by Calculated Risk on 10/07/2012 06:32:00 PM

Sunday, October 07, 2012

More Europe

Earlier today I posted a few key dates this month in Europe. Here are a few more articles on Europe:

From the Financial Times: UK austerity squeeze set to run until 2018

George Osborne is set to be told this autumn by the Office for Budget Responsibility he will have to plug another large hole in the public finances, extending austerity until 2018 and throwing the coalition’s deficit reduction strategy into doubt.From Bloomberg: Europe Seeks to Contain Spanish Troubles as Finance Chiefs Meet

Excerpt with permission.

European officials will move to prevent Spain from dragging the single currency into a new round of convulsions this week as a series of high-level meetings aim to ease the three-year-old European debt crisis.With a 25.1% unemployment rate in Spain, maybe they should call it an "unemployment crisis".

European finance ministers meet in Luxembourg today to discuss Spain’s overhaul effort and closer banking cooperation, while on Oct. 10, Spanish Prime Minister Mariano Rajoy travels for talks with French President Francois Hollande in Paris. Germany’s Chancellor Angela Merkel tomorrow makes her first visit to Greece since the crisis began in 2009.

“It feels as if we are in for a month or so of Spanish trouble,” Erik Nielsen, London-based chief global economist at UniCredit SpA (UCG), wrote in a note yesterday.

And from Bloomberg: Greece’s Coalition Government, Troika Pause on Budget Talks

Greece and its European Union and International Monetary Fund creditors made progress on talks on a 13.5 billion-euro ($18 billion) package of austerity measures for the next two years and said negotiations would continue next week.I doubt Merkel would be visiting Greece on Tuesday if the report was going to be "bad".

Finance Minister Yannis Stournaras told reporters in Athens after briefing Prime Minister Antonis Samaras on the latest round of negotiations that he hoped the inspectors would give euro-area finance ministers meeting on Oct. 8 a good report.

Employment: A decline in the participation rate was expected due to the aging population

by Calculated Risk on 10/07/2012 02:19:00 PM

I've written extensively on the reasons for the decline in the participation rate. Unfortunately some people haven't been paying attention.

Two key points:

• Some of the recent decline in the participation rate has been to due to cyclical issues (severe recession), but MOST of the decline in the overall participation rate over the last decade has been due to the aging of the population. There are also some long term trends toward lower participation for younger workers pushing down the overall participation rate.

• This decline in the participation rate has been expected for years. Here are three projections (two from before the recession started). The key to these projections is that the decline in the participation rates was expected:

1) From BLS economist Mitra Toossi in November 2006: A new look at long-term labor force projections to 2050

2) From Austin State University Professor Robert Szafran in September 2002: Age-adjusted labor force participation rates, 1960–2045

3) BLS economist Mitra Toossi released some new projections for the participation rate as of January 2012: Labor force projections to 2020: a more slowly growing workforce.

Click on graph for larger image.

Click on graph for larger image.

Here is a graph of the actual overall participation rate and a few projections through 2040. The participation rate might increase a little over the next year or two, but in the longer term, the overall participation rate will probably continue to decline until 2040.

Once again, this is not a surprise. Sven Jari Stehn at Goldman Sachs put out a research note early last year arguing:

[T]here is little evidence for the idea that an “unduly” low participation rate is masking an even weaker labor market than indicated by the ... unemployment rate. Instead, we find that most of the drop in participation in recent years reflects changes in the underlying demographics and the “normal” effects of the economic cycle (i.e., the fact that [the] unemployment rate in itself is very high).Bottom line: If someone says the "actual" unemployment rate is much higher than reported because of the decline in the participation rate, they are unaware of a key demographic shift.

Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Europe: Merkel Visits Greece on Tuesday and a few key dates

by Calculated Risk on 10/07/2012 09:18:00 AM

A few key dates in Europe:

• Monday, Oct 8th, at 6 AM ET, Europe's European Stability Mechanism (ESM) will become active.

• Monday, Oct 8th, at 6 AM ET, The "Troika" Report On Greece will be released.

• Monday, Oct 8th, at 12 PM, EU Finance Ministers meeting in Luxembourg.

• Tuesday, Oct 9th, at 6 AM: Eurozone Finance Minsters Meet

• Tuesday, Oct 9th: German Chancellor Angela Merkel will visit Athens and meet with Greek Prime Minister Antonis Samaras. Press conference to follow.

• European Council meeting, October 18th and 19th in Brussels.

From the WSJ: Chancellor Merkel to Pay Visit to Athens

Ms. Merkel's trip is meant to show her support for Greek Prime Minister Antonis Samaras as his government struggles to agree on a new round of unpopular austerity measures, analysts say. The trip will signal the two leaders' attempt at easing strains between indebted Greece and its most powerful creditor, Germany.Since Merkel is visiting Greece, it seems like the Troika report will be somewhat positive.

...

Ms. Merkel will likely express sympathy with the Greek people's economic sacrifices, say analysts, while standing firm on Greece's need to implement promised spending cuts and economic overhauls.

...

A massive security presence is likely during the visit of Ms. Merkel, who plans to return to Berlin by Tuesday night. ... The expected protests could turn violent, as many demonstrations in Athens have in the past three years, which could sully the two governments' attempt to show a renewed fellowship.

Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Saturday, October 06, 2012

Unofficial Problem Bank list declines to 873 Institutions

by Calculated Risk on 10/06/2012 06:15:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 6, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Very quiet week for the Unofficial Problem Bank List with only removal. The list has 873 institutions with assets of $334.9 billion. A year ago, the list held 983 institutions with assets of $404.1 billion. This week, the Federal Reserve terminated the action against Farmers State Bank of West Concord, West Concord, MN ($46 million). Next week will likely be just as quiet.Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Earlier:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Schedule for Week of Oct 7th

by Calculated Risk on 10/06/2012 01:01:00 PM

Earlier:

• Summary for Week Ending Oct 5th

Early in the week, the focus will be on Europe with a report due on Greece, the ESM becoming active, and a finance minister meeting.

The key US report for this week will be the August trade balance report on Thursday.

Note: I will be in San Francisco later this week attending the Zillow / USC housing forum.

6:00 AM ET: Europe's European Stability Mechanism (ESM) will become active.

6:00 AM: The "Troika" Report On Greece will be released.

12:00 PM: the EU Finance Minsters meet in Luxembourg.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.4% increase in inventories.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

8:30 AM: Trade Balance report for August from the Census Bureau.

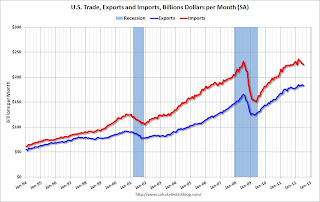

8:30 AM: Trade Balance report for August from the Census Bureau. This graph is through July. Both exports and imports decreased in July. Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

The consensus is for the U.S. trade deficit to increase to $44.0 billion in August, up from from $42.0 billion in July. Export activity to Europe will be closely watched due to economic weakness.

8:30 AM: Import and Export Prices for September. The consensus is a for a 0.7% increase in import prices

10:00 AM: Speech by Fed Governor Jeremy Stein, "Evaluating Large-Scale Asset Purchases", At the Brookings Institution Discussion, Washington, D.C.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for sentiment to be unchanged at 78.3.