by Calculated Risk on 11/09/2012 09:55:00 AM

Friday, November 09, 2012

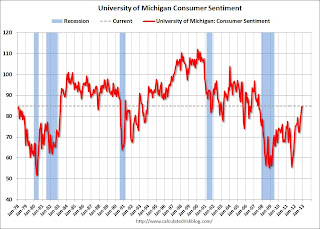

Preliminary November Consumer Sentiment increases to 84.9

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for November increased to 84.9 from the October reading of 82.6. This was the highest level since July 2007 - before the recession started.

This was above the consensus forecast of 83.1. Overall sentiment is still somewhat weak - probably due to a combination of the high unemployment rate and the sluggish economy - but consumer sentiment has been improving recently.

However - remember - that sharp decline in sentiment in August 2011 was due to the threat of default and the debt ceiling debate. Hopefully we will not see that again early next year before the fiscal slope is resolved.

Thursday, November 08, 2012

Friday: Consumer sentiment

by Calculated Risk on 11/08/2012 09:12:00 PM

Tim Duy remains depressed about Europe: Europe Back In The Spotlight

Europe faded from the news over the summer. European Central Bank President Mario Draghi's shift to allowing his institution to serve as a lender of last resort calmed nerves and took the worst case scenario of imminent breakup off the table even though the program has yet to be implemented. With crisis again averted, market participants shifted their focus to the Federal Reserve and the US elections.I wonder when we will see a headline reading "Europe is Back", instead of "Europe Back in he Spotlight"? Not any time in the near future. Very depressing.

In the meantime, economic conditions in Europe continued to slowly deteriorate. We are now looking at another year of dismal growth in the Eurozone. This crisis seems to have no end in sight.

...

Bottom Line: Yes, I remain a Euroskeptic. Maybe it is just in my blood. Europe still looks ugly, and will continue to be so for the next year at least (I tend to think wave after wave of austerity will push the Eurozone into a multi-year malaise, but let's just take it one year at a time for now). I expect European troubles will continue to cloud the global outlook and vex the earning plans of large multinationals for the time being.

Friday:

• At 8:30 AM, Import and Export Prices for October. The consensus is no change in import prices.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for sentiment to increase slightly to 83.3.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for September will be released. The consensus is for a 0.3% increase in inventories.

New CBO report on "Fiscal Cliff"

by Calculated Risk on 11/08/2012 05:12:00 PM

Note: My baseline forecast assumes a compromise on the fiscal slope (more of a "slope" than a "cliff", and January 1st is not a drop dead date). My current guess is an agreement will be reached AFTER January 1st - so that the Bush tax cuts can expire and certain politicians can claim they didn't vote to raise taxes (silly, but that is politics).

I expect the relief from the Alternative Minimum Tax (AMT) will be extended, the tax cuts for low to middle income families will be reenacted, and that most, but not all, of the defense spending cuts will be reversed (aka "sequestration"). However I think the payroll tax cut will probably not be extended, and tax rates on high income earners will increase a few percentage points to the Clinton era levels.

It wasn't worth spending much time on this before the election, but now the details will be important. As the CBO notes, a policy mistake could lead to economic contraction (a new recession), but I think some reasonable agreement is likely.

From the Congressional Budget Office: CBO Releases a Report on the Economic Effects of Policies Contributing to Fiscal Tightening in 2013

Significant tax increases and spending cuts are slated to take effect in January 2013, sharply reducing the federal budget deficit and causing, by CBO’s estimates, a decline in the nation’s economic output and an increase in unemployment. What would be the economic effects of eliminating various components of that fiscal tightening—or what some term the fiscal cliff?

To answer that question, today CBO released a report—Economic Effects of Policies Contributing to Fiscal Tightening in 2013. This report provides additional details about the agency’s estimates—originally released in its August report An Update to the Budget and Economic Outlook: Fiscal Years 2012–2022—of the economic effects of reducing fiscal tightening.

As CBO projected in August, the sharp reduction in the deficit will cause the economy to contract but will also put federal debt on a path more likely to be sustainable over time. If certain scheduled tax increases and spending cuts would not take effect and current tax and spending policies were instead continued, the economy would grow in the short term, but the government’s debt would continue to increase.

This report focuses on the economic effects of eliminating individual components of the changes in policy that are scheduled to take effect: the automatic reductions in defense spending; the automatic reductions in nondefense spending and the scheduled reductions in Medicare’s payment rates for physicians; the extension of certain expiring tax cuts and indexation of the alternative minimum tax; and extension of the payroll tax cut and emergency unemployment benefits.

Eliminating the first three of those changes—which would capture all of the policies included in CBO’s “alternative fiscal scenario”—would boost real (inflation-adjusted) gross domestic product (GDP) by about 2¼ percent by the end of 2013. Eliminating all of those changes would boost real GDP in 2013 by about 3 percent. The bulk of that impact would stem from changes in tax policies, CBO estimates

Lawler: REO inventory of "the F's" and PLS

by Calculated Risk on 11/08/2012 04:00:00 PM

CR Note: Yesterday I posted a graph of REO inventory (lender Real Estate Owned) for the Fs (Fannie, Freddie and the FHA). Economist Tom Lawler has added estimates for PLS (private label securities). Note that the FHA data was for August.

From Tom Lawler:

Here is a chart showing some history of SF REO holdings of Fannie, Freddie, FHA, and private-label securities (from Barclays Capital). Note that FHA has not yet released its report to the FHA commissioner for September (everything there may be focused on the FY 2012 Actuarial Review due out next week, which could be a doozy!), and the number for the end of Q3/2012 (38,187) is actually the August inventory number.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

More from CR: When the FDIC's Q3 quaterly banking profile is released in a couple of weeks, I'm sure Tom will add an estimate for REO at FDIC-insured institutions. This is not all REO: In addition to the FDIC-insured institution REO, this excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other categories.

REO inventories have declined over the last year. This was a combination of more sales and fewer acquisitions.

Also note Tom's comment on the forthcoming FHA FY 2012 Actuarial Review. That will be interesting.

LPS: Mortgage Delinquency Rates increased in September

by Calculated Risk on 11/08/2012 02:17:00 PM

LPS released their Mortgage Monitor report for September today. According to LPS, 7.40% of mortgages were delinquent in September, up from 6.87% in August, and down from 7.72% in September 2011.

LPS reports that 3.87% of mortgages were in the foreclosure process, down from 4.04% in August, and down from 4.18% in September 2011.

This gives a total of 11.27% delinquent or in foreclosure. It breaks down as:

• 2,170,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,530,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,940,000 loans in foreclosure process.

For a total of 5,640,000 loans delinquent or in foreclosure in August. This is up from 5,450,000 last month, and down from 6,130,000 in September 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquency rate has generally been trending down, although there was a pretty sharp increase in September.

Note: A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 3.87%. There are still a large number of loans in this category (about 1.9 million), but it appears this is starting to decline.

From LPS:

The September Mortgage Monitor report released by Lender Processing Services looked at the significant month-over-month increase in the nation’s delinquency rates – up 7.7 percent from August, and representing the largest monthly increase since 2008. While September has historically been marked by seasonal rises in delinquencies, this was still a marked upturn. However, according to LPS Applied Analytics Senior Vice President Herb Blecher, it is important to view the month’s data in its proper context.As Blecher notes, this is just one month of data, and there might be some seasonal issues.

“September’s increase in the delinquency rate was indeed significant, but the overall trend is still one of improvement,” Blecher said. “Despite the monthly jump, delinquencies are down 30 percent from their January 2010 peak, and our analysis revealed some interesting factors related to the spike. Of course, one month’s data does not indicate a trend. We will be monitoring these factors over the coming months to see how the situation develops.”

Blecher continued, “September 2012 was notable in its short duration of business days and virtually all transactional or operational metrics we observed declined in volume for the month; foreclosure starts, foreclosure sales, delinquent cures and loan prepayments all dropped from their August levels. It is important to note that we also saw the percentage of re-defaulting modifications contributing to the delinquency rate actually declined from the month prior.”