by Calculated Risk on 9/26/2012 12:51:00 PM

Wednesday, September 26, 2012

New Home Sales and Distressing Gap

New home sales have averaged 362,000 on an annual rate basis through August. That means sales are on pace to increase 18% from last year (and based on the last few months, sales will probably increase more than 20% this year).

Here is a table showing sales and the change from the previous year since the peak in 2005:

| Year | New Home Sales (000s) | Change |

|---|---|---|

| 2005 | 1,283 | |

| 2006 | 1,051 | -18% |

| 2007 | 776 | -26% |

| 2008 | 485 | -38% |

| 2009 | 375 | -23% |

| 2010 | 323 | -14% |

| 2011 | 306 | -5% |

| 20121 | 362 | 18% |

| 12012 pace through July. | ||

But even with a 20%+ increase this year, 2012 will be the 3rd lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, and it is possible - with a fairly strong last four months - that sales will be close to the level in 2009.

Given the current low level of sales, and current market conditions (supply and demand), sales will probably continue to increase over the next few years. I don't expect sales to increase to 2005 levels, but something close to 800,000 is possible once the number of distressed sales declines to more normal levels.

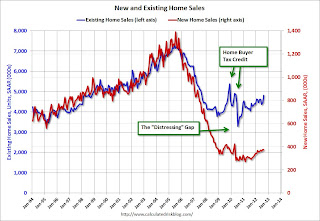

Here is an update to the distressing gap graph.

Click on graph for larger image.

Click on graph for larger image.This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through August. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 373,000 SAAR in August

• New Home Sales graphs

New Home Sales at 373,000 SAAR in August

by Calculated Risk on 9/26/2012 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 373 thousand. This was down slightly from a revised 374 thousand SAAR in July (revised up from 372 thousand). Sales in June were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in August 2012 were at a seasonally adjusted annual rate of 373,000... This is 0.3 percent below the revised July rate of 374,000, but is 27.7 percent above the August 2011 estimate of 292,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in August at 4.5 months. July was revised down from 4.6 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of August was 141,000. This represents a supply of 4.5 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in August. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In August 2012 (red column), 31 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in August. This was the third weakest August since this data has been tracked. The high for August was 110 thousand in 2005.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 362 thousand SAAR over the first 8 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 362 thousand SAAR over the first 8 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.This was below expectations of 380,000, but this was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

MBA: Mortgage Refinance Activity increases as mortgage rates fall to new survey lows

by Calculated Risk on 9/26/2012 07:03:00 AM

From the MBA: Mortgage Rates Drop to New Survey Lows

The Refinance Index increased 3 percent from the previous week to the highest level in six weeks. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.63 percent, the lowest rate in the history of the survey, from 3.72 percent, with points decreasing to 0.41 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

So far the purchase index has not indicated an increase in purchase activity, although the recent Fed survey of loan officers suggested there has been some increase.

The second graph shows the refinance index.

The second graph shows the refinance index.The refinance activity is at the highest level in six weeks and has been generally moving up over the last year.

Tuesday, September 25, 2012

Wednesday: New Home Sales

by Calculated Risk on 9/25/2012 08:53:00 PM

A couple of "zingers" from the WSJ: Seven Zingers in Sheila Bair’s New Book

On Mr. Paulson not having time to meet with her early on: “Clearly, the former CEO of Goldman Sachs didn’t think the head of an agency that insured $100,000 bank deposits was worth his time. That would change...”On Wednesday:

Ms. Bair got zinged herself by a protester outside the Treasury building during TARP negotiations, mistaking her for a “fat cat” banker as she exited. “How much did that suit cost?” the protester asked. $139 at Macy’s, Bair replied.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Look for record low mortgage rates and some pickup in refinance activity.

• At 10:00 AM, the Census Bureau will release the New Home Sales report for August. The consensus is for an increase in sales to 380 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 372 thousand in July. Watch for possible upgrades to the sales rates for previous months.

A question for the September economic prediction contest:

DOT: Vehicle Miles Driven decreased 0.3% in July

by Calculated Risk on 9/25/2012 05:54:00 PM

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -0.3% (-0.8 billion vehicle miles) for July 2012 as compared with July 2011. Travel for the month is estimated to be 258.3 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.9% (14.8 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 56 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.Gasoline prices were down in July to an average of $3.50 per gallon according to the EIA. Last year, prices in July averaged $3.70 per gallon - and even with the decline in gasoline prices, miles driven declined year-over-year in July.

Just looking at gasoline prices suggest miles driven will be down in August too.

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 4+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers. With all these factors, it may be years before we see a new peak in miles driven.

Earlier on house prices:

• Case-Shiller: House Prices increased 1.2% year-over-year in July

• House Price Comments, Real House Prices, Price-to-Rent Ratio