by Calculated Risk on 9/30/2012 09:07:00 PM

Sunday, September 30, 2012

Sunday Night Futures: ISM Mfg Index, Construction Spending, Bernanke Speech

For the economic question contest in September, the leaders were (Congratulations all!):

1st: Andrew Marrinson

2nd: Daniel Brawdy

3rd tie: Billy Forney, Walt Tucker

On Monday:

• At 10:00 AM ET, the ISM Manufacturing Index for September will be released. The ISM index has shown contraction for three consecutive months; the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 49.7, up from 49.6 in August. (below 50 is contraction).

• At 10:00 AM, the Construction Spending report for August will be released. The consensus is for a 0.6% increase in construction spending.

• At 12:30 PM, Fed Chairman Ben Bernanke will speak: "Five Questions about the Federal Reserve and Monetary Policy", At the Economic Club of Indiana, Indianapolis, Indiana

The Asian markets are mixed tonight, with the Nikkei down 0.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly, and the DOW futures up slightly.

Oil prices are mixed with WTI futures up slightly at $92.19 and Brent down at $112.07 per barrel.

Yesterday:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Five questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Analysis: Mark Zandi wrong about housing tax credit

by Calculated Risk on 9/30/2012 12:40:00 PM

Some of Mark Zandi's analysis has been excellent, but I think he is wrong about the housing tax credit and confused about some of the timing of the housing bust.

First, from Mark Zandi, chief economist at Moody’s Analytics in the WaPo: Obama policies ended housing free fall

Temporary tax credits also enticed home buyers to act sooner rather than later, breaking a self-reinforcing deflationary cycle in the housing market. Prospective buyers had remained on the sidelines, waiting for prices to stop falling, and their reluctance caused prices to drop still more.First, house prices declined about 7.5% from January 2009 to the recent low earlier this year. In real terms, house prices declined about 16% from January 2009 to the recent low!. How can Zandi say the tax credit ended "the downdraft in prices"? That is incorrect.

The tax credits didn’t spark additional home sales so much as pull sales forward from the future; sales weakened sharply as soon as the credits expired. The credits also were expensive, costing the Treasury tens of billions of dollars, and much of the benefit went to home buyers who would have bought homes anyway. But the tax benefit gave buyers a reason to stop waiting, ending the downdraft in prices.

Critics charge that the government’s intervention was costly and ineffective, that the administration should have let the housing market sort things out on its own. This would have been a reasonable position if house prices had been too high when Obama’s policies kicked in; but they weren’t. By the time Obama took office, prices had fallen substantially; with low mortgage rates factored in, homes were as affordable as ever. Investors knew this, and as soon as they saw prices nearing the bottom, they began snapping up distressed properties. These investors weren’t house flippers, like those who fueled the housing bubble, but long-term players seeing bargains. Obama’s efforts to shore up housing were well timed.

Most of the decline in house prices happened before January 2009, but the decline since early 2009 would still have been the largest decline in house prices nationally from the Depression through 2006. Only a few regional house price declines (like California in the early '90s) were larger than the 16% real decline over the last 3+ years!

In fact the housing tax credit was expensive and ineffective. I opposed the tax credit early and often. The tax credit for buying new homes was especially dumb. A key problem during the housing bust was the excess supply of vacant housing units, and incentivizing people to buy new homes (and add to the supply) made no sense at all.

Of course the Obama Administration doesn't deserve all the blame for the housing tax credit blunder; the tax credit was originally proposed by Senators Johnny Isakson (R) and Joe Lieberman (I).

Zandi makes another mistake when he conflates investor buying and affordability: "with low mortgage rates factored in, homes were as affordable as ever". The buy-and-rent investors really started buying in late 2008 and early 2009 - and those investors paid cash (low mortgage rates were NOT a factor). At that time the private label securities (Wall Street) were dumping foreclosed properties in mostly low priced areas, and investors responded by buying for the cash flow opportunity. It is correct that prices bottomed earlier in many of those areas (the "destickification" of prices due to PLS dumping), but prices declined in most areas for a few more years.

By now I'd hope that everyone would realize 1) that the housing tax credit was a policy mistake, and 2) most house prices declined significantly over the last 3+ years.

Yesterday:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Gasoline Prices down 8 cents over last 2 weeks

by Calculated Risk on 9/30/2012 09:18:00 AM

Another update: Gasoline prices declined recently, and are down about 8 cents nationally over the last 2 weeks. Brent crude spot prices increased to $117.48 per barrel two weeks ago, and then declined sharply to $108.49. However Brent has increased over the last few days to $113 per barrel.

We are still paying over $4 per gallon in California (I filled up on Friday and paid $4.15 per gallon.

.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.67 per gallon. That is about 10 cents below the current level according to Gasbuddy.com (see graph below).

The following graph shows the recent decrease in gasoline prices. Gasoline prices have been on a roller coaster all year.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Saturday, September 29, 2012

Unofficial Problem Bank List and Quarterly Transition Matrix

by Calculated Risk on 9/29/2012 06:47:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 28, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

FDIC released its enforcement action activity through August 2012 and closed a bank this week leading to many changes in the Unofficial Problem Bank List. In total, there were 12 removals and eight additions that leave the list with 874 institutions with assets of $334.9 billion. While the number of banks on the list declined, it was the first weekly increase in assets since June 29th. A year ago, the list held 986 institutions with assets of $405 billion. For the month, assets increased by $3.4 billion while the institutions count fell by 17 institutions after 18 action terminations, nine unassisted mergers, three failures, and a voluntary liquidation.

Actions were terminated against Ames Community Bank, Ames, IA ($406 million); Farmers & Merchants Bank & Trust, Burlington, IA ($195 million); Bank of Lincoln County, Fayetteville, TN ($130 million); Lake Community Bank, Long Lake, MN ($128 million); EuroBank, Coral Gables, FL ($104 million); Twin City Bank, Longview, WA ($41 million); Beartooth Bank, Billings, MT ($38 million); America's Community Bank, Blue Springs, MO ($28 million).

First United Bank, Crete, IL ($328 million)was removed because of failure. Desert Commercial Bank, Palm Desert, CA ($139 million Ticker: DCBC); The Exchange National Bank of Cottonwood Falls, Cottonwood Falls, KS ($34 million); and Colorado Valley Bank, SSB, La Grange, TX ($28 million) were acquired through unassisted mergers.

The eight additions were Doral Bank, San Juan, PR ($7.6 billion Ticker: DRL); Northwestern Bank, Traverse City, MI ($869 million Ticker: NWBM); Alliance Bank Central Texas, Waco, TX ($208 million); Flathead Bank of Bigfork, Montana, Bigfork, MT ($207 million); Bay Bank, Green Bay, WI ($99 million); Colonial Co-operative Bank, Gardner, MA ($72 million); Elysian Bank, Elysian, MN ($45 million); and Community Bank and Trust - West Georgia, LaGrange, GA ($95 million), which joins its sister bank Community Bank and Trust – Alabama on the list.

With the end of the third quarter, it is time to refresh the transition matrix. As seen in the table below, there have been a total of 1,588 institutions with assets of $810.9 billion that have appeared on the list. Removals have totaled 714 institutions or 45 percent of the total. Failures continue to be the leading removal cause as 340 institutions with assets of $288.2 billion have failed since appearing on the list. Removals from unassisted mergers and voluntary liquidations total 122 institutions. This year, there has been an acceleration in action terminations. In all, actions have been terminated against 252 institutions with assets of $112.9 billion, with 53 termination occurring in this quarter.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 87 | (25,157,616) | |

| Unassisted Merger | 25 | (3,781,599) | |

| Voluntary Liquidation | 2 | (4,855,164) | |

| Failures | 148 | (182,228,947) | |

| Asset Change | (16,422,867) | ||

| Still on List at 9/30/2012 | 127 | 43,867,236 | |

| Additions | 747 | 291,097,603 | |

| End (9/30/2012) | 874 | 334,964,839 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 165 | 87,707,680 | |

| Unassisted Merger | 88 | 48,052,527 | |

| Voluntary Liquidation | 7 | 1,760,816 | |

| Failures | 192 | 105,953,675 | |

| Total | 452 | 243,474,698 | |

| 1Institutions not on 8/7/2009 or 9/30/2012 list but appeared on a list between these dates. | |||

Earlier:

• Summary for Week Ending Sept 28th

• Schedule for Week of Sept 30th

Schedule for Week of Sept 30th

by Calculated Risk on 9/29/2012 01:10:00 PM

Earlier:

• Summary for Week Ending Sept 28th

The key report for this week will be the September employment report to be released on Friday, Oct 5th. Other key reports include the ISM manufacturing index on Monday, vehicle sales also on Tuesday, and the ISM non-manufacturing (service) index on Wednesday.

On Monday, Fed Chairman Ben Bernanke will speak on monetary policy, and on Thursday, October 4th, there is a Governing Council meeting of the European Central Bank with a press conference to follow.

Reis will release their Q3 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, a slight decline in vacancy rates for malls, and that the office vacancy rate was unchanged.

10:00 AM ET: ISM Manufacturing Index for September.

10:00 AM ET: ISM Manufacturing Index for September. Here is a long term graph of the ISM manufacturing index. The ISM index has shown contraction for three consecutive months; the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 49.7, up from 49.6 in August. (below 50 is contraction).

10:00 AM: Construction Spending for August. The consensus is for a 0.6% increase in construction spending.

12:30 PM: Speech, Fed Chairman Ben Bernanke, "Five Questions about the Federal Reserve and Monetary Policy", At the Economic Club of Indiana, Indianapolis, Indiana

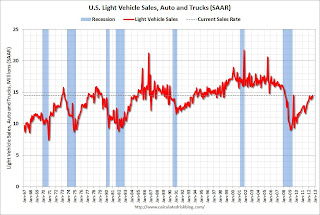

All day: Light vehicle sales for September. The consensus is for light vehicle sales to be unchanged at 14.5 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate. TrueCar is forecasting:

The September 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.6 million new car sales, up from 13.1 million in September 2011 and up from 14.5 million in August 2012Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,145,344 new cars and trucks will be sold in the U.S. in September for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.4 million light vehicles.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in August, down from the 201,000 reported last month.

10:00 AM: ISM non-Manufacturing Index for September. The consensus is for a decrease to 53.5 from 53.7 in August. Note: Above 50 indicates expansion, below 50 contraction.

9:00 PM: First Presidential Debate: President Obama and former Governor Romney.

7:45 AM: Governing Council meeting of the European Central Bank with a press conference to follow. Here is the ECB website and press conference page.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 359 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 6.0% decrease in orders.

10:00 AM: Trulia Price Rent Monitors for September. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

2:00 PM: FOMC Minutes for Meeting of September 12-13, 2012. The minutes might provide additional information about the recent Fed decision.

8:30 AM: Employment Report for September. The consensus is for an increase of 113,000 non-farm payroll jobs in September; there were 96,000 jobs added in August.

8:30 AM: Employment Report for September. The consensus is for an increase of 113,000 non-farm payroll jobs in September; there were 96,000 jobs added in August.The consensus is for the unemployment rate to be unchanged at 8.1% in August.

Note: Analysts at Nomura point out a special issue: "We expect the Chicago teacher strike to reduce local government payrolls by roughly 25k in September ..."

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through June.

The economy has added 5.1 million private sector jobs since employment bottomed in February 2010 including benchmark revision (4.4 million total jobs added including all the public sector layoffs).

The economy has added 5.1 million private sector jobs since employment bottomed in February 2010 including benchmark revision (4.4 million total jobs added including all the public sector layoffs).There are still 3.8 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision). There are 4.3 million fewer total nonfarm jobs (including benchmark).

3:00 PM: Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $7.8 billion in August.