by Calculated Risk on 5/04/2012 10:29:00 AM

Friday, May 04, 2012

April Employment Summary and Discussion

Another disappointing report indicating sluggish employment growth.

It is probably worth a mention that there are now more private sector jobs than when President Obama took office, but the public sector is continuing to hemorrhage jobs (see third and fourth graphs).

Some numbers: There were 115,000 payroll jobs added in April, with 130,000 private sector jobs added, and 15,000 government jobs lost. The unemployment rate declined to 8.1%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, was unchanged at 14.5%. This remains very high - U-6 was in the 8% range in 2007 - but this is the lowest level of U-6 since early 2009.

The participation rate decreased to 63.6% from 63.8% (a new cycle low) and the employment population ratio also decreased slightly to 58.4%.

The change in February payroll employment was revised up from +240,000 to +259,000, and February was revised up from +120,000 to +154,000.

The average workweek was unchanged at 34.5 hours, and average hourly earnings were essentially unchanged. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.5 hours in April. ... In April, average hourly earnings for all employees on private nonfarm payrolls rose by 1 cent to $23.38. Over the past 12 months, average hourly earnings have increased by 1.8 percent." This is sluggish earnings growth, and less than inflation. Earnings are still being impacted by the large number of unemployed and marginally employed workers.

There are a total of 12.5 million Americans unemployed and 5.1 million have been unemployed for more than 6 months. These numbers are declining, but still very high.

Through the first four months of 2012, the economy has added 803 thousand total nonfarm jobs - this is a better pace than in 2011, but still sluggish.

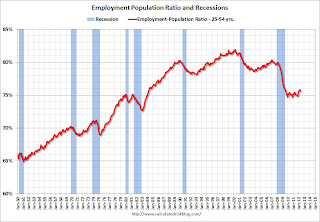

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.7% in April (this was down slightly in April from March.)

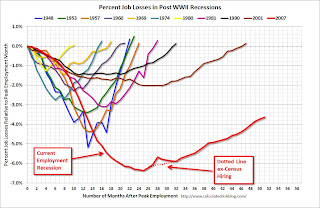

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

Private Sector Jobs Added

These two graphs compare public and private sector job losses (or added) for President George W. Bush's first term (following the stock market bust), and for President Obama's current term (following the housing bust and financial crisis). The Bush term is added for comparison purposes.

There are many differences between the two periods. Both followed the bursting of a bubble (stock and housing), although the housing bust also led to a severe financial crisis. As Reinhart and Rogoff noted, recoveries from financial crisis are usually very sluggish. See: "The Aftermath of Financial Crises".

The employment recovery during Mr. Bush's first term was very sluggish, and private employment was down 913,000 jobs at the end of his first term. The recovery has been sluggish under Mr. Obama's presidency too, but there are now 35 thousand more private sector payroll jobs than when Mr. Obama's term started.

Public Sector Jobs Lost

A big difference between Mr. Bush's first term and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 900,000 jobs), but the public sector has declined since Obama took office (down 607,000 jobs). These job losses are at the state and local level, although the Federal government has been losing jobs over the last year. There job losses are still a significant drag on overall employment.

A big difference between Mr. Bush's first term and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 900,000 jobs), but the public sector has declined since Obama took office (down 607,000 jobs). These job losses are at the state and local level, although the Federal government has been losing jobs over the last year. There job losses are still a significant drag on overall employment.

It appears the state and local public sector job losses are slowing, and it is likely that the decline in state and local public payrolls will end mid-year 2012. However the Federal government jobs losses will probably continue.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged in April at 7.9 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased slightly in April to 7.85 millon.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 14.5% in April - still very high, but the lowest level since early 2009.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.1 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.308 million in March. This is very high, but this is the lowest number since mid-2009.

April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

by Calculated Risk on 5/04/2012 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 115,000 in April, and the unemployment rate was little changed at 8.1 percent, the U.S. Bureau of Labor Statistics reported today.This was below expectations of 165,000 payroll jobs added.

...

The civilian labor force participation rate declined in April to 63.6 percent, while the employment-population ratio, at 58.4 percent, changed little.

...

The change in total nonfarm payroll employment for February was revised from +240,000 to +259,000, and the change for March was revised from +120,000 to +154,000.

Click on graph for larger image.

Click on graph for larger image.Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and then growth started picking up again. Now it appears job growth has slowed again. This was a weak month, but the upward revisions to prior months was a small positive.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was declined to 8.1% (red line).

The Labor Force Participation Rate decreased to 63.6% in April (blue line). This is the percentage of the working age population in the labor force and the participation rate is at a new post bubble low. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the recent decline is due to demographics.

The Labor Force Participation Rate decreased to 63.6% in April (blue line). This is the percentage of the working age population in the labor force and the participation rate is at a new post bubble low. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the recent decline is due to demographics.The Employment-Population ratio declined slightly to 58.4% in April (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 165,000). More later ...

Thursday, May 03, 2012

Look Ahead: April Employment Report, European Elections

by Calculated Risk on 5/03/2012 09:00:00 PM

The focus Friday will be on the April employment report from the Bureau of Labor Statistics (BLS).

• The employment report will be released at 8:30 AM ET. The consensus is for an increase of 165,000 non-farm payroll jobs in April, up from the 120,000 jobs added in March.

The consensus is for the unemployment rate to remain unchanged at 8.2%.

Earlier today I posted a preview of the report.

From Patti Domm at CNBC: Wall Street Has Lowered the Bar for April's Jobs Report

Deutsche Bank chief U.S. economist Joseph LaVorgna ... expects to see 175,000 nonfarm payrolls were added in April.• European elections: On Sunday, France and Greece will hold elections. In France, François Hollande is expected to replace Nicolas Sarkozy as President of the French Republic. Hollande is expected to push for more of a growth agenda, as opposed to austerity only.

Goldman Sachs economists expect to see only 125,000 nonfarm payrolls added in April, and they also see weather as a factor. But Goldman Economist Andrew Tilton agrees that if there’s a surprise, it may be in retail. In the employment reports in February and March, retail showed total layoffs of about 80,000 workers in the general apparel category. About 50,000 of those were in March — a record level — according to Tilton.

No party will win a majority in Greece, and many of the minor parties are expected to get a boost from the anti-auserity vote. However New Democracy will probably receive the most votes, and Pasok will probably finish second. There are some weird rules in Greece - see Greek elections from the Financial Times Alphaville - but it sounds like New Democracy and Pasok will be able to form a government that supports the terms of the recent bailout - although I expect New Democracy will push for some sort of growth agenda.

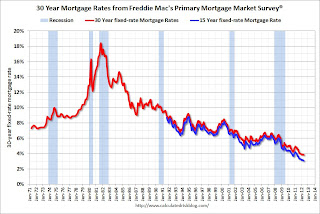

Freddie Mac: Fixed Mortgage Rates Average New All-Time Record Lows

by Calculated Risk on 5/03/2012 07:12:00 PM

This was released earlier ... from Freddie Mac: Fixed Mortgage Rates Average New All-Time Record Lows

Freddie Mac (OTC: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates finding new all-time record lows ... The 30-year fixed averaged 3.84 percent, down from its previous all-time record low of 3.87 percent last registered on February 9, 2012. The 15-year fixed averaged 3.07 percent, also dropping below its previous all-time record low of 3.11 percent set April 12 of this year. The 1-year ARM also averaged a new all-time record low in the PMMS at 2.70 percent.

30-year fixed-rate mortgage (FRM) averaged 3.84 percent with an average 0.8 point for the week ending May 3, 2012, down from last week when it averaged 3.88 percent. Last year at this time, the 30-year FRM averaged 4.71 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The Ten Year treasury yield is near a record low at 1.92%.

NFIB: Small Business hiring was weak in April, "Outlook improves"

by Calculated Risk on 5/03/2012 04:25:00 PM

From the National Federation of Independent Business (NFIB): Job Creation Weakens in April but Prospects Improve

April was another tenuous month for small businesses, sending mixed signals about what the future holds.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“On the job creation front, the news was only fair. The net change in employment per firm (seasonally adjusted) came in at 0.1; this is down from March but still positive.

...

“The percent of owners reporting hard to fill job openings rose 2 points to 17 percent, one point below the January 2012 reading which is the highest we’ve reported since June 2008. Hard-to-fill job openings are a strong predictor of the unemployment rate, making the gain in openings a welcome development. The net percent of owners planning to create new jobs is 5 percent, a 5 point increase after taking a plunge in March ...

“Overall, the April NFIB survey anticipates some strength in the job creation number with little change in the unemployment rate. With job creation plans rebounding, the outlook is a bit more optimistic for the second quarter ..."

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business hiring plans index since 1986. Hiring plans increased in April with the index at 5% compared to 0% in March.

According to NFIB: “Not seasonally adjusted, 18 percent plan to increase employment at their firm (up 3 points), and 5 percent plan reductions (unchanged from March)." This is still very low.