by Calculated Risk on 10/08/2012 11:22:00 AM

Monday, October 08, 2012

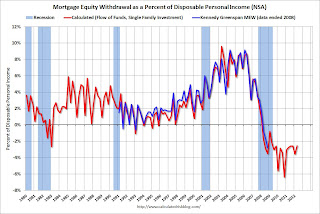

Q2 2012: Mortgage Equity Withdrawal strongly negative

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q2 2012, the Net Equity Extraction was minus $75 billion, or a negative 2.5% of Disposable Personal Income (DPI). This is not seasonally adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q2. Mortgage debt has declined by $1.05 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Greece, Troika talks to resume later

by Calculated Risk on 10/08/2012 09:13:00 AM

From the WSJ: Greece, Troika to Resume Talks This Week

Talks between Greece and a visiting troika of international inspectors made progress ... but no deal has yet been reached and the negotiations will resume next week.And from the Athens News: Police announce ban on rallies during Merkel visit

The inspectors, from the European Commission, the International Monetary Fund and the European Central Bank, will depart Athens ... to attend a meeting of euro-zone finance ministers in Luxembourg Monday, the officials said.

"There has been progress on all fronts, fiscal and structural," one official, speaking to reporters after more than three hours of talks in the Greek capital, said. "The work will continue next week." ...

[As the talks drag on, overshooting their early October deadline, hopes of securing that aid by an Oct. 18 European summit--when European leaders were expected to sign off on Greece's latest aid tranche--now look dim.

The police on Monday announced that all open-air gatherings and rallies will be banned in large sections of central Athens between 9am and 10pm on Tuesday, as a security precaution to "preserve the peace" during a visit by German Chancellor Angela Merkel.

Sunday, October 07, 2012

Sunday Night Futures

by Calculated Risk on 10/07/2012 09:44:00 PM

It appears gasoline prices in California have peaked following several refinery problems, see Jim Hamilton's California gas price spike. These refinery issues happened at a terrible time - just as the refineries were about to change to the winter blend.

From the LA Times: Gov. Brown takes emergency action to try to reduce gas prices

Gov. Jerry Brown took “emergency steps” Sunday to try to bring down record gas prices in the state.The week will start with a focus on Europe. On Monday:

He directed the California Air Resources Board to increase the fuel supply by allowing the immediate sale and import of cheaper and more available winter-blend gasoline.

The move would reduce the price of gas in California by 15 to 20 cents per gallon, probably within a few days, said energy expert Chris Faulkner of Dallas-based Breitling Oil and Gas.

• Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open.

• At 6:00 AM ET, Europe's European Stability Mechanism (ESM) will become active.

• Also at 6:00 AM, the "Troika" Report On Greece will be released.

• At 12:00 PM, the EU Finance Minsters meet in Luxembourg.

The Asian markets are mostly red tonight, with the Hang Seng down 0.3% and the Shanghai down 0.1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2, and the DOW futures are down 17.

Oil prices are down with WTI futures down to $89.88 and Brent down at $111.69 per barrel.

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Two more questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

More Europe

by Calculated Risk on 10/07/2012 06:32:00 PM

Earlier today I posted a few key dates this month in Europe. Here are a few more articles on Europe:

From the Financial Times: UK austerity squeeze set to run until 2018

George Osborne is set to be told this autumn by the Office for Budget Responsibility he will have to plug another large hole in the public finances, extending austerity until 2018 and throwing the coalition’s deficit reduction strategy into doubt.From Bloomberg: Europe Seeks to Contain Spanish Troubles as Finance Chiefs Meet

Excerpt with permission.

European officials will move to prevent Spain from dragging the single currency into a new round of convulsions this week as a series of high-level meetings aim to ease the three-year-old European debt crisis.With a 25.1% unemployment rate in Spain, maybe they should call it an "unemployment crisis".

European finance ministers meet in Luxembourg today to discuss Spain’s overhaul effort and closer banking cooperation, while on Oct. 10, Spanish Prime Minister Mariano Rajoy travels for talks with French President Francois Hollande in Paris. Germany’s Chancellor Angela Merkel tomorrow makes her first visit to Greece since the crisis began in 2009.

“It feels as if we are in for a month or so of Spanish trouble,” Erik Nielsen, London-based chief global economist at UniCredit SpA (UCG), wrote in a note yesterday.

And from Bloomberg: Greece’s Coalition Government, Troika Pause on Budget Talks

Greece and its European Union and International Monetary Fund creditors made progress on talks on a 13.5 billion-euro ($18 billion) package of austerity measures for the next two years and said negotiations would continue next week.I doubt Merkel would be visiting Greece on Tuesday if the report was going to be "bad".

Finance Minister Yannis Stournaras told reporters in Athens after briefing Prime Minister Antonis Samaras on the latest round of negotiations that he hoped the inspectors would give euro-area finance ministers meeting on Oct. 8 a good report.

Employment: A decline in the participation rate was expected due to the aging population

by Calculated Risk on 10/07/2012 02:19:00 PM

I've written extensively on the reasons for the decline in the participation rate. Unfortunately some people haven't been paying attention.

Two key points:

• Some of the recent decline in the participation rate has been to due to cyclical issues (severe recession), but MOST of the decline in the overall participation rate over the last decade has been due to the aging of the population. There are also some long term trends toward lower participation for younger workers pushing down the overall participation rate.

• This decline in the participation rate has been expected for years. Here are three projections (two from before the recession started). The key to these projections is that the decline in the participation rates was expected:

1) From BLS economist Mitra Toossi in November 2006: A new look at long-term labor force projections to 2050

2) From Austin State University Professor Robert Szafran in September 2002: Age-adjusted labor force participation rates, 1960–2045

3) BLS economist Mitra Toossi released some new projections for the participation rate as of January 2012: Labor force projections to 2020: a more slowly growing workforce.

Click on graph for larger image.

Click on graph for larger image.

Here is a graph of the actual overall participation rate and a few projections through 2040. The participation rate might increase a little over the next year or two, but in the longer term, the overall participation rate will probably continue to decline until 2040.

Once again, this is not a surprise. Sven Jari Stehn at Goldman Sachs put out a research note early last year arguing:

[T]here is little evidence for the idea that an “unduly” low participation rate is masking an even weaker labor market than indicated by the ... unemployment rate. Instead, we find that most of the drop in participation in recent years reflects changes in the underlying demographics and the “normal” effects of the economic cycle (i.e., the fact that [the] unemployment rate in itself is very high).Bottom line: If someone says the "actual" unemployment rate is much higher than reported because of the decline in the participation rate, they are unaware of a key demographic shift.

Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th