by Calculated Risk on 5/14/2012 12:15:00 PM

Monday, May 14, 2012

Oil and Gasoline Prices, and the Reversal of Seaway Pipeline

Oil prices have fallen sharply, and once again gasoline prices are lagging. But if oil prices stay at this level - or fall further - then gasoline prices should decline further too (there are always some refinery issues).

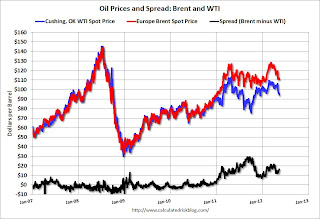

First, gasoline prices tend to track international oil prices, so we need to compare gasoline to Brent oil prices, and not WTI (West Texas Intermediate). A "glut" of oil at Cushing pushed down WTI prices relative to Brent over the last few years, but the spread has narrowed some now that a key pipeline is being reversed.

From Bloomberg: Sweet Crude From Seaway Pipeline Offered in the U.S. Gulf

Low-sulfur oil delivered from the soon-to-be reversed Seaway pipeline is being offered in the U.S. Gulf Coast for June delivery.This following graph shows the prices for Brent and WTI over the last few years.

Enterprise Product Partners LP (EPD) and Enbridge Inc. (ENB) are reversing the pipeline and on May 17 will begin shipping oil from the storage hub at Cushing, Oklahoma, to the Gulf. It is expected to narrow the discount of inland U.S. grades to imports and Gulf Coast production.

The first phase will carry 150,000 barrels a day on the 500-mile (800-kilometer) line, with subsequent phases expanding capacity to 850,000 barrels a day by mid-2014.

Click on graph for larger image.

Click on graph for larger image.The spread narrowed last year with the announcement of the partial reversal of the Seaway pipeline. The spread will probably narrow further as the capacity is expanded.

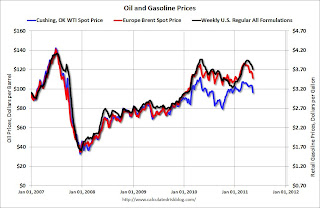

The second graphs shows that gasoline prices track Brent more than WTI.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.Once the "glut" emerged, gasoline prices tracked Brent oil prices. Brent was as high as $128 per barrel in March, and gasoline prices peaked at $3.94 (weekly basis) in early April.

We will probably see a similar lag this time, with gasoline prices falling to below $3.50 per gallon by early June (if oil prices stay at this level). It wouldn't be a surprise if most of the decline in gasoline prices happened after Memorial Day (May 28th).

And below is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early April. Note: The graph below shows oil prices for WTI; as noted above, gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Spanish and Italian Bond Yields Increase

by Calculated Risk on 5/14/2012 08:54:00 AM

From the WSJ: Global Stocks Hit by Greece Worries

Worries about what a Greek exit would mean for other euro-zone nations with hefty deficits pushed yields on 10-year Spanish government bonds above 6% to the highest levels seen since December.Here are the Spanish and Italian 10-year yields from Bloomberg.

The Spanish yields are at 6.3%, the highest level since last November. Compared to the German yield, Spanish borrowing costs at euro-era high:

Spreads on Spanish 10-year bonds over German Bunds hit a euro-era high of 486 basis points, surpassing the record hit last November. Yields on Spanish benchmark debt reached 6.30 per cent while German 10-year Bunds were at an all-time low of 1.44 per cent.The Italian yields are at 5.74%, the highest level since January.

excerpt with permission

The US 10-year yield is down to 1.78%, close to the record low of 1.7% last September.

Sunday, May 13, 2012

Look Ahead: Sunday Night Futures

by Calculated Risk on 5/13/2012 09:52:00 PM

This will be a busy week, but there are no economic indicators scheduled for release on Monday. The spotlight tomorrow will be on Greece and the Eurogroup meeting.

The Asian markets are mostly green tonight. The Nikkei is up about 0.6%, and the Shanghai Composite is up 0.3% after the People's Bank of China cut reserve requirements on Saturday.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down slightly, and Dow futures are down 5.

Oil: WTI futures are down to $95.47 (this is down from $109.77 in February) and Brent is down to $111.78 per barrel.

Yesterday:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

For the monthly economic question contest (for data to be released on Tuesday and Wednesday):

Greek Exit: Looking more likely

by Calculated Risk on 5/13/2012 07:26:00 PM

The Financial Times has an overview of some things that might happen when Greece exits the euro: Eurozone: If Greece goes ...

In any exit scenario, the new drachma would depreciate rapidly. ... Goldman Sachs has estimated ... a devaluation of 30 per cent is needed compared with the rest of the eurozone, and more than 50 per cent with Germany.The price for imports would soar (like oil prices), and living standards would fall - and Greece would have to immediately bring their primary budget into balance. The hope would be that competitiveness would be restored, and the economy could start growing again.

...

Even if all interest payments were stopped [Greece defaults again], additional austerity would still be needed for a period because Greece’s tax revenues still fall short of its public spending – a primary deficit.

excerpt with permission

A key question is spillover to other countries.

Professor Krugman has some thoughts on timing: Eurodämmerung

Some of us have been talking it over, and here’s what we think the end game looks like:Yesterday:

1. Greek euro exit, very possibly next month.

2. Huge withdrawals from Spanish and Italian banks, as depositors try to move their money to Germany.

3a. Maybe, just possibly, de facto controls, with banks forbidden to transfer deposits out of country and limits on cash withdrawals.

3b. Alternatively, or maybe in tandem, huge draws on ECB credit to keep the banks from collapsing.

4a. Germany has a choice. Accept huge indirect public claims on Italy and Spain, plus a drastic revision of strategy — basically, to give Spain in particular any hope you need both guarantees on its debt to hold borrowing costs down and a higher eurozone inflation target to make relative price adjustment possible; or:

4b. End of the euro.

And we’re talking about months, not years, for this to play out.

• Summary for Week Ending May 11th

• Schedule for Week of May 13th

Europe Update: Next Greek Election, Euro-area GDP expected to show recession

by Calculated Risk on 5/13/2012 11:44:00 AM

Greece: It is very unlikely that a coalition government will be formed. This means there will be another election on June 17th. The Europeans have said they will fund Greece through the next election, but it is not clear what will happen next. An exit from the euro is very possible.

From the Financial Times: Greek exit from eurozone ‘possible’

Greece’s exit from the eurozone “would be possible,” even if not in Europe’s interest, and countries should have a democratic right to quit, according to ... Luc Coene, the central bank governor of Belgium, in a Financial Times interview ...And it is appears data this week will confirm the European recession. From Nomura:

Mr Coene’s remarks – echoing similar comments by other eurozone central bankers – hinted at swirling debate within the ECB’s 23-strong council and suggested the ECB now realises such an outcome has become distinctly possible.

Excerpt with permission

An important state election in Germany and a Eurogroup meeting will take center stage amid heightened political uncertainty and GDP data likely to confirm the euro area is in recession. ... Euro-area Q1 GDP first release (Tuesday & Wednesday): The euro area seems to have entered into a technical recession in Q1, albeit with a shallower contraction than in Q4. We expect GDP growth to come in at -0.2% q-o-q in Q1 from -0.3% previously. By country, we think the core should hold up well, while the rest see a less sharp decline in economic output. In Germany and France, we forecast GDP growth of +0.1% q-o-q (vs Q4‟s -0.2%) and 0% q-o-q (vs Q4‟s +0.2%) respectively. ... In Italy, we think GDP growth is likely to print at -0.5% q-o-q in Q4 (vs -0.7% in Q4).Yesterday:

• Summary for Week Ending May 11th

• Schedule for Week of May 13th