by Calculated Risk on 6/05/2012 09:22:00 AM

Tuesday, June 05, 2012

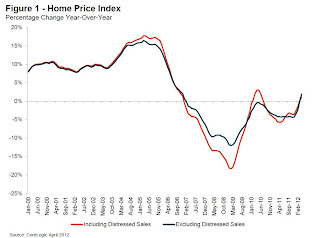

CoreLogic: House Price Index increases in April, Up 1.1% Year-over-year

Notes: This CoreLogic House Price Index report is for April. The Case-Shiller index released last week was for March. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Increase of Just Over One Percent

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 1.1 percent in April 2012 compared to April 2011. This was the second consecutive year-over-year increase this year, and the first time two consecutive increases have occurred since June 2010. On a month-over-month basis, home prices, including distressed sales, increased by 2.2 percent in April 2012. This marks the second consecutive month-over-month increase this year.

Excluding distressed sales, prices increased 2.6 percent in April 2012 compared to March 2012, the third month-over-month increase in a row. The CoreLogic HPI also shows that year-over-year prices, excluding distressed sales, rose by 1.9 percent in April 2012 compared to April 2011. Distressed sales include short sales and real estate owned (REO) transactions.

Beginning with the April 2012 HPI report, CoreLogic is introducing a ... pending HPI that provides the most current indication of trends in home prices. The pending HPI indicates that house prices will rise by at least another 2.0 percent, from April to May. Pending HPI is based on Multiple Listing Service (MLS) data that measure price changes in the most recent month.

“We see the consistent month-over-month increases within our HPI and Pending HPI as one sign that the housing market is stabilizing,” said Anand Nallathambi, president and chief executive officer of CoreLogic. “Home prices are responding to a restricted supply that will likely exist for some time to come—an optimistic sign for the future of our industry.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.2% in April, and is up 1.1% over the last year.

The index is off 32% from the peak - and is just above the post-bubble low set two months ago.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.Excluding the tax credit period, this is the first year-over-year increase since 2006 (March was revised up to a year-over-year increase too). This "stabilization" of house prices is a significant story.

WSJ: Spain Warns of Losing Access to Markets for Borrowing

by Calculated Risk on 6/05/2012 08:51:00 AM

From the WSJ: Spain Warns Market Access Being Shut

Spain's Budget Minister Cristobal Montoro on Tuesday urged euro-zone partners to act faster to help support its enfeebled banks, saying that the government has effectively lost access to capital markets because of steep risk premiums demanded by sovereign bond investors.

In making this dramatic admission, Mr. Montoro joined recent calls by the Spanish government for direct aid from European Union institutions for Spanish banks as the government hopes to avoid a full-blown bailout package ...

"What this premium tells us is that the state, and Spain as a whole, has a problem when it comes to accessing markets, when we need to refinance our debt," Mr. Montoro said in a radio interview. "What that premium says is that Spain doesn't have the market's door open, as such, the challenge is to open that door and regain the confidence of those markets, our creditors."

Monday, June 04, 2012

Look Ahead: ISM non-manufacturing index

by Calculated Risk on 6/04/2012 10:16:00 PM

• At 9:00 AM ET, Ceridian-UCLA Pulse of Commerce Index will be released. This is the diesel fuel index for May (a measure of transportation).

• At 10:00 AM AM, the ISM non-manufacturing (service) index will be released. The consensus is for the index to be unchanged at 53.5.

• Also at 10:00 AM ET, the Trulia House Price & Rent Monitors for May. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

The focus will be on Europe and the "emergency" G7 talks. Also three Fed regional presidents will speak in the afternoon.

The Misfiring Engine of Recovery

by Calculated Risk on 6/04/2012 06:31:00 PM

Gad Levanon at the Conference Board makes some interesting points: Why is Employment Growth Still Disappointing and When Will it be “Normal” Again?

In a typical recovery, rapid economic growth is driven by pent-up demand for consumer durable goods, housing, and business equipment. Also, in a typical recovery the government moderately adds jobs, and economies outside of the U.S. are enjoying robust growth, which helps boost American exports and raises the revenues of American multinationals. So what’s different this time? There are several combined factors that are dragging down the U.S. economy and labor market:Usually housing is an engine of recovery following a recession, but this time, due to the excess supply of vacant homes, housing has lagged the economy.

1) Government spending is shrinking. The hope was that the federal stimulus would create jobs while the private sector was in recession, and that this federal stimulus would eventually wind down while the private sector would pick up. This wind-down has occurred, but the private sector is not generating enough jobs by itself yet. At the same time, state and local governments... have been cutting back for several years now ... In the past year, state and local governments have slowed down their layoffs, but the number of employees in the federal government is still rapidly shrinking -- down by 1.8%. Overall, the public sector has reduced its workforce for three years in a row, cutting a total of about 700,000 workers.

2) The housing market has barely started recovering, and employers in related industries are barely adding jobs. This typically strong driver of growth during expansions is missing in this economy.

3) The global economy is weak. Many countries in Europe are in recession, and the main emerging countries’ economies are significantly slowing down. As a result, U.S. exports and revenues of multinationals and overall consumer and business confidence are suffering.

4) Commodity prices are now at a much higher level than two-to-three years ago. This has caused large price increases in food, energy, and other commodity related products. In the past 2 years, as a result of the price hikes and weakness in housing, the consumption of food, gasoline, public transportation, housing, and utilities have increased by just 0.5% of their annual rate.

And usually government hiring contributes moderately to a recovery, but this time we've seen a significant decline in government employment. This decline has been mostly from state and local cutbacks, but the Federal government has been cutting back too.

And of course, as Levanon notes, the global economy is weak with several key countries in recession.

The little bit of good news is housing is finally starting to slowly recover, and perhaps state and local government layoffs might end mid-year. So far GDP growth has been heavily car driven, and that growth might slow - and, of course, the global economy is a drag.

It seems like one or two cylinders of the growth engine are always misfiring. This is why sluggish and choppy growth has been my general forecast for almost 3 years now.

G7 Emergency Talks on Tuesday

by Calculated Risk on 6/04/2012 03:26:00 PM

From Reuters: G7 to hold emergency euro zone talks, Spain top concern

Finance chiefs of the Group of Seven leading industrialized powers will hold emergency talks on the euro zone debt crisis on Tuesday ...Over the weekend, I put together a short list of key dates this month for Europe. There will probably be plenty of "emergency" discussions too.

Canadian Finance Minister Jim Flaherty said ministers and central bankers of the United States, Canada, Japan, Britain, Germany, France and Italy would hold a special conference call, raising pressure on the Europeans to act.

"The real concern right now is Europe of course - the weakness in some of the banks in Europe, the fact they're undercapitalized, the fact the other European countries in the euro zone have not taken sufficient action yet to address those issues of undercapitalization of banks and building an adequate firewall," Flaherty told reporters.