by Calculated Risk on 9/29/2012 01:10:00 PM

Saturday, September 29, 2012

Schedule for Week of Sept 30th

Earlier:

• Summary for Week Ending Sept 28th

The key report for this week will be the September employment report to be released on Friday, Oct 5th. Other key reports include the ISM manufacturing index on Monday, vehicle sales also on Tuesday, and the ISM non-manufacturing (service) index on Wednesday.

On Monday, Fed Chairman Ben Bernanke will speak on monetary policy, and on Thursday, October 4th, there is a Governing Council meeting of the European Central Bank with a press conference to follow.

Reis will release their Q3 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, a slight decline in vacancy rates for malls, and that the office vacancy rate was unchanged.

10:00 AM ET: ISM Manufacturing Index for September.

10:00 AM ET: ISM Manufacturing Index for September. Here is a long term graph of the ISM manufacturing index. The ISM index has shown contraction for three consecutive months; the first contraction in the ISM index since the recession ended in 2009. The consensus is for an increase to 49.7, up from 49.6 in August. (below 50 is contraction).

10:00 AM: Construction Spending for August. The consensus is for a 0.6% increase in construction spending.

12:30 PM: Speech, Fed Chairman Ben Bernanke, "Five Questions about the Federal Reserve and Monetary Policy", At the Economic Club of Indiana, Indianapolis, Indiana

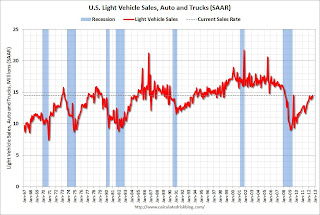

All day: Light vehicle sales for September. The consensus is for light vehicle sales to be unchanged at 14.5 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate. TrueCar is forecasting:

The September 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.6 million new car sales, up from 13.1 million in September 2011 and up from 14.5 million in August 2012Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,145,344 new cars and trucks will be sold in the U.S. in September for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.4 million light vehicles.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in August, down from the 201,000 reported last month.

10:00 AM: ISM non-Manufacturing Index for September. The consensus is for a decrease to 53.5 from 53.7 in August. Note: Above 50 indicates expansion, below 50 contraction.

9:00 PM: First Presidential Debate: President Obama and former Governor Romney.

7:45 AM: Governing Council meeting of the European Central Bank with a press conference to follow. Here is the ECB website and press conference page.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 359 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 6.0% decrease in orders.

10:00 AM: Trulia Price Rent Monitors for September. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

2:00 PM: FOMC Minutes for Meeting of September 12-13, 2012. The minutes might provide additional information about the recent Fed decision.

8:30 AM: Employment Report for September. The consensus is for an increase of 113,000 non-farm payroll jobs in September; there were 96,000 jobs added in August.

8:30 AM: Employment Report for September. The consensus is for an increase of 113,000 non-farm payroll jobs in September; there were 96,000 jobs added in August.The consensus is for the unemployment rate to be unchanged at 8.1% in August.

Note: Analysts at Nomura point out a special issue: "We expect the Chicago teacher strike to reduce local government payrolls by roughly 25k in September ..."

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through June.

The economy has added 5.1 million private sector jobs since employment bottomed in February 2010 including benchmark revision (4.4 million total jobs added including all the public sector layoffs).

The economy has added 5.1 million private sector jobs since employment bottomed in February 2010 including benchmark revision (4.4 million total jobs added including all the public sector layoffs).There are still 3.8 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision). There are 4.3 million fewer total nonfarm jobs (including benchmark).

3:00 PM: Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $7.8 billion in August.