entire housing “universe.” Statistical comparisons between the HVS and the ACS reject the hypothesis that both surveys use unbiased samples from the same housing universe, while comparisons of the HVS and the decennial Census reject the hypothesis that the HVS estimates are unbiased estimates of housing vacancy and homeownership rates.

A recent study comparing the housing “universe” used for the 2010 ACS with that of the decennial Census revealed some startling (and troubling) differences in terms of both housing units omitted or erroneously excluded and (especially) “housing” unit erroneously included. The HVS sample almost certainly has even bigger “issues.”

The biggest apparent “bias” in the HVS is that it materially underestimates the number/share of the housing stock that is occupied by renters (and overstates the number/share of the housing stock that is vacant). I am not sure why.

...

Lawler concludes: The “true” US homeownership rate last quarter was probably the lowest since the mid-80’s.