by Calculated Risk on 9/10/2012 06:04:00 PM

Monday, September 10, 2012

Employment Graphs: Construction Employment, Unemployment by Education

A couple more graphs based on the August employment report. The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment increased by only 1 thousand jobs in August, and so far is down for the year.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Construction employment appears to be moving sideways, although I expect this will change soon (and I'd expect some upward revisions to construction employment). The preliminary annual Benchmark Revision will be released on September 27, 2012.

Note: When housing was collapsing, one of the mysteries was why construction employment wasn't declining - and then finally employment started falling sharply. I think we are seeing a similar "mystery" now, and I expect BLS reported construction employment will start increasing soon.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down - although the unemployment rate for 'high school grads, no college' has increased recently.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

WSJ: UBS expects the Fed to announce QE3 this week

by Calculated Risk on 9/10/2012 02:17:00 PM

On Saturday, I wrote: I expect QE3 on Sept 13th

From the WSJ: UBS: Bernanke Will Unleash QE3 This Week

More and more market prognosticators are calling for the Fed to unveil a third round of quantitative easing this week UBS is the latest to join the fray ...The QE3 view isn't unanimous, from the WSJ:

“We now anticipate an announcement of another round of quantitative easing at the FOMC meeting on Sept. 13,” UBS economists wrote in a note to clients.

The QE3 parameters will likely entail a six-month program of at least $500 billion, primarily focused on buying Treasurys, UBS predicts, while also anticipating the Fed will extend its ultra-low rate guidance into 2015.

One of the outliers not calling for more Fed stimulus is Nomura Securities. ... The disappointing jobs report “is not weak enough to compel the Fed to deliver anouther round of quantitative easing at next week’s meeting,” Nomura said on Friday.I think a combination of lengthening the low rate guidance and some sort of Large Scale Asset Purchases (LSAP, aka QE3) is very likely.

Alphaville: 'German domino theory and book-cooking'

by Calculated Risk on 9/10/2012 10:43:00 AM

This is an interesting piece from David Keohane at FT Alphaville: German domino theory and book-cooking

There are two fairly important bits to this story in Der Spiegel.Keohane goes on to discuss domino theory and the key word: "undoubtedly". The story makes it sound like the outcome of the troika's audit is preordained.

One, that Merkel wants to avoid a Grexit for the time being and two, that the upcoming Troika report might be massaged to make that a reality.

From Der Spiegel (with our emphasis):

In reality, Merkel has already made up her mind. After long hesitation, she has sided with French President François Hollande and the European Commission. The report from the troika — which consists of the European Commission, the International Monetary Fund (IMF) and the European Central Bank (ECB) and which departed on its fact-finding tour last week — will undoubtedly conclude that Greece can remain in the euro zone.The change in mind-set is down to domino theory.

Where once the chancellor saw Greece as the weakest link in a chain which would be stronger without it, now she sees it as a domino which, if toppled, would put the rest of the set in danger ...

LPS: Mortgage Delinquencies decreased slightly in July

by Calculated Risk on 9/10/2012 08:45:00 AM

LPS released their Mortgage Monitor report for July today. According to LPS, 7.03% of mortgages were delinquent in July, down from 7.14% in June, and down from 7.80% in July 2011.

LPS reports that 4.08% of mortgages were in the foreclosure process, down slightly from 4.09% in June, and down slightly from 4.11% in July 2011.

This gives a total of 11.12% delinquent or in foreclosure. It breaks down as:

• 1,960,000 loans less than 90 days delinquent.

• 1,560,000 loans 90+ days delinquent.

• 2,042,000 loans in foreclosure process.

For a total of 5,562,000 loans delinquent or in foreclosure in July. This is down from 5,663,000 last month.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

The total delinquency rate has fallen to 7.03% from the peak in July 2010 of 10.57%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.08%. There are still a large number of loans in this category (about 1.96 million).

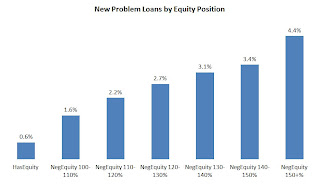

The second graph shows new problem loans by equity position.

The second graph shows new problem loans by equity position.

From LPS:

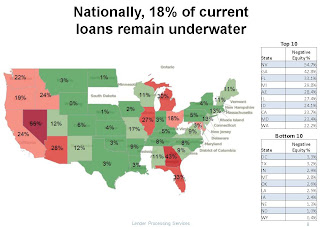

“The July mortgage performance data shows a continuing correlation between negative equity and new problem loans,” explained Herb Blecher, senior vice president, LPS Applied Analytics.The third graph shows percent negative equity by state.

From Herb Blecher:

From Herb Blecher: “Nationally, 18 percent of borrowers who are current on their loan payments are ‘underwater’ (owing more on the mortgage than the home’s current market value), ranging from a low of 0.4 percent in Wyoming to nearly 55 percent in Nevada. As negative equity increases, we see corresponding increases in the number of new problem loans. In Nevada and Florida, two of the states with the highest percentage of underwater borrowers, more than three percent of borrowers who were up to date on their payments are 60 or more days delinquent six months later. This suggests that further home price declines – should they occur – could jeopardize recent improvements.”

Sunday, September 09, 2012

Sunday Night Futures

by Calculated Risk on 9/09/2012 09:24:00 PM

It is time for the next act of the Greek tragedy, from the WSJ: Inspectors Reject Some Cuts Greece Plans

The [European Commission, International Monetary Fund and the European Central Bank — the so-called troika] rejected some €2 billion ($2.6 billion) of proposed spending and revenue measures the government had hoped would help meet budget targets for the next two years ... The troika is demanding €13.5 billion in budget cuts in exchange for its latest €173 billion bailout.The Asian markets are mostly green tonight, although the Nikkei is down 0.2%.

The troika report, to be delivered before a European finance ministers' meeting Oct. 8, will also play a role in determining whether Greece is able to win a sought after two-year extension in meeting tough budget-deficit targets.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down 2, and the DOW futures down 26 points.

Oil prices are moving mostly unchanged with WTI futures are at $96.27 and Brent is at $114.12 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.69 per gallon.

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th

Five more questions for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).