by Calculated Risk on 10/07/2012 09:18:00 AM

Sunday, October 07, 2012

Europe: Merkel Visits Greece on Tuesday and a few key dates

A few key dates in Europe:

• Monday, Oct 8th, at 6 AM ET, Europe's European Stability Mechanism (ESM) will become active.

• Monday, Oct 8th, at 6 AM ET, The "Troika" Report On Greece will be released.

• Monday, Oct 8th, at 12 PM, EU Finance Ministers meeting in Luxembourg.

• Tuesday, Oct 9th, at 6 AM: Eurozone Finance Minsters Meet

• Tuesday, Oct 9th: German Chancellor Angela Merkel will visit Athens and meet with Greek Prime Minister Antonis Samaras. Press conference to follow.

• European Council meeting, October 18th and 19th in Brussels.

From the WSJ: Chancellor Merkel to Pay Visit to Athens

Ms. Merkel's trip is meant to show her support for Greek Prime Minister Antonis Samaras as his government struggles to agree on a new round of unpopular austerity measures, analysts say. The trip will signal the two leaders' attempt at easing strains between indebted Greece and its most powerful creditor, Germany.Since Merkel is visiting Greece, it seems like the Troika report will be somewhat positive.

...

Ms. Merkel will likely express sympathy with the Greek people's economic sacrifices, say analysts, while standing firm on Greece's need to implement promised spending cuts and economic overhauls.

...

A massive security presence is likely during the visit of Ms. Merkel, who plans to return to Berlin by Tuesday night. ... The expected protests could turn violent, as many demonstrations in Athens have in the past three years, which could sully the two governments' attempt to show a renewed fellowship.

Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Yesterday:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Saturday, October 06, 2012

Unofficial Problem Bank list declines to 873 Institutions

by Calculated Risk on 10/06/2012 06:15:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 6, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Very quiet week for the Unofficial Problem Bank List with only removal. The list has 873 institutions with assets of $334.9 billion. A year ago, the list held 983 institutions with assets of $404.1 billion. This week, the Federal Reserve terminated the action against Farmers State Bank of West Concord, West Concord, MN ($46 million). Next week will likely be just as quiet.Friday on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Earlier:

• Summary for Week Ending Oct 5th

• Schedule for Week of Oct 7th

Schedule for Week of Oct 7th

by Calculated Risk on 10/06/2012 01:01:00 PM

Earlier:

• Summary for Week Ending Oct 5th

Early in the week, the focus will be on Europe with a report due on Greece, the ESM becoming active, and a finance minister meeting.

The key US report for this week will be the August trade balance report on Thursday.

Note: I will be in San Francisco later this week attending the Zillow / USC housing forum.

6:00 AM ET: Europe's European Stability Mechanism (ESM) will become active.

6:00 AM: The "Troika" Report On Greece will be released.

12:00 PM: the EU Finance Minsters meet in Luxembourg.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.4% increase in inventories.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

8:30 AM: Trade Balance report for August from the Census Bureau.

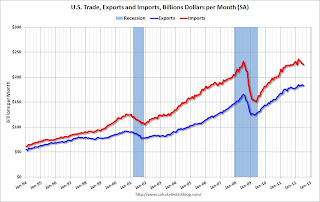

8:30 AM: Trade Balance report for August from the Census Bureau. This graph is through July. Both exports and imports decreased in July. Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

The consensus is for the U.S. trade deficit to increase to $44.0 billion in August, up from from $42.0 billion in July. Export activity to Europe will be closely watched due to economic weakness.

8:30 AM: Import and Export Prices for September. The consensus is a for a 0.7% increase in import prices

10:00 AM: Speech by Fed Governor Jeremy Stein, "Evaluating Large-Scale Asset Purchases", At the Brookings Institution Discussion, Washington, D.C.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for sentiment to be unchanged at 78.3.

Summary for Week Ending Oct 5th

by Calculated Risk on 10/06/2012 08:01:00 AM

This was a very busy week for US economic data, capped off with an encouraging employment report. Yesterday I wrote Employment: Somewhat Better (also more graphs) and I pointed out a number of positives (and a few negatives) in the September report.

Most of the other economic data was somewhat positive too (even without housing!). Both ISM surveys (manufacturing and service) were weak, but above expectations. And auto sales were at the highest level since February 2008.

Also the impact of QE3 was evident in the MBA mortgage refinance index that increased to the highest level since 2009.

Here is a summary of last week in graphs:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

Even though payroll growth was weak, this was a much stronger report than the last few months, especially considering the upward revisions to the July and August reports. And that doesn't include the annual benchmark revision (that will also show more jobs).

Even though payroll growth was weak, this was a much stronger report than the last few months, especially considering the upward revisions to the July and August reports. And that doesn't include the annual benchmark revision (that will also show more jobs).

This was slightly above expectations of 113,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 7.8% (red line). This is from the household report, and that report showed strong job growth.

The Labor Force Participation Rate increased slightly to 63.6% in September (blue line. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased slightly to 63.6% in September (blue line. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio increased to 58.7% in September (black line). This is still very low.

The third graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms compared to other financial crisis (including the Great Depression).

This is an update to a graph by economist Josh Lehner (ht Josh for the data):

This is an update to a graph by economist Josh Lehner (ht Josh for the data):

[I]n the context of the Big 5 financial crises, the current U.S. cycle suddenly does not look quite as dire. Notice how the x-axis, how long it takes to return to peak levels of employment, is measured in years(!) not months like the first graph.Even though payroll growth was weak and close to expectations (expected was 113,000), overall this was a much stronger report than for recent months.

...

[T]he U.S. labor market has performed better than 4 of the previous Big 5 crises, as identified by Reinhart and Rogoff, in terms of job loss and the return to peak time line.

• ISM Manufacturing index increases in September to 51.5

Click on graph for larger image.

Click on graph for larger image.The ISM index indicated expansion after three consecutive months of contraction. PMI was at 51.5% in September, up from 49.6% in August. The employment index was at 54.7%, up from 51.6%, and the new orders index was at 52.3%, up from 47.1%.

Here is a long term graph of the ISM manufacturing index.

This was above expectations of 49.7% and suggests manufacturing expanded in September. The internals were positive too with new orders and employment increasing.

• ISM Non-Manufacturing Index increases in September

The September ISM Non-manufacturing index was at 55.1%, up from 53.7% in August. The employment index decreased in September to 51.1%, down from 53.8% in August. Note: Above 50 indicates expansion, below 50 contraction.

The September ISM Non-manufacturing index was at 55.1%, up from 53.7% in August. The employment index decreased in September to 51.1%, down from 53.8% in August. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.5% and indicates faster expansion in September than in August. The internals were mixed with the employment index down, but new orders up.

• U.S. Light Vehicle Sales at 14.94 million annual rate in September, Highest since Feb 2008

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.94 million SAAR in September. That is up 14% from September 2011, and up 3% from the sales rate last month.

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.94 million SAAR in September. That is up 14% from September 2011, and up 3% from the sales rate last month.This was above the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

It looks like auto sales were up about 2.7% in Q3 compared to Q2 (over 10% annualized increase), and auto sales will probably make another small positive contribution to GDP. However it appears there is a shift to smaller cars, so total revenue might not increase much.

• Office Vacancy Rate declines slightly in Q3 to 17.1%

From Reuters: U.S. office market barely gains in third quarter

From Reuters: U.S. office market barely gains in third quarterThis graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis is reporting the vacancy rate declined in Q3 to 17.1%, down slightly from 17.2% in Q2, and down from 17.4% in Q3 2011. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010.

This is a sluggish recovery for office space.

• Reis: Apartment Vacancy Rate declined slightly to 4.6% in Q3, More Supply coming in 2013

Reis reported that the apartment vacancy rate (82 markets) fell slightly to 4.6% in Q3, down from 4.7% in Q1 2012. The vacancy rate was at 5.6% in Q3 2011 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate (82 markets) fell slightly to 4.6% in Q3, down from 4.7% in Q1 2012. The vacancy rate was at 5.6% in Q3 2011 and peaked at 8.0% at the end of 2009.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999).

Reis is just for large cities. It appears that the declines in vacancy rates is slowing, and rent increases might slow too. Also, as Reis economist Calanog notes, there will be a significant increase in new supply in 2013 (and in 2014).

• Reis: Regional Mall Vacancy Rate declines in Q3, Strip Mall vacancy rate unchanged

Reis reported that the vacancy rate for regional malls declined to 8.7% in Q3 from 8.9% in Q2. This is down from a cycle peak of 9.4% in Q3 of last year.

Reis reported that the vacancy rate for regional malls declined to 8.7% in Q3 from 8.9% in Q2. This is down from a cycle peak of 9.4% in Q3 of last year.For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged at 10.8% in Q3. For strip malls, the vacancy rate peaked at 11.0% in Q2 of last year.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The yellow line shows mall investment as a percent of GDP. This has been increasing a little recently because this includes renovations and improvements. New mall investment has essentially stopped.

• Weekly Initial Unemployment Claims increase to 367,000

The DOL reports:

The DOL reports:In the week ending September 29, the advance figure for seasonally adjusted initial claims was 367,000, an increase of 4,000 from the previous week's revised figure of 363,000. The 4-week moving average was 375,000, unchanged from the previous week's revised average.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 375,000.

This was lower than the consensus forecast of 370,000. Mostly moving sideways this year ...

• Construction Spending decreased in August

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 60% below the peak in early 2006, and up 23% from the post-bubble low. Non-residential spending is 30% below the peak in January 2008, and up about 27% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and near the post-bubble low.

Note: Spending in August would have been up compared to July without the upward revision to July spending. With both June and July revised up, this report was decent. Residential construction spending was up in August, and the solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit).

• Other Economic Stories ...

• LPS: Mortgage prepayment rates highest since 2005

• MBA: Mortgage Refinance Applications increases sharply, Highest Since 2009

• U.S. Births Decline for the fourth consecutive year in 2011

• Trulia: Asking House Prices increased in September

• FOMC Minutes: "Most participants agreed numerical thresholds could be useful"

• ADP: Private Employment increased 162,000 in September

Friday, October 05, 2012

Gasoline Prices surge in California due to Refinery Problems

by Calculated Risk on 10/05/2012 05:56:00 PM

Earlier on employment:

• September Employment Report: 114,000 Jobs, 7.8% Unemployment Rate

• Employment: Somewhat Better (also more graphs)

• All Employment Graphs

Last night I mentioned the soaring gasoline prices in California, here is an update from the LA Times: California facing new record high for gasoline prices

The average price for a gallon of regular gasoline in California jumped a whopping 17.1 cents overnight. That makes it almost certain that the state's motorists will see a new all-time record high for gas sometime this weekend.The following graph shows the recent decrease in gasoline prices. Gasoline prices have been on a roller coaster all year.

Friday's average price for a gallon of unleaded regular in California is $4.486 a gallon, which is by far the highest in the nation.

...

Analysts have blamed the sudden increase on a recent spate of refinery problems.

Add Los Angeles or San Francisco, and you'll see the graph go straight up!

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |