by Calculated Risk on 8/14/2012 06:54:00 PM

Tuesday, August 14, 2012

DataQuick: SoCal Home Sales increase year-over-year in July

From DataQuick: Southland Home Sales Up Again From 2011; Median Price Nears 4-Yr High

Southern California home sales rose above the year-ago level for the seventh consecutive month in July despite continued declines in low-end distress sales. Increased activity in move-up and high-end submarkets also contributed to a significant rise in the region’s median sale price, which neared a four-year high, a real estate information service reported.The percent of distressed sales is still very high, but this is the lowest level since January 2008 - something we are seeing in most areas.

“Even adjusting for changes in market mix, there’s growing evidence prices have crept up in areas where more demand has met a shrinking number of homes for sale. But we’re approaching the peak of the traditional spring-summer home-buying season. Whether these trends hold into the fall and winter isn’t clear. If they do, then logically the number of homes on the market would eventually rise to meet the demand. More owners will be interested in selling, knowing their homes are likely to fetch a higher price, and more people will shift from a negative to at least a slightly positive equity position, enabling them to sell. Home builders could rev up operations and lenders could push more distressed properties onto the market sooner. It would tame any price appreciation,” said John Walsh, DataQuick president.

In July, a total of 20,588 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was down 6.7 percent from 22,075 in June, and up 13.8 percent from 18,090 in July 2011.

Distressed property sales – the combination of foreclosure resales and short sales – made up 39.7 percent of last month’s resale market. That was the lowest level since the figure was 36.0 percent in January 2008.

The median price is being impacted by the mix, with fewer low end distressed sales pushing up the median. This is why I focus on the repeat sales indexes.

The NAR is scheduled to report July existing home sales and inventory next week on Wednesday, August 22nd.

A couple earlier posts on housing:

• House Prices and a Foreclosure Supply Shock

• Lawler: Table of Short Sales and Foreclosures for Selected Markets

Lawler: Table of Short Sales and Foreclosures for Selected Markets

by Calculated Risk on 8/14/2012 03:18:00 PM

CR Note: Yesterday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler has been digging up similar data, and he sent me the table below for several more distressed areas. For all of these areas, the share of distressed sales is down from July 2011 - and for the areas that break out short sales, the share of short sales has increased (except Minneapolis) and the share of foreclosure sales are down. In most areas, short sales are higher than foreclosures, and for some areas like Phoenix, Reno and Las Vegas, short sales are now double the rate of foreclosures.

From Lawler:

Below is a table showing the share of home sales by realtors in various markets identified in local MLS as being “distressed,” as reported by local realtor associations or MLS.

As the table indicates, the distressed sales share of total sales last month was down compared to last July in all of the above markets, in some (but not all) cases by significant amount. And for those areas breaking out “distressed” sales by short sales or foreclosures, in most (but not all) cases the short sales share was higher, and the foreclosure sales share significantly lower, than a year ago.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-July | 11-July | 12-July | 11-July | 12-July | 11-July | |

| Las Vegas | 40.0% | 20.2% | 20.7% | 50.2% | 60.7% | 70.4% |

| Reno | 38.0% | 28.0% | 15.0% | 37.0% | 53.0% | 65.0% |

| Phoenix | 29.5% | 23.6% | 14.6% | 43.1% | 44.1% | 66.7% |

| Sacramento | 32.0% | 22.3% | 22.4% | 39.0% | 54.4% | 61.3% |

| Minneapolis | 9.3% | 11.0% | 24.8% | 34.4% | 34.1% | 45.4% |

| Mid-Atlantic (MRIS) | 11.3% | 10.2% | 8.7% | 15.1% | 20.0% | 25.2% |

| Hampton Roads VA | 29.1% | 30.3% | ||||

| Northeast Florida | 39.0% | 44.1% | ||||

[The second table shows] the YOY growth in total home sales and in “non-distressed” home sales for each of the these areas, as reported by local realtor associations/MLS.

While home sales for these markets combined this July were actually down a bit from last July, “non-distressed” home sales were up by almost 23%.

CR Note: In the post Home Sales Reports: What Matters, I noted: "When we look at sales for existing homes, the focus should be on the composition between conventional and distressed." Even if existing home sales declined in July, the composition appears to be shifting towards more conventional sales - a positive.

| YOY % Growth, Home Sales (July 2012) | ||

|---|---|---|

| Total | Non-Distressed | |

| Las Vegas | -11.5% | 17.6% |

| Reno | -3.1% | 30.0% |

| Phoenix | -14.8% | 43.1% |

| Sacramento | 4.7% | 23.4% |

| Minneapolis | 14.6% | 38.3% |

| Mid-Atlantic (MRIS) | 4.7% | 12.0% |

| Hampton Roads VA | 20.1% | 22.1% |

| Northeast Florida | 1.3% | 10.5% |

| Total of Above Markets | -0.9% | 22.8% |

House Prices and a Foreclosure Supply Shock

by Calculated Risk on 8/14/2012 12:25:00 PM

Those making the argument for further house price declines usually start with “shadow inventory”. Although there is no formal definition of “shadow inventory” it usually includes 1) some properties with homeowners who are current on their mortgages, but have negative equity in their homes, and 2) properties not listed for sale, but where the homeowner is seriously delinquent on their mortgage or already in the foreclosure process.

This can lead to some pretty scary numbers being bandied about. As an example, CoreLogic recently reported that “11.4 million, or 23.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2012”. And LPS reported 1.6 million loans were 90+ days delinquent at the end of June, and another 2.1 million are in the foreclosure process.

These numbers suggest a coming “flood” of foreclosures to those arguing house prices will fall further. I think this is incorrect.

If we look at negative equity, it is a serious issue for many homeowners, but it seems unlikely they will default en masse. Recent homebuyers who have negative equity are probably less than 10% underwater. And homeowners with significant negative equity probably bought in the 2004 through 2006 period; and they’ve been paying their mortgage for 6 to 8 years – so it is unlikely they will just default without some unfortunate event (divorce, death, disease).

Probably the biggest impact on the housing market is that people with negative equity can’t sell, and this restricts supply (the opposite of the “shadow inventory” argument). For more on this, see: Zillow chief economist Stan Humphries has been discussing this: The Connection Between Negative Equity, Inventory Shortage and Increasing Home Values: Why the Bottom Won’t Be as Boring as We Expected

And I expect with the recent increase in house prices that the number of reported homeowners with negative equity will be down sharply in Q2. The HARP refinance program will help too.

A more immediate concern is the 3.7 million homeowners currently 90+ days delinquent or in the foreclosure process. Many of these properties will eventually be a distressed sale, either a foreclosure or short sale, although some will receive loan modifications. It is important to remember that some of these homes are already listed for sale (so they are included in the “visible inventory”), and there has been a significant shift by lenders from foreclosures to short sales (short sales have less of an impact on prices than foreclosures).

But here is the key: Although forecasting house prices is very complex, we can make some simplifying assumptions and think in terms of supply and demand with foreclosures being a supply shock (increased supply). It is important to remember that national prices are an aggregate of many local prices (although there are national impacts, housing markets are local). And housing prices are more complex than say commodity prices (as an example, house prices tend to be stick downwards).

Imagine a multi-year supply shock with a bell curve shape. The supply shock shifts the supply curve to the right relative to the height of the bell curve. Prices will bottom when the supply shock is at the peak, NOT when the supply shock is over.

The supply shock from foreclosures probably peaked in late 2008, with a second smaller peak in 2010. Prices didn’t bottom in 2008 because 1) prices are sticky downwards (so the bottom happens after the peak of the supply shock) and 2) fundamentals such as price-to-income and price-to-rent were still out of line.

Now fundamentals are close to normal, and any supply shock will probably be smaller than the 2008 or 2010 peaks. And this analysis assumed demand was stable. Actually there was a demand shock too (less demand) due to tighter lending, and buyer psychology (potential buyers were afraid that prices would fall further). There were few investors in 2008 when the supply shock hit – just a few individual and small group investors buying REOs. Now there are large well capitalized groups looking to buy. Of course lending standards are still tight, but as the recent Senior Loan Officer showed, demand is picking up.

The bottom line is house prices have probably bottomed, and the concern about more distressed sales coming is real – but will probably not push house prices to new post-bubble lows.

Note: For reference, back in April 2005 I argued that prices were way out of line and that speculation was the key, and that speculation could be modeled as storage, see: Housing: Speculation is the Key

Retail Sales increased 0.8% in July

by Calculated Risk on 8/14/2012 08:30:00 AM

On a monthly basis, retail sales were up 0.8% from June to July (seasonally adjusted), and sales were up 4.1% from July 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $403.9 billion, an increase of 0.8 percent from the previous month and 4.1 percent above July 2011. ... The May to June 2012 percent change was revised from -0.5 percent to -0.7%.Ex-autos, retail sales increased 0.8% in July.

Click on graph for larger image.

Click on graph for larger image.Sales for June were revised down to a 0.7% decrease (from 0.5% decrease).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 21.9% from the bottom, and now 6.6% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.1% from the bottom, and now 7.0% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data, but just since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.1% from the bottom, and now 7.0% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.0% on a YoY basis (4.1% for all retail sales). Retail sales ex-gasoline increased 0.8% in July.

This was above the consensus forecast for retail sales of a 0.3% increase in July, and above (edit) the consensus for a 0.4% increase ex-auto.

This was above the consensus forecast for retail sales of a 0.3% increase in July, and above (edit) the consensus for a 0.4% increase ex-auto. This mostly just reversed the sharp decline in June.

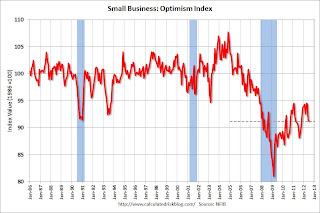

NFIB: Small Business Optimism Index declines in July

by Calculated Risk on 8/14/2012 07:54:00 AM

From the National Federation of Independent Business (NFIB): Small-Business Optimism Continues to Decline in July

Dipping for a second consecutive month, after ending several months of slow growth, the Small Business Optimism Index gave up 0.2 points, falling to 91.2. ... The Index has oscillated between 86.5 (July 2009) and 94.5 (February 2012) since the recession officially ended in June 2009. Prior to 2008, the Index averaged 100, well above the current reading.Note: These survey results are based on a small sample and the commentary is getting more and more political (calling the 2000s the "best economy in history" is absurd), so I'm going to discontinue posting this survey.

...

While "poor sales" has been eclipsed by other concerns as the top business problem, it still remains the No.1 issue for 20 percent of owners surveyed (down from 23 percent).

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 91.2 in July from 91.4 in June.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. This index remains low, and once again, lack of demand is a huge problem for small businesses.