by Calculated Risk on 1/23/2013 08:58:00 AM

Wednesday, January 23, 2013

LPS: Mortgage delinquencies increased slightly in December, "In Foreclosure" Declines

LPS released their First Look report for December today. LPS reported that the percent of loans delinquent increased in December compared to November, and declined about 9% year-over-year. Also the percent of loans in the foreclosure process declined further in December and were down significantly in 2012.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.17% from 7.12% in November. Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.44% in December from 3.51% in November.

The number of delinquent properties, but not in foreclosure, is down about 11% year-over-year (465,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 20% or 434,000 properties year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is now declining.

LPS will release the complete mortgage monitor for December in early February.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Dec 2012 | Nov 2012 | Dec 2011 | |

| Delinquent | 7.17% | 7.12% | 7.89% |

| In Foreclosure | 3.44% | 3.51% | 4.20% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 2,031,000 | 1,999,000 | 2,250,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,545,000 | 1,584,000 | 1,791,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,716,000 | 1,767,000 | 2,150,000 |

| Total Properties | 5,292,000 | 5,350,000 | 6,192,000 |

Tuesday, January 22, 2013

Suspending the Debt Ceiling

by Calculated Risk on 1/22/2013 09:07:00 PM

Earlier on Existing Home Sales:

• Existing Home Sales: Another Solid Report

• Existing Home Sales in December: 4.94 million SAAR, 4.4 months of supply

• Existing Home Sales graphs

And on apartments: NMHC Apartment Survey: Market Conditions Loosen Slightly

From CNBC: GOP Moves to Suspend Debt Ceiling Until May

House Speaker John Boehner indicated Tuesday that Republicans will vote on an extension of the federal debt ceiling to allow Treasury to borrow money until mid-May. ...After the "sequester" comes the "continuing resolution" on March 27th. Note: Congress decided last September to extend spending authority for six months with a "continuing resolution".

... the next moment of high political and market drama will occur when the so-called "sequester" or automatic across the board spending cuts, kicks in on March 1.

I expect something will be worked out on the sequester, but there is a strong possibility the “continuing resolution" will lead to a government shutdown. A government shutdown would be disruptive, but probably not catastrophic since most of the government expenditures would continue.

Of course I think they should suspend the debt ceiling permanently (the debt ceiling is about paying the bills). From Ezra Klein: Suspending the debt ceiling is a great idea. Let’s do it forever!

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:45 AM, LPS will released their "First Look" report on December mortgage performance

• At 10:00 AM, FHFA House Price Index for November 2012. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

• During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

ATA Trucking Index increases 2.8% in December

by Calculated Risk on 1/22/2013 06:11:00 PM

This is a minor indicator that I follow.

From ATA: ATA Truck Tonnage Index Jumped 2.8% in December

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.8% in December after surging 3.9% in November. (The 3.9% gain in November was revised from a 3.7% increase ATA reported on December 18, 2012.) The back-to-back increases in November and December were by far the best of gains of 2012. As a result, the SA index equaled 121.6 (2000=100) in December versus 118.3 in November. Despite the solid monthly increase, compared with December 2011, the SA index was off 2.3%, the worst year-over-year result since November 2009. For all of 2012, tonnage was up 2.3%. In 2011, the index increased 5.8%.Note from ATA:

...

“December was better than anticipated in light of the very difficult year-over-year comparison,” ATA Chief Economist Bob Costello said. In December 2011, the index surged 6.4% from the previous month. Costello anticipates more sluggishness in the index this year, especially early in the year, as the economy continues to face several headwinds.

“As paychecks shrink for all households due to higher taxes, I’m expecting a weak first quarter for tonnage and the broader economy” Costello said. “Since trucks account for the vast majority of deliveries in the retail supply chain, any reduction in consumer spending will have ramifications on truck tonnage levels.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Overall the index has been mostly moving sideways this year due to the slowdown in manufacturing. The spike down in October was related to Hurricane Sandy.

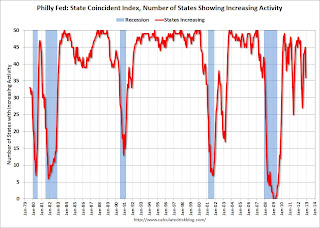

Philly Fed: State Coincident Indexes increased in 36 States in December

by Calculated Risk on 1/22/2013 04:15:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for December 2012. In the past month, the indexes increased in 32 states, decreased in 10, and remained stable in eight for a one-month diffusion index of 44. Over the past three months, the indexes increased in 41 states, decreased in seven, and remained stable in two (New Mexico and Wisconsin) for a three-month diffusion index of 68. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.2 percent in December and 0.6 percent over the past three months.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In December, 36 states had increasing activity, down from 45 in November(including minor increases). This measure has been and up down over the last few years since the recovery has been sluggish.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map was all green early in 2012, than started to turn red, and is mostly green again.

NMHC Apartment Survey: Market Conditions Loosen Slightly

by Calculated Risk on 1/22/2013 01:45:00 PM

From the National Multi Housing Council (NMHC): Expansion Moderates for Apartment Markets in January

After a seven-quarter run, expansion moderated for apartment markets according to the National Multi Housing Council’s (NMHC) January Quarterly Survey of Apartment Market Conditions. For the first time since 2010, two of the four indexes – Market Tightness (45) and Sales Volume (49) – dipped below 50, though just barely. The two financing indexes show continued improvement for the 8th consecutive quarter, as the Equity Financing (56) and Debt Financing (57) Indexes remained above the breakeven level of 50.

“The pace of improvement in the apartment industry is moderating, but the expansion remains solid,” said Mark Obrinsky, NMHC’s Vice President for Research and Chief Economist. “Lease-up demand is seasonally weak in January, which would fully explain the small drop in the Market Tightness Index. Beyond that, markets were quite tight three months ago, and remain tight today. New construction has picked up considerably since its 2009 low, but is still playing catch-up with the increase in demand for apartment residences.”

...

Market Tightness Index declined to 45 from 56. The change ends an 11-quarter run for the index at 50 or higher. Fifty-nine percent of respondents said that markets were unchanged, reflecting stable demand conditions. One quarter of respondents saw markets as looser, up from 14 percent in October, while 16 percent viewed markets as tighter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. This quarterly decline followed eleven consecutive quarters with tighter market conditions.

The recent Reis data showed apartment vacancy rates fell in Q4 2012 to 4.5%, down from 4.7% in Q3 2012. As Obrinsky noted, markets are still tight, but this might suggest the vacancy rate will stop declining (caveat: this is just one quarter of survey data and the index might bounce back).

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 than in 2012, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might stop falling - a possible significant market change - although apartment markets are still tight, so rents will probably continue to increase.