by Calculated Risk on 6/20/2012 11:42:00 AM

Wednesday, June 20, 2012

AIA: Architecture Billings Index declines sharply in May

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Substantial Drop in Architecture Billings Index

Following the first negative reading in five months, the Architecture Billings Index (ABI) has had a significant drop in May. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 45.8, following a mark of 48.4 in April. This score reflects a sharp decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 54.0, down slightly from mark of 54.4 the previous month.

“For the second year in a row, we’re seeing declines in springtime design activity after a healthy first quarter. Given the ongoing uncertainly in the economic outlook, particularly the weak job growth numbers in recent months, this should be an alarm bell going off for the design and construction industry,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The commercial/industrial sector is the only one recording gains in design activity at present, and even this sector has slowed significantly. Construction forecasters will have to reassess what conditions will look like moving forward.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.8 in May, the lowest since July of last year. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment (it will be some time before investment in offices and malls increases).

LPS: Mortgage delinquencies increased in May

by Calculated Risk on 6/20/2012 09:00:00 AM

LPS released their First Look report for May today. LPS reported that the percent of loans delinquent increased in May from April, and declined year-over-year. The percent of loans in the foreclosure process decreased slightly and remains at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.20% from 7.12% in March. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.97%, so delinquencies have fallen over half way back to normal. The increase was in the less than 90 days delinquent category.

The following table shows the LPS numbers for May 2012, and also for last month (April 2012) and one year ago (May 2011).

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| May-12 | Apr-12 | May-11 | |

| Delinquent | 7.20% | 7.12% | 7.96% |

| In Foreclosure | 4.12% | 4.14% | 4.11% |

| Number of loans: | |||

| Loans Less than 90 days | 1,967,000 | 1,927,000 | 2,265,000 |

| Loans More than 90 days | 1,575,000 | 1,595,000 | 1,921,000 |

| Loans In foreclosure | 2,027,000 | 2,048,000 | 2,164,000 |

| Total | 5,569,000 | 5,570,000 | 6,350,000 |

The number of delinquent loans, but not in foreclosure, is down about 15% year-over-year (644,000 fewer mortgages delinquent), and the number of loans in the foreclosure process is down 6% or 137,000 year-over-year (the percent in foreclosure is mostly unchanged, but the number of total loans has declined).

The percent of loans less than 90 days delinquent is about normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process are still very high.

MBA: FHA Mortgage Refinance Applications increase sharply

by Calculated Risk on 6/20/2012 07:00:00 AM

From the MBA: Government Refinance Applications More Than Double in Latest MBA Survey

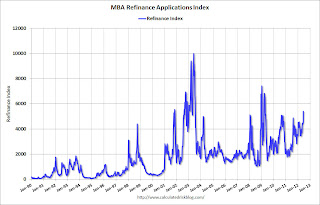

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index fell 9 percent from one week earlier.

“Refinance volume increased again last week, but the composition of activity changed markedly. Despite rates remaining near all-time lows, conventional refinance application volume declined, and the HARP share of refinance activity dropped to 20 percent,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “On the other hand, FHA refinance volume exploded to an all-time high, more than doubling over the week. New, lower FHA premiums on streamlined refinance loans came fully into effect, and borrowers seized the opportunity to lower their mortgage rates without increasing their FHA premiums. Purchase activity fell off last week, but this is likely only a recalibration following the Memorial Day holiday, as the level of activity remains within the narrow band seen for the past 3 years.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.87 percent, matching the lowest rate in the history of the survey, from 3.88 percent, with points increasing to 0.49 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak, and is mostly moving sideways.

Refinance activity continues to increase, especially with the surge in FHA streamline refinancing - and because mortgage rates are near the record low set the previous week.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

Tuesday, June 19, 2012

Look Ahead: Fed Day

by Calculated Risk on 6/19/2012 09:47:00 PM

For those suffering with insomnia, here is the G20 communiqué released tonight. There is no grand bond buying scheme mentioned as was rumored earlier in the day.

The decision of the FOMC tomorrow is very uncertain. Cardiff Garcia at Alphaville has an excellent overview: Problems with extending Twist, and one final preview

The WSJ argues there are several possible outcomes: Europe, Weak Economy Add to Pressure on Fed

Fed officials ... could extend a program known as "Operation Twist," in which the central bank sells short-term Treasury bills and notes and plows the proceeds into longer-term securities. They also could decide to shift the proceeds into mortgage- backed securities rather than long-term Treasury bonds.The consensus seems to be the FOMC will expand and extend Operation Twist, but anything - including QE3 - or doing nothing are possible.

Among other choices: launching a new round of bond-buying, known to some as quantitative easing, to expand the central bank's portfolio of assets. Or they could alter the way they describe their plans for interest rates with an assurance that short-term interest rates will stay near zero beyond 2014.

Policy makers also could stand pat but offer assurance that they stand ready to act if the economy gets weaker.

And on Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Refinance activity has been increasing sharply, and it appears purchase activity is increasing too.

• At 12:30 PM, the FOMC statement will be released.

• At 2:00 PM, the Federal Open Market Committee (FOMC) participants' projections will be released.

• And at 2:15 PM, Fed Chairman Ben Bernanke will hold a press briefing.

• Also tomorrow, the AIA's Architecture Billings Index for May will be released (expect some weakness), and the LPS First Look Mortgage Report.

ATA Trucking index declined 0.7% in May

by Calculated Risk on 6/19/2012 05:15:00 PM

From ATA: ATA Truck Tonnage Fell 0.7% in May

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.7% in May after falling 1.1% in April. (April’s loss was the same as ATA reported on May 22.) The latest drop lowered the SA index to 117.8 (2000=100), down from April’s level of 118.7. Compared with May 2011, the SA index was 4.1% higher, the largest year-over-year increase since February 2012. Year-to-date, compared with the same period last year, tonnage was up 3.8%.

...

“Two straight months of contractions is disappointing,” ATA Chief Economist Bob Costello said. “The drops in tonnage are reflective of the broader economy, which has slowed.”

“The good news is that the decrease in fuel prices will help support retail sales going forward, which is a big part of truck tonnage,” he said. As a negative, Costello said he’s concerned about businesses sitting on cash instead of hiring more workers or spending it on capital, both of which would give the economy and tonnage a shot in the arm, as they are worried about Europe and the so-called U.S. fiscal cliff at the end of the year. He also reiterated last month’s comment: “Annualized tonnage growth should be in the 3% to 3.9% range this year.”

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and still up 3.8% year-over-year - but has been moving mostly sideways in 2012.

From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Earlier on Housing:

• On Yahoo: McBride: Total Housing Starts Decline in May, but the Trend Is Positive

• Comments on Housing

• Housing Starts at 708 thousand in May, Single Family starts increase to 516 thousand