by Calculated Risk on 8/15/2012 10:00:00 AM

Wednesday, August 15, 2012

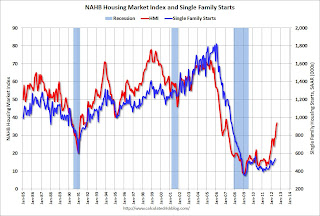

NAHB Builder Confidence increases in August, Highest since February 2007

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 2 points in August to 37. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Continues To Improve in August

Builder confidence in the market for newly built, single-family homes improved for a fourth consecutive month in August with a two-point gain to 37 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This gain builds on a six-point increase in July and brings the index to its highest level since February of 2007.

“From the builder’s perspective, current sales conditions, sales prospects for the next six months and traffic of prospective buyers are all better than they have been in more than five years,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Fla. “While there is still much room for improvement, we have come a long way from the depths of the recession and the outlook appears to be brightening.”

...

Every HMI component posted gains in August. The components gauging current sales conditions and traffic of prospective buyers each rose three points, to 39 and 31, respectively, while the component gauging sales expectations in the next six months inched up one point to 44. All were at their highest levels in more than five years.

Regionally, builder confidence rose nine points to 42 in the Midwest and two points to 35 in the South, but declined nine points to 25 in the Northeast and three points to 40 in the West in August. For the August HMI release, NAHB is introducing an alternative trend comparison of regional HMIs by also showing a three-month moving average of each region’s index. The current three-month moving averages show a two-point decline to 29 in the Northeast, a five-point gain to 35 in the Midwest, a three-point gain to 32 in the South and a three-point gain to 38 in the West.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the August release for the HMI and the June data for starts (July housing starts will be released tomorrow). A reading of 37 was above the consensus.

Industrial Production increased 0.6% in July, Capacity Utilization increased

by Calculated Risk on 8/15/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.6 percent in July after having risen 0.1 percent in both May and June. Revisions to the rates of change for recent months left the level of the index in June little changed from its previous estimate. Manufacturing output rose 0.5 percent in July, the same rate of increase as was recorded for June. In July, the output of mines increased 1.2 percent, and the output of utilities rose 1.3 percent. At 98.0 percent of its 2007 average, total industrial production in July was 4.4 percent above its year-earlier level. Capacity utilization for total industry moved up 0.4 percentage point to 79.3 percent, a rate 1.0 percentage point below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.3% is still 1.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 98.0. This is 17.4% above the recession low, but still 2.7% below the pre-recession peak.

The consensus was for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%. The increase in IP and Capacity Utilization was above expectations.

NY Fed Manufacturing Survey indicates contraction, CPI unchanged in July

by Calculated Risk on 8/15/2012 08:30:00 AM

• From the NY Fed: Empire State Manufacturing Survey

The general business conditions index slipped below zero for the first time since October 2011, falling thirteen points to -5.9. At -5.5, the new orders index was below zero for a second consecutive month, and the shipments index fell six points to 4.1.This was the first regional manufacturing survey released for August. The general business conditions index was worse than expected and new orders were down.

...

The index for number of employees inched lower, but remained positive at 16.5, suggesting a moderate increase in employment levels, and the average workweek index rose to 3.5.

...

Indexes for the six-month outlook were generally positive but lower than in July, indicating that respondents expected business conditions to improve little in the months ahead.

The Philly Fed index was especially weak in June and July, and the August index will be released tomorrow.

• From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in July on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.4 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was below the consensus forecast of a 0.2% increase for CPI and a 0.2% increase in core CPI and makes QE3 more likely in September.

...

The index for all items less food and energy rose 0.1 percent in July, ending a streak of four consecutive 0.2 percent increases.

Report: Housing Inventory declines 19.3% year-over-year in July

by Calculated Risk on 8/15/2012 06:00:00 AM

From Realtor.com: July 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) remains at historic lows across the country, with 1.866 million units for sale in July, down -19.25% compared to a year ago and -39.80% below its peak of 3.10 million units in September, 2007 when Realtor.com began monitoring these markets.The NAR is scheduled to report July existing home sales and inventory next week on Wednesday, August 22nd. The key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in July.

The median age of the inventory of for sale listings was 88 days in July 2012, up slightly from June (84), but -9.27% below the median age one year ago (July 2011). While the median age of the inventory is highly seasonal, the year-over-year decline is consistent with other data showing a significant improvement in market conditions compared to one year ago.

For sale inventories of SFH/CTHCOPS in July declined on an annual basis in all but two of the 146 MSAs monitored by Realtor.com, with for-sale inventory dropping -20% or more in 67 of the 146 markets covered. Eight out of 10 MSAs with the largest year-over-year declines in their for-sale inventories in July 2012 are in California.

Only two areas experienced a year-over-year increase in their for-sale inventories— Shreveport, LA (+23.06%), and Philadelphia, PA (+3.04%).

Tuesday, August 14, 2012

Wednesday: CPI, Industrial Production, NY Fed Manufacturing Survey, Homebuilder Confidence

by Calculated Risk on 8/14/2012 09:15:00 PM

First on Europe, from the WSJ: Euro Zone Economy Shrinks, Darkening Outlook

Economic activity in the 17-country currency bloc fell at an annualized rate of 0.7% in the second quarter after stagnating in the first three months of 2012, according to data from the European Union's statistics arm.And on Greece from the Financial Times: Greece seeks two-year austerity extension

The extension plan calls for a slower adjustment with cuts spread over four years until 2016 ... Greece would need additional funding of €20bnEurope will be a hot topic in September and October (a few key dates here).

Excerpt with permission

• On Wednesday, at 8:30 AM ET, the Consumer Price Index for July will be released. The consensus is for CPI to increase 0.2% in July and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for August will be released. The consensus is for a reading of 7.0, down from 7.4 in July (above zero is expansion).

• At 9:15 AM, theThe Fed will release Industrial Production and Capacity Utilization for July. The consensus is for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 35, unchanged from 35 in July.

For the August economic prediction contest: