by Calculated Risk on 5/05/2012 08:05:00 AM

Saturday, May 05, 2012

Summary for Week ending May 4th

The key report – the April employment report – was disappointing. With only 115 thousand jobs added in April, this has raised a key question: Is this a slowdown in hiring, or were the January and February numbers boosted by the mild weather, and the apparently slowdown in March and April was just some "payback"?

If the former, hiring has slowed to about 135,000 per month (or less); if the later, the economy is adding about 200,000 jobs per month. Note: Through the first four months of 2012, the economy has added 803 thousand payroll jobs, a better pace than in 2011.

There are some positives we’ve discussed lately: it appears state and local government layoffs are slowing (although there was a little increase in April), residential investment (and construction employment) is increasing from a very low level, and it appears the drag from several sectors of non-residential investment will end mid-year. So my guess is job growth will pick up from the March and April pace, but remain sluggish compared to the slack in the labor force.

The other data was mixed. The ISM manufacturing index was above expectations, but the ISM service index was below. The Chicago PMI was soft, but auto sales were solid at a 14.4 million seasonally adjusted annual rate (SAAR).

Here is a summary in graphs:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

There were 115,000 payroll jobs added in April, with 130,000 private sector jobs added, and 15,000 government jobs lost. The unemployment rate declined to 8.1%. The participation rate decreased to 63.6% from 63.8% (a new cycle low) and the employment population ratio also decreased slightly to 58.4%.

The change in February payroll employment was revised up from +240,000 to +259,000, and February was revised up from +120,000 to +154,000.

This was below expectations of 165,000 payroll jobs added.

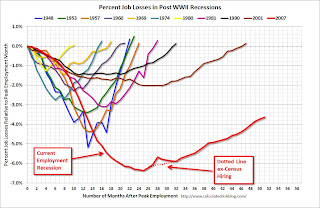

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

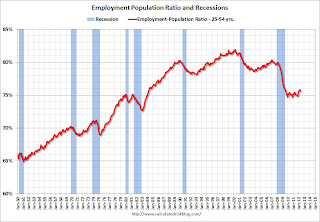

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.7% in April (this was down slightly in April from March.)

• ISM Manufacturing index indicates faster expansion in April

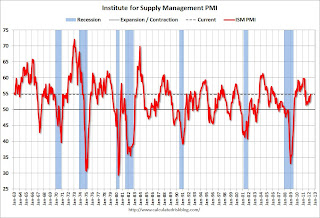

PMI was at 54.8% in April, up from 53.4% in March. The employment index was at 57.3%, up from 56.1%, and new orders index was at 58.2%, up from 54.5%.

PMI was at 54.8% in April, up from 53.4% in March. The employment index was at 57.3%, up from 56.1%, and new orders index was at 58.2%, up from 54.5%.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 53.0%. This suggests manufacturing expanded at a faster rate in April than in March. It appears manufacturing employment expanded faster in April with the employment index at 57.3%.

• U.S. Light Vehicle Sales at 14.42 million annual rate

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.42 million SAAR in April. That is up 9.8% from April 2011, and up 0.7% from the sales rate last month (14.3 million SAAR in March 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.42 million SAAR in April. That is up 9.8% from April 2011, and up 0.7% from the sales rate last month (14.3 million SAAR in March 2012).This was at the consensus forecast of 14.4 million SAAR (seasonally adjusted annual rate).

This graph shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

• Construction Spending increases slightly in March

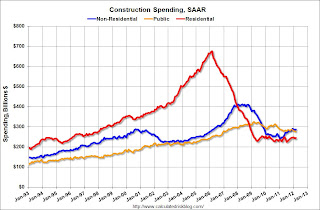

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 64% below the peak in early 2006, and up 8.4% from the recent low. Non-residential spending is 30% below the peak in January 2008, and up about 18% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and at a new post-bubble low.

On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

• ISM Non-Manufacturing Index indicates slower expansion in April

The April ISM Non-manufacturing index was at 53.5%, down from 56.0% in March. The employment index decreased in April to 54.2%, down from 56.7% in March. Note: Above 50 indicates expansion, below 50 contraction.

The April ISM Non-manufacturing index was at 53.5%, down from 56.0% in March. The employment index decreased in April to 54.2%, down from 56.7% in March. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 55.9% and indicates slower expansion in April than in March.

• Weekly Initial Unemployment Claims decline to 365,000

The DOL reports:

The DOL reports:In the week ending April 28, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 27,000 from the previous week's revised figure of 392,000. The 4-week moving average was 383,500, an increase of 750 from the previous week's revised average of 382,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,500.

This is the highest level for the 4-week moving average since last December.

This was below the consensus of 378,000. However, even though weekly claims declined, the 4-week average has increased for four straight weeks and is at the highest level this year.

• Other Economic Stories ...

• Trulia on Houses: Asking Prices increase slightly Year-over-year in April

• LPS: March Foreclosure Starts increase, Foreclosure Sales lowest since December 2010

• ADP: Private Employment increased 119,000 in April

• Chicago PMI declines to 56.2

• Personal Income increased 0.4% in March, Spending 0.3%

• Q1 2012 GDP Details: Office and Mall Investment falls to record low, Single Family investment increases

• Restaurant Performance Index increases in March

• Fannie Mae and Freddie Mac Serious Delinquency rates declined in March

Friday, May 04, 2012

Bank Failure #23 in 2012: Security Bank, National Association, North Lauderdale, Florida

by Calculated Risk on 5/04/2012 09:22:00 PM

Once graceful on a tight rope

Fell as gator chum

by Soylent Green is People

From the FDIC: Banesco USA, Coral Gables, Florida, Assumes All of the Deposits of Security Bank, National Association, North Lauderdale, Florida

As of March 31, 2012, Security Bank, National Association had approximately $101.0 million in total assets and $99.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.8 million. ... Security Bank, National Association is the 23rd FDIC-insured institution to fail in the nation this year, and the third in Florida.Earlier on the employment report:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• More Graphs: Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Current Employment Graphs

More Graphs: Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 5/04/2012 05:43:00 PM

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment decreased by 2 thousand jobs in April, but previous months were revised up slightly. Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Usually residential investment leads the economy out of a recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course there was no pickup for residential construction this time because of the large excess supply of vacant homes - although that appears to be changing.

Construction employment is now generally increasing, and construction will add to both GDP and employment growth in 2012.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down. The less than 5 week category is back to normal levels, and the other categories are still elevated.

The the long term unemployed declined to 3.3% of the labor force - this is still very high, but the lowest since August 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down. The unemployment rate for those with a bachelors degree has fallen to 4% for the first time since early 2009.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 56.8 in April, down from 64.7 in March. For manufacturing, the diffusion index declined to 59.9, down from 69.8 in March.

This is a little more technical. The BLS diffusion index for total private employment was at 56.8 in April, down from 64.7 in March. For manufacturing, the diffusion index declined to 59.9, down from 69.8 in March. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was not as widespread in April as in March.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Earlier on the employment report:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• All Current Employment Graphs

Another Housing Bear leaves the Woods

by Calculated Risk on 5/04/2012 04:26:00 PM

The list of former housing bears arguing that house prices are now at or near the bottom is growing. Even Professor Robert Shiller - without making a prediction and suggesting prices could "overshoot" - said this week on CNBC that "[house prices] are back to normal levels".

Even your local Grizzly Bear left the woods earlier this year.

Now from Mark Kiesel at Pimco: Back In

I’m back in. Yes, I’ve finally purchased a house after renting for the past six years. I sold my previous house in May 2006 after nearly a decade of being a homeowner because I was convinced U.S. housing prices were set to fall, and I wrote about it in prior Credit Perspectives pieces, “For Sale” (June 2006) and “Still Renting” (May 2007). Many of my friends, family and colleagues have asked me over the past several years, “Are you still renting?” In fact, that is probably the question I’ve heard most often from clients, consultants and the media over the years.And from Bloomberg: Pimco Housing Bear Kiesel Says It’s Time to Start Buying

So, next weekend I’ll be moving into a house. My decision to buy was mainly driven by the improved relative value of U.S. housing. ...

Today, however, U.S. housing looks like a decent place to put money over the next several years. I’m not sure if U.S. housing prices have bottomed – only time will tell – but there are many more positives today than there were six years ago when I sold my house

...

For those of you renting or on the sidelines, I recommend you at least consider getting “back in” and buying a house in the U.S., particularly in an area of the country where supportive fundamentals and policies could cause inventories to fall and job growth to improve.

Earlier on the employment report:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• All Current Employment Graphs

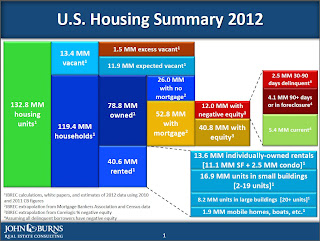

Graph: U.S. Housing Market Summary

by Calculated Risk on 5/04/2012 02:14:00 PM

Wayne Yamano at John Burns Real Estate Consulting sent me the following graphic last night. This provides a summary of the U.S. housing market in one graph.

Posted with permission: Source: John Burns Real Estate Consulting

The sources are listed on the graph. Wayne noted in his email to me: "We had to make some simplifying assumptions to make the chart look readable. One of those assumptions is that all delinquent borrows have negative equity. That’s obviously not true, but showing the overlap would have been exceedingly complicated."

The numbers on the left (total, vacant and occupied housing units) are extrapolations from the 2010 Census (the Census was a snapshot as of April 1, 2010 - over 2 years ago).

As an example, Yamano estimates that the number of housing units has increased from 131.7 million on April 1, 2010 to 132.8 million today. That is an increase of only 1.1 million housing units over the last two years - and that is probably close with the record low number of housing completions over that period.

I think the estimate of excess vacant housing units is too high. Using the Census 2010 state data, I estimated that the number of excess vacant housing units was above 1.8 million on April 1, 2010 (the date of the Census). See: The Excess Vacant Housing Supply. The number of excess units is lower today, and I think it is now less than 1 million units nationwide. A key difference is that I used both the 1990 and 2000 Census data to estimate the excess supply, and Yamano only used the 2000 Census data.

As Yamano noted, he made a "simplifying assumption" on delinquencies to make the chart readable (I think the chart is great). However it is important to remember that not all delinquent borrowers have negative equity, especially those in the 30 to 90 day delinquent category. Even in good times, around 2 million borrowers are one to two payments delinquent, and that is probably happening now too. This probably means there are another 1 to 2 million borrowers with negative equity that are current than shown on the chart. That is a key category since these properties could become distressed sales in the future - and that is why these borrowers are the main target of the HARP refinance program.

Also on delinquencies: I think the total of 6.6 million delinquencies is too high. Yamano used data from the MBA and extrapolated to the entire market, but the recent LPS release suggests there are about 5.6 million total delinquent loans (The MBA will probably show a significant decrease in Q1 too).

I think this graph provides a nice quick overview of the U.S. housing market. My thanks to Wayne.

Earlier on the employment report:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• All Current Employment Graphs