by Calculated Risk on 9/17/2012 09:16:00 PM

Monday, September 17, 2012

Tuesday: Homebuilder Confidence Survey

First a re-mention: Michael Pettis wrote an interesting article about supply and demand for commodities: By 2015 hard commodity prices will have collapsed

On house prices, Redfin released their "real time" home price tracker today for August: Home Prices Hit Two-Year High in August, Up 5% From 2011

Following is a summary of key metrics across 19 major metropolitan markets:The decline in inventory is a huge story. It is possible that the NAR will report on Wednesday that months-of-supply for existing homes declined to around 6.0 months for August. This will be the lowest months-of-supply for August since 2005. Last year, in August 2011, there were 8.2 months-of-supply.

• Home prices in August increased 4.9% year over year, and were flat month over month (+0.1%).

• The number of homes for sale declined 28.5% from August 2011 to August 2012, and by 4.5% since July.

...

Home prices will no doubt decline a bit into the winter (as they do every year) ... All signs point to continued modest year-over-year price gains through the end of the year, more or less in line with inflation in most markets.

On Tuesday:

• At 10:00 AM ET, 10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 38, up from 37 in August. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

Lawler: Early Read: Decent Bounce in Existing Home Sales in August

by Calculated Risk on 9/17/2012 04:57:00 PM

From economist Tom Lawler:

While I’m missing reports from some key areas of the country, what I’ve seen so far suggest to me that existing home sales as measured by the National Association of Realtors increased significantly on a seasonally adjusted basis last month. Right now my “best guess” is that the NAR’s existing home sales estimate for August will come in at a seasonally adjusted annual rate of about 4.87 million, up 8.9% from July’s pace, and up 10.4% from last August’s pace. Such a gain would be way above the “consensus” forecast of a SAAR of 4.55 million, but is consistent with the local realtor/MLS reports I’ve seen so far.

If indeed the NAR reports such a bounce, this summer’s “pattern of surprises” will be reminiscent of last summer’s. Below is a table showing (1) the “consensus” forecast for existing home sales for last June, July, and August (as measured the NAR; of course the “preliminary” data have been revised a boatload, including the benchmark and seasonal revisions) right before the NAR’s release; (2) the “actual” preliminary sales pace released by the NAR; and (3) the LEHC forecast for that release.

| Existing Home Sales "Surprises" Last Summer (SAAR, millions) | ||||

|---|---|---|---|---|

| Sales for: | Released on: | Consensus | Actual on Release Date | LEHC Forecast before release |

| Jun-11 | 7/20/2011 | 4.9 | 4.77 | 4.71 |

| Jul-11 | 8/18/2011 | 4.92 | 4.67 | 4.69 |

| Aug-11 | 9/21/2011 | 4.75 | 5.03 | 4.92 |

| Jun-12 | 7/19/2012 | 4.65 | 4.37 | 4.56 |

| Jul-12 | 8/22/2012 | 4.51 | 4.47 | 4.47 |

| Aug-12 | 9/19/2012 | 4.55 | 4.87 | |

Last June and July, of course, existing home sales came in well south of “expectations,” and this was “picked up” by my regional tracking ahead of the NAR’s release.

This June existing home sales also came in well south of consensus, though this was only partially captured by my regional tracking. Somewhat surprisingly, the “consensus” forecast for July adjusted down after June’s surprise by more this year than last, though the still “disappointing” July sales figures were captured well by regional tracking.

Last August, of course, existing home sales rebounded by a boatload more than consensus, and a good chunk of this rebound was captured by my regional tracking.

Another “similarity” is that in both years June and July sales were surprisingly weak given the NAR’s Pending Home Sales Index.

CR Note: The NAR is scheduled to release the existing home sales report this Wednesday, Sept 19th at 10 AM ET. The preliminary consensus is for sales of 4.55 million SAAR in August.

LA area Port Traffic: Imports and Exports down YoY in August

by Calculated Risk on 9/17/2012 02:55:00 PM

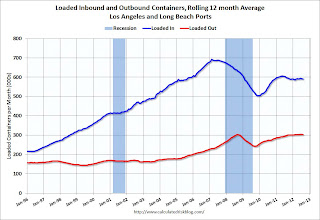

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are down slightly compared to the 12 months ending in July.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of August, loaded outbound traffic was down 4% compared to August 2011, and loaded inbound traffic was down 1% compared to August 2011.

For the month of August, loaded outbound traffic was down 4% compared to August 2011, and loaded inbound traffic was down 1% compared to August 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase over the next couple of months, but probably not by much.

This suggests trade with Asia might be down slightly in August.

FNC: Residential Property Values increased 0.8% in July

by Calculated Risk on 9/17/2012 11:38:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and other house price indexes.

FNC released their July index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.8% in July compared to June (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.8% and 0.9% in July. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since this index is NSA, the month-to-month changes will probably turn negative later this year. However this is the first month-to-month increase for the month of July since 2006.

The year-over-year trends continued to show improvement in July, with the 100-MSA composite up 0.6% compared to July 2011. This is the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through July 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Some of the month-to-month gain is seasonal since this index is NSA. The key is the indexes are now showing a year-over-year increase in July.

The July Case-Shiller index will be released next week on Tuesday, September 25th.

NY Fed Empire State Mfg Index declines in September

by Calculated Risk on 9/17/2012 08:41:00 AM

From MarketWatch: Empire State index hits nearly two-year low

The Empire State index decreased to negative 10.4 in September from negative 5.9 in August, according to the manufacturing survey released by the New York Federal Reserve. It is the lowest reading since November 2010.The number of employees fell from 16.47 in August to 4.3 in September. This was significantly below expectations of a reading of minus 2.0.

The new-orders index worsened to negative 14.0 in September from negative 5.5 in August.

One bright spot in the report was an increase in a key barometer of future activity that asks manufacturers about expectations six months ahead. The forward-looking index rose to 27.2 in September from 15.2 in August.

The index of the number of employees fell sharply in September but remained slightly above negative territory at 4.3.

Manufacturing remains a weak spot for the US economy.