by Calculated Risk on 9/20/2012 03:10:00 PM

Thursday, September 20, 2012

The Trillion Dollar Bear

Memories ... some new readers might not realize that once upon a time I was one of the most bearish analysts around.

The Flow of Funds report today showed that household mortgage debt has declined by more than $1 trillion following the housing bust (see previous post). Most of that decline is due to defaults (as opposed to homeowners paying down debt). And that reminds me of a post I wrote almost 5 years ago.

From the WSJ in December 2007: How High Will Subprime Losses Go?

The global race is on to find the best phrase to describe the housing and credit mess. The U.K.’s Telegraph quotes an economist who says it “could make 1929 look like a walk in the park” if central banks don’t solve the crisis in a matter of weeks.Many people thought I was crazy.

The report cites the recent prediction from Barclays Capital that losses from the subprime-mortgage meltdown could hit $700 billion. That would top Merrill Lynch’s recent estimate of $500 billion. The Australian newspaper notes that a $700 billion “bloodbath” — potentially leading the U.S. economy into “the blackest year since the Great Depression” — would top the GDPs of all but 15 nations.

Back in the U.S., the Calculated Risk blog sidestepped the colorful language and went straight for the big number: “The losses for the lenders and investors might well be over $1 trillion.”

And if you look at the post the WSJ referenced, the first paragraph starts: "Within the next couple of years, probably somewhere between 10 million and 20 million U.S. homeowners will owe more on their homes, than their homes are worth."

I was a grizzly bear!

Fed's Q2 Flow of Funds: Household Mortgage Debt down $1 Trillion from Peak

by Calculated Risk on 9/20/2012 12:00:00 PM

The Federal Reserve released the Q2 2012 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth declined slightly in Q2 compared to Q1 2011. Net worth peaked at $67.4 trillion in Q3 2007, and then net worth fell to $51.2 trillion in Q1 2009 (a loss of $16.2 trillion). Household net worth was at $62.7 trillion in Q2 2012 (up $11.5 trillion from the trough, but still down $4.7 trillion from the peak).

The Fed estimated that the value of household real estate increased $353 billion to $16.9 trillion in Q2 2012. The value of household real estate is still $5.9 trillion below the peak.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles. The ratio decreased a little in Q2.

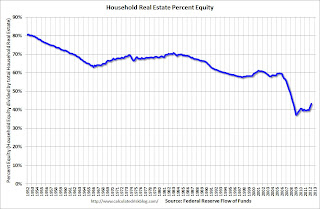

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2012, household percent equity (of household real estate) was at 43.1% - up from Q1, and the highest since Q2 2008. This was because of a small increase in house prices in Q2 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 43.1% equity - and over 10 million have negative equity.

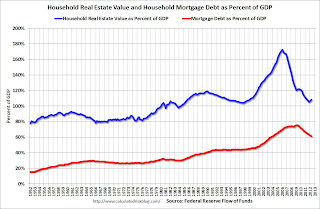

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $51 billion in Q2. Mortgage debt has now declined by $1.05 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q2 (as house prices increased), but is still near the lows of the last 30 years. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

Philly Fed "Region’s manufacturing sector has steadied"

by Calculated Risk on 9/20/2012 10:00:00 AM

The Philly Fed manufacturing index showed slight contraction in September. From the Philly Fed: September Manufacturing Survey

Firms responding to the September Business Outlook Survey reported nearly flat business activity this month. The survey’s indicators for general activity and new orders both improved from last month but recorded levels near zero. Firms reported continuing declines in shipments, employment, and hours worked. Indicators for the firms’ expectations over the next six months, however, improved notably this month, although the same firms forecast continued deceleration in production growth in the fourth quarter.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of ‐1.9. Although this marks the fifth consecutive negative reading for the index, the index has been edging nearer to zero over the last three months.

Labor market conditions at the reporting firms remained weak this month. The current employment index, at ‐7.3, was little changed from its reading in July and August.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys increased slightly in September, and has remained negative for four consecutive months. This suggests another weak reading for the ISM manufacturing index.

Weekly Initial Unemployment Claims at 382,000

by Calculated Risk on 9/20/2012 08:30:00 AM

The DOL reports:

In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000. The 4-week moving average was 377,750, an increase of 2,000 from the previous week's revised average of 375,750.The previous week was revised up from 382,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

This was above the consensus forecast of 373,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but moving up recently.

Wednesday, September 19, 2012

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 9/19/2012 08:46:00 PM

From Jim Hamilton at Econbrowser: Thresholds in the economic effects of oil prices

As U.S. retail gasoline prices once again near $4.00 a gallon, does this pose a threat to the economy and President Obama's prospects for re-election? My answer is no.See Professor Hamilton's piece for supporting data and graphs.

...

This is now the fourth time we've been near the $4 threshold. It first happened in June 2008, again in May 2011, and again in April of this year. In fact, on each of those previous 3 occasions the average U.S. retail price of gasoline was higher than it is today.

...

There is quite a bit of empirical support for the claim that the second or third time oil prices move back near a previous high, the economic disruption is significantly less than the first time; see for example the evidence and literature reviewed in my 2003 Journal of Econometrics paper (ungated version here) and two recent surveys [1], [2].

$4/gallon? Been there, done that.

The good news is oil prices have fallen sharply over the last few days, with Brent down to $108.96 per barrel. Brent closed at $117.48 last Friday. The peak for the year was $128.14 back in March, and the closing low was $88.69 in June.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 373 thousand from 382 thousand.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for September. The consensus is for a reading of 51.5, down from 51.9 in August.

• At 10:00 AM, the Philly Fed Manufacturing Survey for September will be released. The consensus is for a reading of minus 4.0, up from minus 7.1 last month (below zero indicates contraction).

• Also at 10:00 AM, the Conference Board Leading Indicators for September. The consensus is for no change in this index.

• At 12:00 PM, the Q2 Flow of Funds Accounts from the Federal Reserve will be released.

• Note: On Thursday, the Census Bureau will release the 2011 American Community Survey estimates.

One more question for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).