by Calculated Risk on 9/20/2012 10:00:00 AM

Thursday, September 20, 2012

Philly Fed "Region’s manufacturing sector has steadied"

The Philly Fed manufacturing index showed slight contraction in September. From the Philly Fed: September Manufacturing Survey

Firms responding to the September Business Outlook Survey reported nearly flat business activity this month. The survey’s indicators for general activity and new orders both improved from last month but recorded levels near zero. Firms reported continuing declines in shipments, employment, and hours worked. Indicators for the firms’ expectations over the next six months, however, improved notably this month, although the same firms forecast continued deceleration in production growth in the fourth quarter.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of ‐1.9. Although this marks the fifth consecutive negative reading for the index, the index has been edging nearer to zero over the last three months.

Labor market conditions at the reporting firms remained weak this month. The current employment index, at ‐7.3, was little changed from its reading in July and August.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys increased slightly in September, and has remained negative for four consecutive months. This suggests another weak reading for the ISM manufacturing index.

Weekly Initial Unemployment Claims at 382,000

by Calculated Risk on 9/20/2012 08:30:00 AM

The DOL reports:

In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000. The 4-week moving average was 377,750, an increase of 2,000 from the previous week's revised average of 375,750.The previous week was revised up from 382,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

This was above the consensus forecast of 373,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but moving up recently.

Wednesday, September 19, 2012

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 9/19/2012 08:46:00 PM

From Jim Hamilton at Econbrowser: Thresholds in the economic effects of oil prices

As U.S. retail gasoline prices once again near $4.00 a gallon, does this pose a threat to the economy and President Obama's prospects for re-election? My answer is no.See Professor Hamilton's piece for supporting data and graphs.

...

This is now the fourth time we've been near the $4 threshold. It first happened in June 2008, again in May 2011, and again in April of this year. In fact, on each of those previous 3 occasions the average U.S. retail price of gasoline was higher than it is today.

...

There is quite a bit of empirical support for the claim that the second or third time oil prices move back near a previous high, the economic disruption is significantly less than the first time; see for example the evidence and literature reviewed in my 2003 Journal of Econometrics paper (ungated version here) and two recent surveys [1], [2].

$4/gallon? Been there, done that.

The good news is oil prices have fallen sharply over the last few days, with Brent down to $108.96 per barrel. Brent closed at $117.48 last Friday. The peak for the year was $128.14 back in March, and the closing low was $88.69 in June.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 373 thousand from 382 thousand.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for September. The consensus is for a reading of 51.5, down from 51.9 in August.

• At 10:00 AM, the Philly Fed Manufacturing Survey for September will be released. The consensus is for a reading of minus 4.0, up from minus 7.1 last month (below zero indicates contraction).

• Also at 10:00 AM, the Conference Board Leading Indicators for September. The consensus is for no change in this index.

• At 12:00 PM, the Q2 Flow of Funds Accounts from the Federal Reserve will be released.

• Note: On Thursday, the Census Bureau will release the 2011 American Community Survey estimates.

One more question for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 9/19/2012 06:02:00 PM

Two-thirds of the way through 2012, single family starts are on pace for 515 thousand this year, and total starts are on pace for about 740 thousand. That is an increase of about 20% from 2011, and is above the forecasts for most analysts (however Lawler was very close).

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

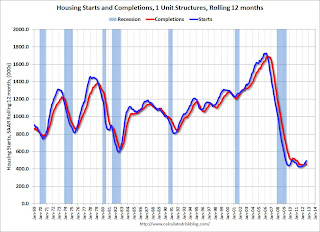

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Starts are moving up, but the increase in completions has just started (wait a few months!).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Starts are moving up, but the increase in completions has just started (wait a few months!).

For the seventh consecutive month, the rolling 12 month total for starts has been above completions - that usually only happens after housing has bottomed.

Earlier:

• Housing Starts increased to 750 thousand in August

• Existing Home Sales in August: 4.82 million SAAR, 6.1 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

AIA: Architecture Billings Index shows slight expansion in August

by Calculated Risk on 9/19/2012 02:54:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Inches Back into Positive Territory

On the heels of a nearly three-point increase, the Architecture Billings Index (ABI) climbed into positive terrain for the first time in five months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 50.2, up from the mark of 48.7 in July. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.2, up from mark of 56.3 the previous month.

“Until the economy is on firmer ground, there aren’t likely to be strong increases in demand for design services,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “In the meantime, we can expect to see design activity alternate between modest growth and modest decline.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.2 in August, up from 48.7 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

Earlier:

• Housing Starts increased to 750 thousand in August

• Existing Home Sales in August: 4.82 million SAAR, 6.1 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs