by Calculated Risk on 9/18/2012 10:00:00 AM

Tuesday, September 18, 2012

NAHB Builder Confidence increases in September, Highest since June 2006

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 3 points in September to 40. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Continues to Gain Momentum in September

Builder confidence in the market for newly built, single-family homes rose for a fifth consecutive month in September to a level of 40 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This latest three-point gain brings the index to its highest reading since June of 2006.

“Builders across the country are expressing a more positive outlook on current sales conditions, future sales prospects and the amount of consumer traffic they are seeing through model homes than they have in more than five years,” noted NAHB Chief Economist David Crowe. “However, against the improving demand for new homes, concerns are now rising about the lack of building lots in certain markets and the rising cost of building materials. Given the fragile nature of the housing and economic recovery, these are significant red flags.”

...

All three HMI components posted gains in September. While the component gauging current sales conditions increased four points to 42, the component gauging sales prospects in the next six months rose eight points to 51 and the component measuring traffic of prospective buyers edged up one point to 31.

Builder confidence also rose across every region of the country in September. Looking at the three-month moving average for each region, the Midwest and West each registered five-point gains, to 40 and 43, respectively, while the South posted a four-point gain to 36 and the Northeast posted a two-point gain to 30.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the September release for the HMI and the July data for starts (August housing starts will be released tomorrow). This was above the consensus estimate of a reading of 38.

Report: Housing Inventory declines 18.7% year-over-year in August

by Calculated Risk on 9/18/2012 08:01:00 AM

From Realtor.com: August 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) remained at historic lows, with 1.84 million units for sale in August, down -18.68% compared to a year ago and 40% below its peak of 3.10 million units in September 2007, when Realtor.com began monitoring these markets.The NAR is scheduled to report August existing home sales and inventory on Wednesday. The key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in August.

The median age of inventory of for sale listings was 91 days in August, up by 3.41% from July, but -11.65% below the median age one year ago (August 2011). While the median age of the inventory is highly seasonal, the year-over-year decline is consistent with other data showing a significant improvement in market conditions.

For sale inventories of SFH/CTHCOPS in August declined on an annual basis in all but two of the 146 MSAs monitored by Realtor.com, with for-sale inventory dropping by -20% or more in 62 of the 146 markets covered. ... Eight out of [top] 10 of these markets are in California, with Seattle, WA, and Atlanta, GA, also registering declines of -41% and -37%, respectively.

Only two areas experienced a year-over-year increase in their for-sale inventories— Shreveport, LA (+17.87%), and Philadelphia PA (+3.51%). Increasing inventories in these markets most likely reflect the impact of continued weaknesses in their local economies.

Monday, September 17, 2012

Tuesday: Homebuilder Confidence Survey

by Calculated Risk on 9/17/2012 09:16:00 PM

First a re-mention: Michael Pettis wrote an interesting article about supply and demand for commodities: By 2015 hard commodity prices will have collapsed

On house prices, Redfin released their "real time" home price tracker today for August: Home Prices Hit Two-Year High in August, Up 5% From 2011

Following is a summary of key metrics across 19 major metropolitan markets:The decline in inventory is a huge story. It is possible that the NAR will report on Wednesday that months-of-supply for existing homes declined to around 6.0 months for August. This will be the lowest months-of-supply for August since 2005. Last year, in August 2011, there were 8.2 months-of-supply.

• Home prices in August increased 4.9% year over year, and were flat month over month (+0.1%).

• The number of homes for sale declined 28.5% from August 2011 to August 2012, and by 4.5% since July.

...

Home prices will no doubt decline a bit into the winter (as they do every year) ... All signs point to continued modest year-over-year price gains through the end of the year, more or less in line with inflation in most markets.

On Tuesday:

• At 10:00 AM ET, 10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 38, up from 37 in August. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

Lawler: Early Read: Decent Bounce in Existing Home Sales in August

by Calculated Risk on 9/17/2012 04:57:00 PM

From economist Tom Lawler:

While I’m missing reports from some key areas of the country, what I’ve seen so far suggest to me that existing home sales as measured by the National Association of Realtors increased significantly on a seasonally adjusted basis last month. Right now my “best guess” is that the NAR’s existing home sales estimate for August will come in at a seasonally adjusted annual rate of about 4.87 million, up 8.9% from July’s pace, and up 10.4% from last August’s pace. Such a gain would be way above the “consensus” forecast of a SAAR of 4.55 million, but is consistent with the local realtor/MLS reports I’ve seen so far.

If indeed the NAR reports such a bounce, this summer’s “pattern of surprises” will be reminiscent of last summer’s. Below is a table showing (1) the “consensus” forecast for existing home sales for last June, July, and August (as measured the NAR; of course the “preliminary” data have been revised a boatload, including the benchmark and seasonal revisions) right before the NAR’s release; (2) the “actual” preliminary sales pace released by the NAR; and (3) the LEHC forecast for that release.

| Existing Home Sales "Surprises" Last Summer (SAAR, millions) | ||||

|---|---|---|---|---|

| Sales for: | Released on: | Consensus | Actual on Release Date | LEHC Forecast before release |

| Jun-11 | 7/20/2011 | 4.9 | 4.77 | 4.71 |

| Jul-11 | 8/18/2011 | 4.92 | 4.67 | 4.69 |

| Aug-11 | 9/21/2011 | 4.75 | 5.03 | 4.92 |

| Jun-12 | 7/19/2012 | 4.65 | 4.37 | 4.56 |

| Jul-12 | 8/22/2012 | 4.51 | 4.47 | 4.47 |

| Aug-12 | 9/19/2012 | 4.55 | 4.87 | |

Last June and July, of course, existing home sales came in well south of “expectations,” and this was “picked up” by my regional tracking ahead of the NAR’s release.

This June existing home sales also came in well south of consensus, though this was only partially captured by my regional tracking. Somewhat surprisingly, the “consensus” forecast for July adjusted down after June’s surprise by more this year than last, though the still “disappointing” July sales figures were captured well by regional tracking.

Last August, of course, existing home sales rebounded by a boatload more than consensus, and a good chunk of this rebound was captured by my regional tracking.

Another “similarity” is that in both years June and July sales were surprisingly weak given the NAR’s Pending Home Sales Index.

CR Note: The NAR is scheduled to release the existing home sales report this Wednesday, Sept 19th at 10 AM ET. The preliminary consensus is for sales of 4.55 million SAAR in August.

LA area Port Traffic: Imports and Exports down YoY in August

by Calculated Risk on 9/17/2012 02:55:00 PM

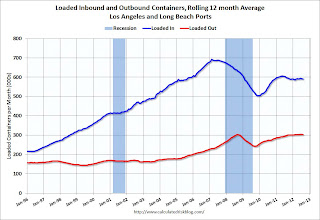

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are down slightly compared to the 12 months ending in July.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of August, loaded outbound traffic was down 4% compared to August 2011, and loaded inbound traffic was down 1% compared to August 2011.

For the month of August, loaded outbound traffic was down 4% compared to August 2011, and loaded inbound traffic was down 1% compared to August 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase over the next couple of months, but probably not by much.

This suggests trade with Asia might be down slightly in August.