by Calculated Risk on 5/22/2012 02:32:00 PM

Tuesday, May 22, 2012

Lawler: Comments on Existing home sales and FHA REO

Some comments from housing economist Tom Lawler:

The National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 4.62 million in April, up 3.4% from March’s downwardly revised (to 4.47 million from 4.48 million) pace and up 10.0% from last April’s pace. The NAR’s estimate exceeded my estimate based on regional tracking, though almost all of my “miss” was related to the NAR’s seasonal adjustment factor: while seasonally adjusted sales were up 10.0% YOY, unadjusted sales showed just a 6.7% YOY gain (I guess the timing of Easter was the reason; my bad).

The NAR also estimated that the inventory of existing homes for sale at the end of April totaled 2.540 million, up 9.5% from March’s downwardly revised (to 2.32 million from 2.37 million) level and down 20.6% from last April. This was pretty close to my “guess” for a 21% YOY decline, and today’s report continued the trend for the NAR’s inventory estimates to show significantly lower monthly gains (or larger declines) in March and significantly larger monthly gains in April than that suggested by actual listings data.

Finally, the NAR estimated that the median existing home sales price in April was $177,400, up a whopping 10.1% from last April. The median existing SF sales price last month was $178,000, up 10.4% from last April. According to the NAR, the median existing SF sales price in the Northeast showed a YOY gain of 10.9%; in the Midwest, 8.1%; in the South, 8.5%; and in the West, 14.7%. While I was looking for a YOY increase exceeding 5%, this gain was obviously a boatload larger. Based on regional data I’ve seen the gain in the Northeast that the NAR reported seemed particularly “whacky,” though other regions – including the West – seemed high as well (Phoenix had a YOY gain of around 24%, but that was an outlier!).

CR Note: Remember the median price is impacted by the change in mix, and there are fewer low end foreclosures for sale this year and that pushes up the median price.

Lawler on FHA REO:

HUD finally got around to releasing the Monthly Report to the FHA Commissioner for March, and one “stand-out” stat was the sharp rise in SF property conveyances in March. Here are some historical stats (from the current and past monthly commissioner reports).

The number of SF properties “conveyed” to FHA has been surprising low over the last year given the number of properties in the foreclosure process, and FHA had noted that servicing “issues” were artificially depressing conveyances. Obviously, that was not the case in March!

| Monthly Report to FHA Commissioner | ||||

|---|---|---|---|---|

| SF REO Inventory (EOM) | Conveyances | Sales | Adjustments | |

| 10-Jun | 44,850 | 8,487 | 8,893 | 41 |

| 10-Jul | 44,944 | 8,341 | 8,508 | 261 |

| 10-Aug | 47,007 | 9,810 | 7,686 | -61 |

| 10-Sep | 51,487 | 11,411 | 7,439 | 508 |

| 10-Oct | 54,609 | 9,908 | 7,289 | 503 |

| 10-Nov | 55,488 | 6,752 | 5,817 | -56 |

| 10-Dec | 60,739 | 7,728 | 2,749 | 272 |

| 11-Jan | 65,639 | 7,709 | 2,632 | -177 |

| 11-Feb | 68,801 | 7,383 | 4,221 | 0 |

| 11-Mar | 68,997 | 8,647 | 8,728 | 277 |

| 11-Apr | 65,063 | 7,410 | 11,375 | 31 |

| 11-May | 59,465 | 7,032 | 12,659 | 29 |

| 11-Jun | 53,164 | 7,240 | 13,600 | 59 |

| 11-Jul | 48,507 | 6,509 | 11,379 | 213 |

| 11-Aug | 44,749 | 8,005 | 11,701 | -62 |

| 11-Sep | 40,719 | 6,567 | 10,554 | -43 |

| 11-Oct | 37,922 | 6,541 | 9,883 | 545 |

| 11-Nov | 35,192 | 6,212 | 9,178 | 236 |

| 11-Dec | 32,170 | 5,997 | 8,800 | -219 |

| 12-Jan | 31,046 | 6,771 | 7,670 | -225 |

| 12-Feb | 30,005 | 7,132 | 7,637 | -536 |

| 12-Mar | 35,613 | 14,007 | 8,219 | -180 |

CR Note: This probably means FHA REO sales will increase in May and June.

Click on graph for larger image.

Click on graph for larger image.This graph shows the combined REO inventory for Fannie, Freddie and the FHA.

The combined REO inventory is down to 209 thousand in Q1 2012, down about 16% from Q1 2011.

CR Note: Even though REO inventories are down, there are still more distressed sales coming because of all the loans 90+ days delinquent and in the foreclosure process.

Earlier on existing home sales:

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 5/22/2012 12:08:00 PM

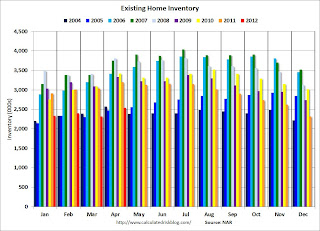

The NAR reported inventory increased to 2.54 million units in April, up 9.5% from the downwardly revised 2.32 million in March (revised down from 2.40 million). This is down 20.6% from April 2011, and up 2.7% from the inventory level in April 2005 (mid-2005 was when inventory started increasing sharply). Inventory was down slightly compared to April 2004 (see first graph below). This decline in inventory remains a significant story.

There is a seasonal pattern for inventory - usually inventory is the lowest in the winter months, and inventory usually peaks mid-summer. However most of the seasonal increase typically happens by April - so we could be close to the peak for this year.

Earlier this year, there were several analysts projecting that inventory would increase to 3 million by mid-summer. I thought that was too high, and it now looks like inventory will peak in the 2.6+ million range. That would be well below the inventory peak in 2005 of 2.9 million units.

At the current sales rate, 2.6 million units of inventory this would push the months-of-supply measure up to 6.7 to 6.8 months from the current 6.6 months. Note: Months-of-supply uses the seasonally adjusted sales rate, and the not seasonally adjusted inventory (even though there is a seasonal pattern for inventory). That would be the lowest seasonal peak for months-of-supply since 2005.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we comparing inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. However, in the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for the month of April since 2005, and inventory is slightly below the level in April 2004 (not counting contingent sales). Sometime this summer, I expect inventory to be below the same month in 2005. However inventory is still elevated - especially with the much lower sales rate.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Also it appears distressed sales were down in April. From the NAR:

Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 28 percent of April sales (17 percent were foreclosures and 11 percent were short sales), down from 29 percent in March and 37 percent in April 2011.The increase in existing home sales, combined with fewer distressed sales, is a positive sign for the housing market.

Earlier:

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

• Existing Home Sales graphs

Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

by Calculated Risk on 5/22/2012 10:00:00 AM

The NAR reports: April Existing-Home Sales Up, Prices Rise Again

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 3.4 percent to a seasonally adjusted annual rate of 4.62 million in April from a downwardly revised 4.47 million in March, and are 10.0 percent higher than the 4.20 million-unit level in April 2011.

...

Total housing inventory at the end of April rose 9.5 percent to 2.54 million existing homes available for sale, a seasonal increase which represents a 6.6-month supply at the current sales pace, up from a 6.2-month supply in March. Listed inventory is 20.6 percent below a year ago when there was a 9.1-month supply; the record for unsold inventory was 4.04 million in July 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2012 (4.62 million SAAR) were 3.4% higher than last month, and were 10.00% above the April 2011 rate.

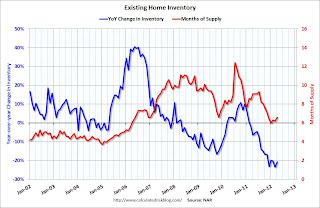

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.Months of supply was increased to 6.6 months in April.

This was slightly below expectations of sales of 4.66 million. I'll have more soon ...

New Push for Eurozone Bonds

by Calculated Risk on 5/22/2012 08:48:00 AM

From the Financial Times: OECD joins call for eurozone bonds

The Organization for Economic Co-operation and Development has joined French and EU officials in calling for a move towards jointly-guaranteed euro bonds ...Earlier from the Financial Times: France to push for eurozone bonds

Speaking to the Financial Times, Pier Carlo Padoan, the OECD deputy secretary general and chief economist, said fiscal consolidation alone without other elements of a “growth compact” could ruin chances of a longer-term economic union.

“We need to get on the path towards the issuance of euro bonds sooner rather than later,” he said.

excerpts with permission

France is determined to push the idea of jointly guaranteed bonds as a new form of borrowing for eurozone countries despite Germany’s opposition, Pierre Moscovici, finance minister, said in Berlin on Monday.Update: From the WSJ: IMF Chief, OECD Call For More Euro Debt Sharing

Speaking after a first intensive meeting with Wolfgang Schäuble, his German counterpart, Mr Moscovici confirmed that François Hollande, the newly elected French president, would include the concept as part of a package of growth measures to be debated by European leaders at an informal summit on Wednesday.

International Monetary Fund head Christine Lagarde Tuesday called on euro-zone governments to accept more common liability for each other's debts, saying that the region urgently needs to take further steps to contain the crisis.

"We consider that more needs to be done, particularly by way of fiscal liability-sharing, and there are multiple ways to do that," Ms. Lagarde told a press conference in London to mark the completion of a regular review of U.K. finances.

Monday, May 21, 2012

Look Ahead: Existing Home Sales

by Calculated Risk on 5/21/2012 09:31:00 PM

• Existing home sales for April will be released by the National Association of Realtors (NAR) at 10 AM ET. Existing home sales were at a 4.48 million seasonally adjusted annual rate in March, and the consensus is that sales increased to 4.66 million in April. Housing economist Tom Lawler is forecasting the NAR will report sales of 4.53 million.

Inventory will be closely watched. The NAR reported inventory at 2.37 million in March, and usually inventory increases sharply in April. The median increase from March to April over the last 10 years was 8%. Other sources suggest a smaller than normal seasonal increase, but as Tom Lawler noted last week: "for some reason the NAR’s inventory number in April has for many years shown a much larger monthly gain than listings data might suggest ...", and Lawler is projecting the NAR will report a 6.8% increase for April.

• Also at 10:00 AM, the Richmond Fed will release the regional Survey of Manufacturing Activity for May. The consensus is for a decrease to 11 for this survey from 14 in April (above zero is expansion).

For the monthly economic question contest: