by Calculated Risk on 6/16/2012 01:11:00 PM

Saturday, June 16, 2012

Schedule for Week of June 17th

Earlier:

• Summary for Week Ending June 15th

The focus will be on Greece on Sunday. For the US, this week is about the Fed and housing. The key reports are housing starts on Tuesday, and Existing Home Sales on Thursday.

On Wednesday, the FOMC concludes a two day meeting, and there is the possibility of additional policy accommodation.

12:00 PM ET: Election in Greece. Polls close at noon ET on Sunday and the first "safe" results are expected around 2:30 PM ET.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 29, unchanged from May. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for May.

8:30 AM: Housing Starts for May. Total housing starts were at 717 thousand (SAAR) in April, up 2.6% from the revised March rate of 699 thousand (SAAR). Note that March was revised up sharply from 654 thousand.

The consensus is for total housing starts to increase to 720,000 (SAAR) in May from 717,000 in April.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in March to 3.737 million, up from 3.565 million in February. The number of job openings (yellow) has generally been trending up, and openings are up about 17% year-over-year compared to March 2011. Quits also increased in March, and quits are now up about 8.5% year-over-year and quits are now at the highest level since 2008. These are voluntary separations and more quits might indicate some improvement in the labor market.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Refinance activity has been increasing sharply, and it appears purchase activity is increasing too.

12:30 PM: FOMC Meeting Announcement. No changes are expected to interest rates, however additional policy accommodation is possible.

2:00 PM: FOMC Forecasts The will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 383 thousand from 386 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for June. The consensus is for a reading of 53.8, down slightly from 53.9 in May.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for sales of 4.57 million on seasonally adjusted annual rate (SAAR) basis.

Housing economist Tom Lawler is forecasting the NAR will report sales of 4.66 million in May.

A key will be inventory and months-of-supply.

10:00 AM: Philly Fed Survey for June. The consensus is for a reading of 0.5, up from -5.8 last month (above zero indicates expansion).

10:00 AM: FHFA House Price Index for April 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Conference Board Leading Indicators for May. The consensus is for no changed in this index.

No economic releases scheduled.

Summary for Week ending June 15th

by Calculated Risk on 6/16/2012 08:02:00 AM

Another week. More disappointment. A broken record ...

The European problems are dominating the headlines, with the Greek election on Sunday, and bond yields increasing in Spain and Italy. In response, the UK has announced a new stimulus plan, and the ECB is hinting at further monetary accommodation.

US data was weak again. Retail sales and industrial production declined, consumer sentiment was down, and initial weekly unemployment claims increased. And the NY Fed manufacturing survey showed slow expansion in June.

However inflation appears to be falling and this increases the possibility of further Fed policy accommodation at the FOMC meeting next week.

The coming week will be about Europe – especially Greece – housing, and the Fed.

Here is a summary of last week in graphs:

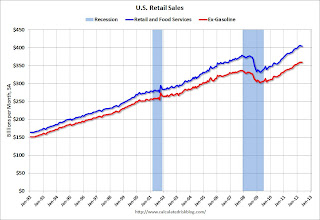

• Retail Sales declined 0.2% in May

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales were down 0.2% from April to May (seasonally adjusted), and sales were up 5.3% from May 2011. Sales for April was revised down to a 0.2% decrease from a 0.1% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.1% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted)

This was at the consensus forecast for retail sales of a 0.2% decrease in May, and below the consensus for a 0.1% decrease ex-auto.

• Key Measures show slowing inflation in May

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.1%, and core CPI rose 2.3%. Core PCE is for April and increased 1.9% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.1%, and core CPI rose 2.3%. Core PCE is for April and increased 1.9% year-over-year. Most of these measures show inflation on a year-over-year basis are still above the Fed's 2% target, but it appears the inflation rate is slowing. On a monthly basis (annualized), most of these measure were below the Fed's target; median CPI was at 1.5%, trimmed-mean CPI was at 1.1%, and Core PCE for April was at 1.6% - although core CPI was at 2.4%.

• Industrial Production, Capacity Utilization declined in May

"Capacity utilization for total industry declined 0.2 percentage point to 79.0 percent."

"Capacity utilization for total industry declined 0.2 percentage point to 79.0 percent."

This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.0% is still 1.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production declined 0.1 to in May to 97.3. This is 16.6% above the recession low, but still 3.4% below the pre-recession peak.

The consensus was for no change in Industrial Production in April, and for no change in Capacity Utilization at 79.2%. This was below expectations.

• Consumer Sentiment declines in June to 74.1

The preliminary Reuters / University of Michigan consumer sentiment index for June declined to 74.1, down from the May reading of 79.3.

The preliminary Reuters / University of Michigan consumer sentiment index for June declined to 74.1, down from the May reading of 79.3.This was below the consensus forecast of 77.5 and the lowest level this year.

Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy.

• Weekly Initial Unemployment Claims increased to 386,000

"In the week ending June 9, the advance figure for seasonally adjusted initial claims was 386,000, an increase of 6,000 from the previous week's revised figure of 380,000."

"In the week ending June 9, the advance figure for seasonally adjusted initial claims was 386,000, an increase of 6,000 from the previous week's revised figure of 380,000."This graph shows the 4-week moving average of weekly claims since January 2000. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 382,000.

The average has been between 363,000 and 384,000 all year, and this is near the high for the year.

• NFIB: Small Business Optimism Index "Stagnates" in May

This graph shows the small business optimism index since 1986. The index decreased slightly to 94.4 in May from 94.5 in April.

This graph shows the small business optimism index since 1986. The index decreased slightly to 94.4 in May from 94.5 in April.For the second consecutive month, the "single most important problem" was not "poor sales". In the best of times, small business owners complain about taxes and regulations, and that is starting to happen again.

This index remains low, but as housing continues to recover, I expect this index to increase (there is a high concentration of real estate related companies in this index).

• Other Economic Stories ...

• Fed Survey: From 2007 to 2010, Median Family income declined 7.7%, Median Net Worth declined 38.8%

• CoreLogic: Existing Home Shadow Inventory declines 15% year-over-year

• NY Fed: Regional manufacturing activity "expanded slightly" in June Survey

Friday, June 15, 2012

David Rosenberg cracks me up!

by Calculated Risk on 6/15/2012 10:27:00 PM

I've always enjoyed reading Gluskin Sheff economist David Rosenberg's analysis. Of course Rosenberg has been bearish on the economy and the stock market for years. But I found his comments in this article amusing: Market Bear Gets (a Little) Bullish

[It]caused a mini-sensation within financial circles this week when Mr. Rosenberg—the former economist at Merrill Lynch & Co. who’s now at Canadian money-management firm Gluskin Sheff—wrote a morning commentary titled “Parting of the Clouds?”And the article concludes:

... “I do see a light at the end of the dark tunnel,” [Rosenberg] wrote.

“Don’t be surprised,” he wrote, “if I end up turning bullish ahead of the pack.”Really? After missing the sluggish recovery and the large run up in the stock market, Rosenberg thinks he will be "ahead of the pack"?

Geesh. I wrote "Looking for the Sun" in February 2009. That was one of several posts about the coming end of the recession. I even used some of Rosenberg's analysis on auto sales (arguing Rosenberg was wrong), as one of my reasons that we were nearing the end of the recession (see Vehicle Sales, Jan, 2009). Needless to say I was correct about auto sales - auto sales have been a key driver of the sluggish recovery - and I was correct about the economy (and, in a rarity for me, I even mentioned my bullish outlook on the stock market). Of course, even though I thought a recovery would start, I thought it would be choppy and sluggish.

So Rosenberg was wrong, and I was correct. And now, three years later, he is looking for the "parting of the clouds?" and he thinks he will be "ahead of the pack"? Oh my. I feel like saying "Check the scoreboard, Mr. Rosenberg!"

But I still enjoy reading his analysis :-)

P.S. His reasons for turning more optimistic (more austerity in the US) are wrong too.

Bank Failures #29 - #31 in 2012

by Calculated Risk on 6/15/2012 06:16:00 PM

Oceans boil with cheap money

Still banks submerging

by Soylent Green is People

From the FDIC: Harbor Community Bank, Indiantown, Florida, Assumes All of the Deposits of Putnam State Bank, Palatka, Florida

As of March 31, 2012, Putnam State Bank had approximately $169.5 million in total assets and $160.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $37.4 million. ... Putnam State Bank is the 29th FDIC-insured institution to fail in the nation this year, and the fourth in Florida.From the FDIC: Fidelity Bank, Atlanta, Georgia, Assumes All of the Deposits of Security Exchange Bank, Marietta, Georgia

As of March 31, 2012, Security Exchange Bank had approximately $151.0 million in total assets and $147.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $34.3 million. ... Security Exchange Bank is the 30th FDIC-insured institution to fail in the nation this year, and the fifth in Georgia.From the FDIC: Clayton Bank and Trust, Knoxville, Tennessee, Assumes All of the Deposits of the Farmers Bank of Lynchburg, Lynchburg, Tennessee

As of March 31, 2012, The Farmers Bank of Lynchburg had approximately $163.9 million in total assets and $156.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $28.3 million. ... The Farmers Bank of Lynchburg is the 31st FDIC-insured institution to fail in the nation this year, and the third in Tennessee.That makes seven failed banks in two weeks (so far) - feels like old times!

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/15/2012 05:15:00 PM

From economist Tom Lawler:

Based on local realtor/MLS reports I’ve seen so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.66 million, up 0.9% from April’s pace and up 12.3% from last May’s SA pace. For folks watching unadjusted data, May’s YOY sales gain almost certainly exceeded April’s by a far amount. However, this April’s seasonal factor was lower than last year’s (meaning SA sales YOY rose by more than NSA sales), while this May’s seasonal factor (due mainly to a higher business day count) will be higher than last May’s (meaning SA sales YOY will rise by less than NSA sales).

On the inventory side, various reports tracking listings across metro areas across the country suggest that the inventory of existing homes for sale in May were up 1-2% on the month and down 20-22%from a year ago. However, NAR inventory data month to month don’t track these “listings” reports very closely, with the monthly “differences” having a distinct seasonal component. (Every April, e.g., the NAR’s inventory number shows a much larger gain than folks who track listings.)

My “best guess” is that the NAR’s inventory estimate in May will be down about 20.8% from last May. That would imply an estimate of about 2.48 million, which would be down 2.4% from April. Of course, the inventory of existing homes for sale did not really decline 2.4% from April to May, just as the inventory didn’t increase 9.5% from March to April. But listings data seem to track NAR data best if one looks at YOY data, and ignore the strange monthly “quirks” in the NAR estimates.

On median sales prices, my “best guess” using regional data and a sales-weighting scheme is that the median existing SF home sales price this May will be up about 6.6% from last May. However, I should note that last month I was only looking for a YOY increase of 5.5%, and NAR’s report showed a 10.4% YOY increase. After getting in more local data, for the life of me I can’t figure out how the NAR’s number came in so high last month. The regional data were even wackier, with the 10.9% YOY increase in the median SF sales price in the Northeast looking almost inconceivable given reported YOY increases in the various states in the Northeast. I say “almost” because the “mix” of sales can produce “strange” results, but my gut is that the NAR’s number was ... well, simply wrong (would not be the first time!)

CR Note: The NAR is scheduled to release their May existing home sales report next Thursday, June 21st. The consensus forecast is for sales of 4.57 million (seasonally adjusted annual rate).

Based on Lawler's estimate of 4.66 million SAAR and inventory at 2.48 million, months-of-supply would decline to 6.4 months from 6.6 months in April. That would be the lowest months-of-supply for May since 2005.