by Calculated Risk on 10/26/2012 09:55:00 AM

Friday, October 26, 2012

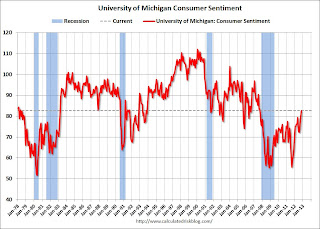

Final October Consumer Sentiment at 82.6

Note: I'll have much more on GDP soon.

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October declined to 82.6 from the preliminary reading of 83.1, and was up from the September reading of 78.3.

This was slightly below the consensus forecast of 83.1. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy - but consumer sentiment has been improving.

Real GDP increased 2.0% annual rate in Q3

by Calculated Risk on 10/26/2012 08:38:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.0 percent in the third quarter of 2012 (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.3 percent.

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), federal government spending, and residential fixed investment that were partly offset by negative contributions from exports, nonresidential fixed investment, and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

The acceleration in real GDP in the third quarter primarily reflected an upturn in federal government spending, a downturn in imports, an acceleration in PCE, a smaller decrease in private inventory investment, an acceleration in residential fixed investment, and a smaller decrease in state and local government spending that were partly offset by downturns in exports and in nonresidential fixed investment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the quarterly real GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the advance estimate for Q3 GDP.

A few comments:

• Consumer spending picked up a little. Real personal consumption expenditures increased 2.0 percent in the third quarter, compared with an increase of 1.5 percent in the second.

• Residential investment increased. Real residential fixed investment increased 14.4 percent, compared with an increase of 8.5 percent.

• State and local government made a negative contribution to GDP for the twelfth straight quarter, but the negative contribution was very minor.

This was slightly above expectations. I'll have more on GDP later ...

Thursday, October 25, 2012

Friday: Q3 GDP

by Calculated Risk on 10/25/2012 09:06:00 PM

Expectations for Q3 GDP are pretty low ... and moving lower. From the WSJ: GDP Estimates Move Lower Following Durables Report

The consensus estimate of economists surveyed by Dow Jones Newswires is that Friday’s report will show the economy grew at a seasonally adjusted annual rate of 1.8% in the July-to-September quarter. But after Thursday’s figures on business investment, some economists said they are bracing for a weaker GDP report than the consensus figure.Friday:

Wells Fargo — pointing out that shipments of core capital goods fell at an annual pace of 4.9% over three months — lowered its estimate of third-quarter GDP growth to an annual rate of 1.4% from 1.6%. J.P. Morgan Chase lowered its forecast to 1.6% from 1.8%.

“The downside risks are mounting to our already below-consensus estimate that GDP increased by only 1.3% in the third quarter,” Paul Ashworth, chief U.S. economist at London-based Capital Economics, said in a note to clients. “At 1.8%, the consensus forecast looks way to high.”

• At 8:30 AM ET, the advance release for Q3 GDP will be released by the BEA. The consensus is that real GDP increased 1.9% annualized in Q3.

• At 9:55 AM, the Reuters/University of Michigan's Consumer sentiment index (final for October). The consensus is for no change from the preliminary reading of 83.1.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Lawler: Home Builders: On Balance, Strong Results

by Calculated Risk on 10/25/2012 04:17:00 PM

From economist Tom Lawler:

Several publicly-traded home builders posted results for the quarter ended September 30th this week, and the general theme was strong net orders, slightly lower cancellation rates, higher margins/lower concessions, and higher home sales prices. Below are some summary stats.

Average sales prices, of course, don’t necessarily reflect gains in “constant-quality” homes, but are affected by changes in the type of homes sold and the regional mix of homes sold. Nevertheless, most home builders appear to be selling homes at “effective” prices well above a year ago.

The combined order backlog of the five builders on September 30th, 2012 was 17,907, up 42.2% from last September.

| New Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 10,570 | 8,283 | 27.6% | 10,339 | 8,890 | 16.3% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $287,229 | $270,558 | 6.2% |

Housing: What Numbers Matter (Part 2)

by Calculated Risk on 10/25/2012 02:28:00 PM

Apparently some people think if existing home sales go flat, or even decline, the housing recovery is in trouble ... or something ...

From Diana Olick at CNBC: Why Today's Housing Report Spooked Investors So Much

[T]he National Association of Realtors reported no change in signed contracts to buy existing homes in September. ...The number of existing home sales is just part of the story.

It wasn't so much the slight disappointment in the monthly index, it was more the comment from the Realtors' chief economist Lawrence Yun:

"This means only minor movement is likely in near-term existing-home sales, but with positive underlying market fundamentals they should continue on an uptrend in 2013.”

Not exactly a rave.

We know we're coming off the bottom of the housing crash, but over the summer it felt to some like we were rocketing off the bottom. Now, not so much.

...

Existing home sales are coming off lows from last year, but last year was the hangover from the 2010 home buyer tax credit ...

"The year-over-year gain was the smallest of the year and comps against last year when the housing market was in a full blown double-dip mode," notes analyst Mark Hanson.

Let me repeat what I wrote earlier this year: Home Sales Reports: What Matters: "When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. Total sales are probably close to the normal level of turnover, but the composition of sales is far from normal - sales are still heavily distressed sales. Over time, existing home sales will probably settle around 5 million per year, but the percentage of distressed sales will eventually decline. Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales."

Unfortunately I have little confidence in the NAR's estimate of conventional sales, but most local data shows a fairly strong increase in conventional sales (as opposed to short sales and foreclosures). As an example, the percent of conventional sales in Phoenix increased from 35.9% in September 2011 to 60.1% in September 2012. Now overall sales were down sharply - the Arizona Regional MLS reported sales in September were down 17.9% from September 2011, but conventional sales were up 37%. I think this is a positive.

Of course the key housing numbers for the economy and jobs are housing starts and new home sales. Also house prices matter too. But the housing report this morning (pending home sales) was mostly irrelevant.