by Calculated Risk on 5/16/2012 04:27:00 PM

Wednesday, May 16, 2012

Report: Housing Inventory declines 18.9% year-over-year

From Realtor.com: April 2012 Real Estate Data

On the national level, inventory of for-sale single family homes, condominiums, townhouses and co-ops declined by -18.85% in April 2012 compared to a year ago, and declined in all but five of the 146 markets covered by Realtor.com.Realtor.com also reports that inventory was up 2.0% from the March level.

Inventory usually increases seasonally from March to April. Over the last 11 years, the average increase was close to 9% since many people typically list their homes in the spring, hoping to move during the summer months. If the NAR also reports a 2% increase, this would be the smallest increase in inventory from March to April since the year 2000.

The NAR is scheduled to report April existing home sales and inventory on Tuesday, May 22nd. Economist Tom Lawler told me he expects to have a preliminary estimate of April existing home sales tomorrow.

Earlier:

• Housing Starts increase to 717,000 in April

• Industrial Production up in April, Capacity Utilization increases

• MBA: Mortgage Delinquencies decline in Q1

• Q1 MBA National Delinquency Survey Comments

FOMC Minutes: "Several members indicated that additional monetary policy accommodation could be necessary" if economy slows

by Calculated Risk on 5/16/2012 02:00:00 PM

The Fed's program to "extend the average maturity of its holdings of securities" (aka Operation Twist) is schedule to end in June. Now analysts are looking for clues about the possibility of QE3.

Although there was no discussion of easing alternatives, several members indicated they'd support additional monetary policy accommodation if the economy slows. This was an increase from a "couple" members in the previous meeting.

From the Fed: Minutes of the Federal Open Market Committee, April 24-25, 2012 . Excerpt:

Several members indicated that additional monetary policy accommodation could be necessary if the economic recovery lost momentum or the downside risks to the forecast became great enough.Earlier:

• Housing Starts increase to 717,000 in April

• Industrial Production up in April, Capacity Utilization increases

• MBA: Mortgage Delinquencies decline in Q1

• Q1 MBA National Delinquency Survey Comments

Q1 MBA National Delinquency Survey Comments

by Calculated Risk on 5/16/2012 11:19:00 AM

A few comments from Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education, and Michael Fratantoni, MBA's Vice President, Vice President of Research and Economics, on the conference call.

• All delinquency categories were down in Q1, both seasonally adjusted (SA) and NSA.

• The 30 day delinquency rate is back to normal (at the long term average). (This means a normal amount of loans are going delinquent each month)

• This was the largest quarter-to-quarter drop in delinquencies in history (there is usually a large seasonal drop in Q1, but this was larger than normal).

• The biggest problem is the number of loans in the foreclosure process. This is primarily a problem in states with a judicial foreclosure process. States like California and Arizona are now below the national average of percent of loans in the foreclosure process.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (14.31% in foreclosure), New Jersey (8.37%), Illinois (7.46%), Nevada (the only non-judicial state in the top 10 at 6.47%), and New York (6.17%).

As Jay Brinkmann noted, California (3.29%) and Arizona (3.57%) are now below the national average and improving quickly.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.13% from 3.22% in Q4. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.21% in Q1, from 1.25% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.06% from 3.11% in Q4 2011. This is the lowest level since 2008, but still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process increased slightly to 4.39% from 4.38%.

A final comment: I asked about the impact of the mortgage settlement (signed on April 5th, after Q1 ended). Jay Brinkmann said that servicers might have been waiting for the settlement and that might have "built up" the in-foreclosure rate in Q1. The two key categories to watch for the impact of the settlement are the in-foreclosure and 90+ days delinquent buckets.

To reiterate: the key problem remains the very high level of seriously delinquent loans and loans in the foreclosure process.

Note: the MBA's National Delinquency Survey (NDS) covers about "42.8 million first-lien mortgages on one- to four-unit residential properties" and is "estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives about 5.7 million loans delinquent or in the foreclosure process.

MBA: Mortgage Delinquencies decline in Q1

by Calculated Risk on 5/16/2012 10:02:00 AM

The MBA reported that 11.79 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2012 (delinquencies seasonally adjusted). This is down from 11.96 percent in Q4 2011 and is the lowest level since 2008.

From the MBA: Delinquencies Decline in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.40 percent of all loans outstanding as of the end of the first quarter of 2012, a decrease of 18 basis points from the fourth quarter of 2011, and a decrease of 92 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased 121 basis points to 6.94 percent this quarter from 8.15 percent last quarter.Note: 7.40% (SA) and 4.39% equals 11.79%.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 0.96 percent, down three basis points from last quarter and down 12 basis points from one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 4.39 percent, up one basis point from the fourth quarter and 13 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.44 percent, a decrease of 29 basis points from last quarter, and a decrease of 66 basis points from the first quarter of last year.

...

“Mortgage delinquencies normally fall during the first quarter of the year, but the declines we saw were even greater than the normal seasonal adjustments would predict, so delinquencies are clearly continuing to improve. Newer delinquencies, loans one payment past due as of March 31, are down to the lowest level since the middle of 2007, indicating fewer new problems we will need to deal with in the future. The percentage of loans three payments or more past due, the loans that represent the backlog of problems that still need to be handled, is down to the lowest level since the end of 2008. Foreclosure starts are at their lowest level since the end of 2007,” said Michael Fratantoni, MBA's Vice President of Research and Economics.

...

"The problem continues to be the slow-moving judicial foreclosure systems in some of the largest states. While the rate of foreclosure starts is essentially the same in judicial and non-judicial foreclosure states, the percent of loans in the foreclosure process has reached another all-time high in the judicial states, 6.9 percent. In contrast, that rate has fallen to 2.8 percent in non-judicial states, the lowest since early 2009. As the foreclosure starts rate is essentially the same in both groups of states, that difference is due entirely to the systems some states have in place that effectively block timely resolution of non-performing loans and is not an indicator of the fundamental health of the housing market or the economy. In fact, hard-hit markets like Arizona that have moved through their foreclosure backlog quickly are seeing home price gains this spring."

I'll have more later after the conference call this morning.

Industrial Production up in April, Capacity Utilization increases

by Calculated Risk on 5/16/2012 09:33:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in April. Output is now reported to have fallen 0.6 percent in March and to have moved up 0.4 percent in February; previously, industrial production was estimated to have been unchanged in both months. Manufacturing output increased 0.6 percent in April after having decreased 0.5 percent in March. Excluding motor vehicles and parts, which increased nearly 4 percent, manufacturing output moved up 0.3 percent, and output for all but a few major industries increased. Production at mines rose 1.6 percent, and the output of utilities gained 4.5 percent after unseasonably warm weather in the first quarter held down demand for heating. At 97.4 percent of its 2007 average, total industrial production for April was 5.2 percent above its year-earlier level. The rate of capacity utilization for total industry moved up to 79.2 percent, a rate 3.1 percentage points above its level from a year earlier but 1.1 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

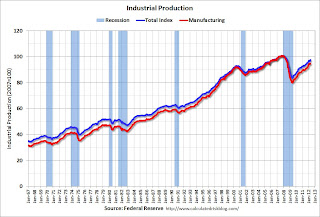

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 97.4. March was revised down (so the month-to-month increase was greater than expected), and February was revised up.

The consensus was for a 0.5% increase in Industrial Production in April, and for an increase to 79.0% (from 78.7%) for Capacity Utilization. This was above expectations.