by Calculated Risk on 5/23/2012 11:22:00 AM

Wednesday, May 23, 2012

New Home Sales Comments

Clearly new home sales have bottomed. Although sales are still historically very weak, sales are up 25% from the low, and up about 15% from the May 2010 through September 2011 average.

Update: Some people think housing will recover rapidly to the 1.2+ million rate we saw in 2004 and 2005. I think that is incorrect for two reasons. First, I think the recovery will be sluggish - 2012 will probably be the third worst year ever. Second, the 1.2 million in annual sales was due to an increasing homeownership rate and speculative buying. With a stable homeownerhip rate, and little speculative buying, sales will probably only rise to around 800 thousand at full recovery.

There were more upward revisions this month too. Sales were revised up for January, February and March.

And inventory of completed homes is at a new record low

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Click on graph for larger image.

Click on graph for larger image.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at a record low 46,000 units in April. The combined total of completed and under construction is at the lowest level since this series started.

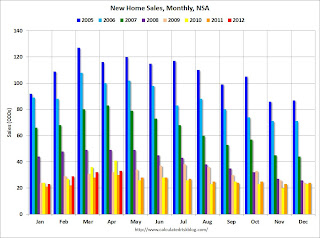

The second graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In April 2012 (red column), 33 thousand new homes were sold (NSA). Last year only 30 thousand homes were sold in March. This was the fourth weakest April since this data has been tracked. The high for April was 116 thousand in 2005.

The debate is now about the strength of the recovery, not whether there is a recovery. My view is housing will remain sluggish for some time, and I expect 2012 to be another historically weak year, but clearly better than 2011.

The debate is now about the strength of the recovery, not whether there is a recovery. My view is housing will remain sluggish for some time, and I expect 2012 to be another historically weak year, but clearly better than 2011.Below is an update to the "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through April. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties. I expect this gap to eventually close, but it will probably take a number of years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase in April to 343,000 Annual Rate

by Calculated Risk on 5/23/2012 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 343 thousand.

This was up from a revised 332 thousand SAAR in March (revised up from 328 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The second graph shows New Home Months of Supply.

Months of supply decreased to 5.1 in April from 5.2 in March.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 340 thousand SAAR over the last 5 months, after averaging under 300 thousand for the previous 18 months. All of the recent revisions have been up too.

This was a solid report and above the consensus forecast of 335 thousand.

More graphs soon ...

MBA: Mortgage Refinance activity increases, Mortgage Rates at Record Low

by Calculated Risk on 5/23/2012 08:30:00 AM

From the MBA: Record Low Mortgage Rates Fuel Third Consecutive Increase In Refinance Applications In Latest MBA Weekly Survey

The Refinance Index increased 5.6 percent from the previous week. This is the third consecutive weekly increase in the Refinance Index which is at its highest level since February 10, 2012. The seasonally adjusted Purchase Index decreased 3.0 percent from one week earlier to its lowest level since April 20, 2012.The purchase index is still very weak.

"Mortgage rates again dipped to new record lows in the survey, which spurred more borrowers back into the refinance market. As a result, applications for refinance loans have increased for the third straight week and are at the highest level since February of this year. The HARP share of refinance applications was essentially unchanged over the week at 28 percent, so it was not the primary driver of the increase over the previous week." [said] Michael Fratantoni, MBA's Vice President of Research and Economics.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.93 percent, the lowest rate in the history of the survey, from 3.96 percent,with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Tuesday, May 22, 2012

Look Ahead: New Home Sales

by Calculated Risk on 5/22/2012 09:05:00 PM

• At 10:00 AM ET, the Census Bureau is scheduled to release the New home sales report for April. The consensus is for an increase in sales to 335,000 on a Seasonally Adjusted Annual Rate basis (SAAR) in April from 328,000 in March. Based on recent builder comments, and the homebuilder confidence survey, new home sales probably increased in April. Also, watch for upward revisions to prior reports.

• Also at 10:00 AM, the FHFA House Price Index for March 2012 will be released. This is based on GSE repeat sales and is not as closely followed as Case-Shiller or CoreLogic. Last month this index turned positive on a year-over-year basis: "For the 12 months ending in February, U.S. prices rose 0.4 percent, the first 12-month increase since the July 2006 - July 2007 interval." Look for a larger year-over-year increase in March.

For the monthly economic question contest:

Earlier on existing home sales:

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

ATA Trucking index declined 1.1% in April

by Calculated Risk on 5/22/2012 05:31:00 PM

From ATA: ATA Truck Tonnage Fell 1.1% in April

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.1% in April after increasing 0.6% in March. (March’s gain was more than the preliminary 0.2% increase ATA reported on April 24.) The latest drop put the SA index at 118.7 (2000=100), down from March’s level of 120. Compared with April 2011, the SA index was up 3.5%, better than March’s 3.1% increase. Year-to-date, compared with the same period last year, tonnage was up 3.8%.

...

“While April’s decrease was a little disappointing, the March gain turned out to be stronger than originally thought,” ATA Chief Economist Bob Costello said. “The ups and downs so far this year are similar to other economic indicators.”

“While just one month, the April’s decrease also matches with an economy that is likely to grow slightly slower in the second quarter than in the first quarter,” he said. Costello reiterated last month’s noting that the industry should not expect the rate of growth seen over the last couple of years, when tonnage grew 5.8% in both 2010 and 2011. “I continue to expect tonnage to moderate from the pace over the last two years. Annualized growth in the 3% to 3.9% seems more likely.”

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 3.5% year-over-year.

From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.