by Calculated Risk on 9/10/2012 08:45:00 AM

Monday, September 10, 2012

LPS: Mortgage Delinquencies decreased slightly in July

LPS released their Mortgage Monitor report for July today. According to LPS, 7.03% of mortgages were delinquent in July, down from 7.14% in June, and down from 7.80% in July 2011.

LPS reports that 4.08% of mortgages were in the foreclosure process, down slightly from 4.09% in June, and down slightly from 4.11% in July 2011.

This gives a total of 11.12% delinquent or in foreclosure. It breaks down as:

• 1,960,000 loans less than 90 days delinquent.

• 1,560,000 loans 90+ days delinquent.

• 2,042,000 loans in foreclosure process.

For a total of 5,562,000 loans delinquent or in foreclosure in July. This is down from 5,663,000 last month.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

The total delinquency rate has fallen to 7.03% from the peak in July 2010 of 10.57%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.08%. There are still a large number of loans in this category (about 1.96 million).

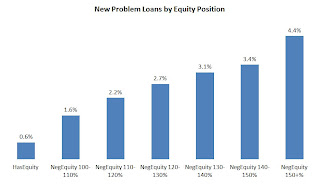

The second graph shows new problem loans by equity position.

The second graph shows new problem loans by equity position.

From LPS:

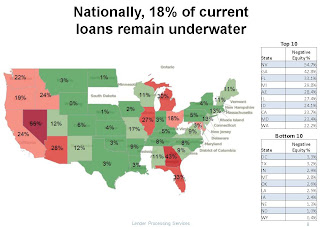

“The July mortgage performance data shows a continuing correlation between negative equity and new problem loans,” explained Herb Blecher, senior vice president, LPS Applied Analytics.The third graph shows percent negative equity by state.

From Herb Blecher:

From Herb Blecher: “Nationally, 18 percent of borrowers who are current on their loan payments are ‘underwater’ (owing more on the mortgage than the home’s current market value), ranging from a low of 0.4 percent in Wyoming to nearly 55 percent in Nevada. As negative equity increases, we see corresponding increases in the number of new problem loans. In Nevada and Florida, two of the states with the highest percentage of underwater borrowers, more than three percent of borrowers who were up to date on their payments are 60 or more days delinquent six months later. This suggests that further home price declines – should they occur – could jeopardize recent improvements.”

Sunday, September 09, 2012

Sunday Night Futures

by Calculated Risk on 9/09/2012 09:24:00 PM

It is time for the next act of the Greek tragedy, from the WSJ: Inspectors Reject Some Cuts Greece Plans

The [European Commission, International Monetary Fund and the European Central Bank — the so-called troika] rejected some €2 billion ($2.6 billion) of proposed spending and revenue measures the government had hoped would help meet budget targets for the next two years ... The troika is demanding €13.5 billion in budget cuts in exchange for its latest €173 billion bailout.The Asian markets are mostly green tonight, although the Nikkei is down 0.2%.

The troika report, to be delivered before a European finance ministers' meeting Oct. 8, will also play a role in determining whether Greece is able to win a sought after two-year extension in meeting tough budget-deficit targets.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down 2, and the DOW futures down 26 points.

Oil prices are moving mostly unchanged with WTI futures are at $96.27 and Brent is at $114.12 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.69 per gallon.

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th

Five more questions for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Employment Report Graphs: Participation Rate, Duration of Unemployment and Diffusion Indexes

by Calculated Risk on 9/09/2012 01:41:00 PM

Below are three more graphs based on the August employment report.

For more employment graphs and analysis, see:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

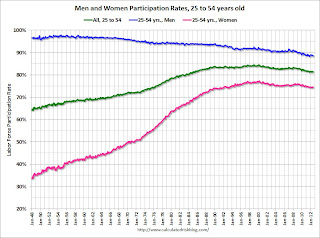

The following graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The participation rate for women increased significantly from the mid 30s to the mid 70s. This rate was at 75.5% prior to the recession, and declined to a post-recession low of 74.3%. There has been almost no recovery in the participation rate for prime working age women. This rate has mostly flattened out this year, and was still near the low in August at 74.5%.

The participation rate for men has decreased from the high 90s a few decades ago, to a low of 88.3% after the recession. This rate hasn't increased very much, and was at 88.5% in August.

There might be some "bounce back" for both men and women (some of the recent decline is probably cyclical), but the long term trend for men is down.

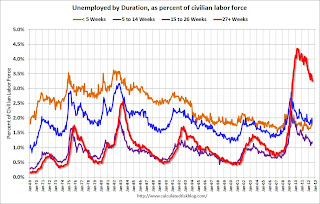

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 weeks, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 weeks, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down, but there was an increase in the 'less than 5 weeks' and '15 to 26 weeks' categories in August.

Unfortunately the long term unemployed remains very high at 3.3% of the labor force in August, but this is the lowest percentage since 2009.

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS:

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS: Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The BLS diffusion index for total private employment was at 50.2 in August, down from 54.3 in July. For manufacturing, the diffusion index declined to 36.4 from 50.6 in July. This is the lowest level for manufacturing since 2009.

Not only was job growth was weak in August, but job gains were not widespread across industries (another negative).

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th

LA Times: Boom Time in Bakersfield

by Calculated Risk on 9/09/2012 09:33:00 AM

Coastal California is doing better. And some inland areas are improving (I've mentioned the turnaround in Temecula before - one of the hardest hit areas during the recession). Here is another area doing better ...

From the LA Times: Many signs point to a Bakersfield boom

The state's economic recovery has largely been concentrated on the coast, leaving behind much of the hard-hit San Joaquin Valley. But Bakersfield, perhaps best known for oil, agriculture and country music, has reclaimed an old title: boomtown.High energy prices have really helped Bakersfield, but it appears the entire economy is growing.

Bakersfield has been adding population and jobs at a brisk pace and is a few thousand jobs from matching its peak employment level of five years ago. ... Employment has grown across many sectors, including manufacturing. Even construction, which suffered mightily statewide during the housing bust, has strengthened. And unlike many struggling municipalities, in Kern County officials have recommended a budget increase that would allow hiring of more than 150 people.

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th

Saturday, September 08, 2012

Analysis: I expect QE3 on Sept 13th

by Calculated Risk on 9/08/2012 06:46:00 PM

Since the Jackson Hole Symposium, I've been thinking it is very likely that so-called "QE3" would be announced at the next FOMC meeting (Sept 12th and 13th). And after thinking about Columbia University professor Michael Woodford's paper presented at Jackson Hole, I think this round of asset purchases might be more effective than most people expect.

Notes: QE3 is shorthand for another Large Scale Asset Purchases (LSAP) program. "QE" is monetary policy, not fiscal policy (not spending).

Yesterday, Goldman Sach economist Sven Jari Stehn beat me to the punch. He wrote:

[W]e expect the Federal Open Market Committee (FOMC) to announce a return to asset purchases as well as a lengthening of the FOMC’s forward guidance for the first hike in the funds rate to mid-2015 or beyond at the September 12-13 FOMC meeting. Our baseline forecast is an open-ended purchase program, focused on agency mortgage-backed securities.I'd like to add a few points:

[O]ur “double punch” Fed call relates to the much-discussed study presented by Columbia University professor Michael Woodford at Jackson Hole last Friday. Woodford argues that forward guidance is a powerful tool both in theory and practice. But in his view the effect of asset purchases is largely confined to their role in conveying guidance about future monetary policy actions. ...

We fully agree with Woodford’s view that such aggressive guidance measures could be a powerful tool. However, we also believe that Fed officials are unlikely to adopt them anytime soon.

Fortunately, we are somewhat more optimistic than Woodford with regard to the impact of Fed asset purchases. ... we believe that a more moderate strengthening of the forward guidance coupled with renewed asset purchases could provide a decent amount of monetary easing next week.

• Nothing in recent data suggests a "substantial and sustainable strengthening" in economic activity. This was the key sentence from the last FOMC minutes:

"Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery"• Note that Goldman Sachs expects BOTH "a lengthening of the forward guidance to mid-2015" AND "an open-ended purchase program". Atlanta Fed President Dennis Lockhart alluded to this in his interview in the WSJ last week:

If the Fed were to act, Mr. Lockhart said half-measures would not get the job done. While he didn't state what the steps could be, he said stimulus, if chosen, should be "a package. When I say package that means two or three things done at the same time to create maximum possible gains."• As far as additional forward guidance, imagine if Fed Chairman Ben Bernanke made it very clear that the 2% inflation target is symmetrical - not a ceiling, and that the FOMC would not move quickly to slow inflation if the unemployment rate was still high.

This isn't as strong a forward guidance as nominal GDP targeting (NGDP), but it would still provide guidance that the Fed will show patience before raising rates.

In fact, back in April, Fed Chairman Ben Bernanke said:

“[The 2 percent target is] not a ceiling, it’s a symmetric objective, and we attempt to bring inflation close to 2 percent. And in particular, if inflation were to jump for whatever reason—and we don’t have, obviously don’t have perfect control of inflation—we’ll try to return inflation to 2 percent at a pace which takes into account the situation with respect to unemployment.”I expect Bernanke to reiterate this again in the press conference this week.

• And on effectiveness, one of the key transmission channels for monetary policy is through residential investment and mortgages. The previous rounds of QE (and "twist") have lowered mortgage rates and allowed homeowners with excellent credit and income to refinance. However this channel has been limited as Bernanke noted in his Jackson Hole speech:

It is likely that the crisis and the recession have attenuated some of the normal transmission channels of monetary policy relative to what is assumed in the models; for example, restrictive mortgage underwriting standards have reduced the effects of lower mortgage rates.As residential investment recovers, and house prices increase (or at least stabilize), this channel will probably become more effective.

Last month I summarized some of The economic impact of a slight increase in house prices. This includes mortgage lenders and appraisers becoming more confident in the mortgage and housing markets. I think that is starting to happen, and I think QE might have more traction now through the housing channel.

Conclusion: I expect both QE, and an extended forward guidance, to be announced this week at the FOMC meeting.

Earlier:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th