by Calculated Risk on 7/31/2012 09:00:00 AM

Tuesday, July 31, 2012

Case Shiller: House Prices increased 2.2% in May

S&P/Case-Shiller released the monthly Home Price Indices for May (a 3 month average of March, April and May).

This release includes prices for 20 individual cities and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continue to Rise in May 2012 According to the S&P/Case-Shiller Home Price Indices

Data through May 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed that average home prices increased by 2.2% in May over April for both the 10- and 20-City Composites.

With May’s data, we found that home prices fell annually by 1.0% for the 10-City Composite and by 0.7% for the 20-City Composite versus May 2011. Both Composites and 17 of the 20 MSAs saw increases in annual returns in May compared to April. ... All 20 cities and both Composites posted positive monthly returns.

...

“With May’s data, we saw a continuing trend of rising home prices for the spring,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “On a monthly basis, all 20 cities and both Composites posted positive returns and 17 of those cities saw those rates of change increase compared to what was observed for April. Seventeen of the 20 cities and both Composites also saw improved annual rates of return. We have observed two consecutive months of increasing home prices and overall improvements in monthly and annual returns; however, we need to remember that spring and early summer are seasonally strong buying months so this trend must continue throughout the summer and into the fall.

“The 10- and 20-City Composites were each up 2.2% for the month and recorded respective annual rates of decline of 1.0% and 0.7%, compared to May 2011. While still negative, these annual changes are the best we’ve since in at least 18 months."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.6% from the peak, and up 0.9% in May (SA). The Composite 10 is up from the post bubble low set in March, Not Seasonally Adjusted (NSA).

The Composite 20 index is off 32.3% from the peak, and up 0.9% (SA) in May. The Composite 20 is also up from the post-bubble low set in March (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 1.0% compared to May 2011.

The Composite 20 SA is down 0.7% compared to May 2011. This was a smaller year-over-year decline for both indexes than in April, and the smallest year-over-year decline since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.This was better than the consensus forecast and it is now possible that prices will turn positive year-over-year in June. I'll have more on prices later.

Personal Income increased 0.5% in June, Spending decreased slightly

by Calculated Risk on 7/31/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $61.8 billion, or 0.5 percent ... in June, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $1.3 billion, or less than 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in June, in contrast to an increase of 0.1 percent in May. ... PCE price index -- The price index for PCE increased 0.1 percent in June, in contrast to a decrease of 0.2 percent in May. The PCE price index, excluding food and energy, increased 0.2 percent, compared with an increase of 0.1 percent.

...

Personal saving -- DPI less personal outlays -- was $529.5 billion in June, compared with $472.4 billion in May. The personal saving rate -- personal saving as a percentage of DPI -- was 4.4 percent in June, compared with 4.0 percent in May.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

A key point is the PCE price index has only increased 1.5% over the last year, and core PCE is up 1.8%.

Monday, July 30, 2012

FHFA Nears Decision on Debt Forgiveness, and Tuesday: Case-Shiller House Prices

by Calculated Risk on 7/30/2012 09:29:00 PM

From Nick Timiraos at the WSJ: Data Show Fannie, Freddie Savings From Debt Forgiveness

As the regulator for Fannie Mae and Freddie Mac nears its decision on whether to approve debt forgiveness for troubled borrowers, a new analysis by the regulator suggests that taxpayers could actually benefit from the move...FHFA acting director Edward DeMarco focused on this last point in his speech in April:

In April, the agency said that loan forgiveness would save about $1.7 billion for the companies, relative to other types of relief. At the time, the agency said that because the Treasury was paying to subsidize those write-downs, the relief would still cost taxpayers $2.1 billion, offsetting any savings to the companies.

But the latest analysis done by the agency found that such write-downs would generate $3.6 billion in savings for the companies, under certain assumptions, according to people familiar with the analysis. Even after subtracting the cost of the Treasury subsidies, the program would save $1 billion, these people said. As many as 500,000 borrowers could be eligible, these people said.

...

The FHFA has raised other concerns beyond the cost of such write-downs. Chief among them is the fear that more borrowers, upon hearing that Fannie and Freddie are instituting a debt-forgiveness program, might default to seek more generous terms.

One factor that needs to be considered is the borrower incentive effects. That means, will some percentage of borrowers who are current on their loans, be encouraged to either claim a hardship or actually go delinquent to capture the benefits of principal forgiveness?The FHFA might decide that the risk from "strategic modifiers" outweighs the possible savings.

...

It is difficult to model these borrower incentive effects with any precision. What we can do is give a sense of how many current borrowers would have to become “strategic modifiers” for the NPV economic benefit provided by the HAMP triple PRA incentives to be eliminated. In this context, a “strategic modifier” would be a borrower that either claims a financial hardship or misses two consecutive mortgage payments in order to attempt to qualify for HAMP and a principal forgiveness modification.

Also from Nick Timiraos at the WSJ Are Home Prices Rising? A Price-Index Primer

On Tuesday:

• At 8:30 AM ET, the Personal Income and Outlays report for June will be released by the BEA. The consensus is for a 0.2% increase in personal income in June, and for 0.1% increase in personal spending, and for the Core PCE price index to increase 0.2%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for May is scheduled to be released. The consensus is for a 1.4% decrease year-over-year in Composite 20 prices (NSA) in May. The Zillow forecast is for the Composite 20 to decline 1.0% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted.

• At 9:45 AM: Chicago Purchasing Managers Index for July will be released. The consensus is for a decrease to 52.5, down from 52.9 in June.

• Also at 10:00 AM, the Conference Board's consumer confidence index for July. The consensus is for a decrease to 61.5 from 62.0 last month.

And the final question for the July economic contest:

More FOMC Preview

by Calculated Risk on 7/30/2012 08:09:00 PM

Most of this article is about the ECB and there isn't anything new on the Fed, from Jon Hilsenrath and Brian Blackstone at the WSJ: Heat Rises on Central Banks

The two-day Federal Open Market Committee meeting convenes Tuesday, following signs that Fed officials have become more willing to act to address disappointingly slow U.S. economic growth.From Goldman Sachs analysts today:

...

The Fed could unveil a new program for buying mortgage or government securities to bring down long-term interest rates, or take other actions to spur growth, or simply promise to do more later if necessary. Officials might wait until September, when they will formally update their economic forecasts, before deciding anything significant.

Although a new Fed asset purchase program is a possibility in the near term if the data continue to disappoint, our central expectation is for a return to QE in December or early 2013.

...

We expect an extension of the current “exceptionally low…at least through late 2014” interest rate guidance to "mid 2015." Such a shift would roughly restore the forward guidance to the same three-year horizon as at the January FOMC meeting, when the "late 2014" formulation was first adopted. We would, however, regard this rate extension as a relatively modest step.

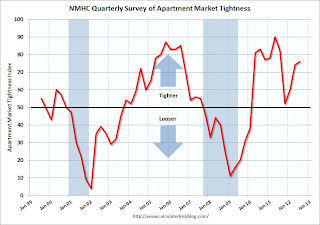

NMHC Apartment Survey: Market Conditions Tighten in Q2 2012

by Calculated Risk on 7/30/2012 04:51:00 PM

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues

For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter.

“The apartment sector’s strength continues unabated,” said NMHC Chief Economist Mark Obrinsky. “Even as new construction ramps up, higher demand for apartment residences still outstrips new supply with no letup in sight. Despite the need for new apartments, acquisition and construction finance remains constrained in all but the best properties in the top markets.”

...

Majority report increased market tightness. The Market Tightness Index edged up to 76 from 74. For the first time in a year, more than half (55 percent) of respondents said that markets were tighter. By contrast, only 2 percent reported the markets as loosening and 43 percent reported no change over the past three months.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last ten quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q2 2012 to 4.7%, down from 4.9% in Q1 2012, and down from 9.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

This survey indicates demand for apartments is still strong. And even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be more completions in 2012 than in 2011, but it looks like another strong year for the apartment industry.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.