by Calculated Risk on 10/31/2012 04:00:00 PM

Wednesday, October 31, 2012

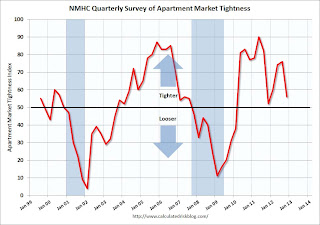

NMHC Apartment Survey: Market Conditions Tighten, Growth Rate Moderates

From the National Multi Housing Council (NMHC): Apartment Market Expansion Continues as Growth Rate Moderates

Apartment markets improved across all areas for the seventh quarter in a row, but the pace of improvement moderated according to the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (56), Sales Volume (51), Equity Financing (56) and Debt Financing (65) all measured at 50 or higher, indicating growth from the previous quarter.

“Even after nearly three years of recovery, apartment markets around the country remain strong as more report tightening conditions than not,” said NMHC Chief Economist Mark Obrinsky. “The dynamic that began in 2010 remains in place: the increase in prospective apartment residents continues to outpace the pickup in new apartments completed. While development activity has picked up considerably since the trough, finance for both acquisition and construction remains constrained, flowing mainly to the best properties in the top markets.”

...

Market Tightness Index declined to 56 from 76. Marking the 11th straight quarter of the index topping 50, the majority (62 percent) reported stable market conditions. One quarter reported tighter markets and 14 percent indicated markets as looser.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last eleven quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q3 2012 to 4.6%, down from 4.7% in Q2 2012, and down from 8.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2012 than in 2011, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.

Fed: Some domestic banks "reported easing standards", Many banks seeing "strengthening of demand"

by Calculated Risk on 10/31/2012 02:30:00 PM

From the Federal Reserve: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, small fractions of domestic banks, on net, reported easing standards for business lending and some categories of consumer lending over the past three months. Respondents reported little change in residential real estate lending standards on balance. Significant fractions of banks reported a strengthening of demand for commercial real estate loans, residential mortgages, and auto loans, on balance, while demand for most other types of loans was about unchanged.

...

Within consumer lending, modest fractions of respondents continued to report an easing of standards on credit card and auto loans; respondents indicated that their standards on other types of consumer loans were about unchanged.

...

Special questions on lending to and competition from European banks. The October survey also included questions about European banking institutions and their affiliates that have been asked on several recent surveys. Respondents to the domestic and foreign survey again reported that their lending standards to European banks and their affiliates had tightened over the past three months, but the fractions of respondents indicating that they had tightened standards declined significantly between the July and October surveys, on net. As in the July survey, domestic banks reported that they had experienced little change in demand for loans from European banks and their affiliates and subsidiaries.

Of the respondents that indicated that their banks compete with European banks for their business, a slight majority reported that they had experienced a decrease in competition from European banks over the past three months, but the decrease did not appreciably boost business at their banks. A smaller but significant fraction of respondents indicated that a decrease in competition from European banks had increased business at their banks to some extent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in demand for CRE (commercial real estate) loans.

Increasing demand and some easing in standards suggests some increase in CRE activity.

The second graph shows the change in demand for residential mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.

The second graph shows the change in demand for residential mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.The survey also has some discussion on Europe. Whereas domestic banks are easing standards slightly and seeing an increase in demand, they are tightening standards for lending to European banks.

CoreLogic: 57,000 Completed Foreclosures in September

by Calculated Risk on 10/31/2012 12:42:00 PM

From CoreLogic: CoreLogic® Reports 57,000 Completed Foreclosures in September

CoreLogic ... today released its National Foreclosure Report for September that provides monthly data on completed U.S. foreclosures and the overall foreclosure inventory. According to the report, there were 57,000 completed foreclosures in the U.S. in September 2012, down from 83,000 in September 2011 and 59,000 in August 2012. Prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 3.9 million completed foreclosures across the country.Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 3.87% of mortgages or 1.9 million in foreclosure.

Approximately 1.4 million homes, or 3.3 percent of all homes with a mortgage, were in the national foreclosure inventory as of September 2012 compared to 1.5 million, or 3.5 percent, in September 2011. Month-over-month, the national foreclosure inventory was down 1.1 percent from August 2012 to September 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process.

“The continuing downward trend in foreclosures along with a gradual clearing of the shadow inventory are signs of stabilization and improvement in the housing market,” said Anand Nallathambi, president and CEO of CoreLogic. “Increasingly improving market conditions and industry and government policy are allowing distressed homeowners to pursue refinancing, loan modifications or short sales rather than foreclosures.”

...

“Homes lost to foreclosure in September 2012 are down 50 percent since the peak month in September 2010 and 22 percent less than the beginning of the year,” said Mark Fleming, chief economist for CoreLogic. “While there is significant progress to be made before returning to pre-crisis levels, the trend is in the right direction as short sales, up 27 percent year over year in August, continue to gain popularity.”

Many observers expected a "surge" in foreclosures this year, but that hasn't happened. However there are still a large number of properties in the foreclosure inventory in some states:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: Florida (11.5 percent), New Jersey (7.3 percent), New York (5.3 percent), Illinois (5.2 percent) and Nevada (4.9 percent).

Chicago PMI: Activity "Idled"

by Calculated Risk on 10/31/2012 09:53:00 AM

From the Chicago ISM:

October 2012: The Chicago Purchasing Managers reported October's Chicago Business Barometer idled, up just 0.2 to a still contractionary 49.9.New orders improved slightly from 47.4 to 50.6 in October. Employment was at 50.3, down from 52.0 in September.

Business Activity measures reflected weakness in five of seven indexes, most notably as the rate of expansion in Production and Employment slowed while New Orders stalled near neutral and Order Backlogs remained in contraction.

EMPLOYMENT: 33 month low;

INVENTORIES: slipped into contraction;

PRICES PAID: inflation slowed a bit;

This was below expectations of a reading of 51.0.

MBA:Refinance Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 10/31/2012 07:03:00 AM

From the MBA: Refinance Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week to the lowest level since the end of August. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.The refinance index has declined for four straight weeks, but is still at a high level.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.65 percent from 3.63 percent, with points decreasing to 0.39 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

This index is not indicating a pickup in purchase activity.