by Calculated Risk on 5/02/2012 06:39:00 PM

Wednesday, May 02, 2012

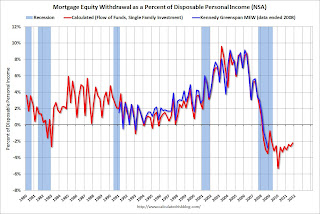

Mortgage Equity Withdrawal update

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q4 2011, the Net Equity Extraction was minus $64 billion, or a negative 2.2% of Disposable Personal Income (DPI). This is not seasonally adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q4. Mortgage debt has declined by $777 billion over the last four years. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

For reference:

Dr. James Kennedy also has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Lawler: Update on Home Builder Sales

by Calculated Risk on 5/02/2012 02:31:00 PM

From economist Tom Lawler:

Standard Pacific Homes, the 12th largest US home builder in 2010, reported that net home orders (excluding jvs) in the quarter ended March 31st totaled 934, up 43.3% from the comparable quarter of 2011. SPF’s sales cancellation rate, expressed as a % of gross orders, was 13% last quarter, down from 14% a year ago. The company said that its average community count last quarter was up 14.5% from a year ago. Home deliveries (ex jvs) last quarter totaled 642, up 46.2% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 was 973, up 55.2% from last March. The company’s CEO said that “(a)fter a strong finish to 2011, we are pleased to report that the positive momentum has continued into the first quarter,” and that “(w)e believe our solid first quarter results reflect the execution of our strategy and suggest that there may be some stabilization in the economy and the overall housing market." The company’s average selling price was up 4.9% from a year ago, which the company attributed to “general price increases and a product mix shift to move-up home deliveries.” Standard Pacific is one of several builder reporting moderate gains in pricing in some markets.

Beazer Homes, the 9th largest US home builder in 2010, reported that net home orders (including discontinued operations) in the quarter ended March 31sr totaled 1,511, up 26.0% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 22.5% last quarter, up from 20.0% a year ago. Home deliveries last quarter totaled 845, up 44.9% from the comparable quarter of last year. The company’s order backlog on 3/31/12 was 1,975, up 39.5% from last March. The company CEO said that the YOY increase in orders and closings reflected “both the initial operational benefits of our path-to-profitability strategies and gradually improving conditions in the housing market,” and he remains “hopeful, but cautious, about the prospects for a sustained market recovery.”

MDC Holdings, the 11th largest US home builder in 2010, reports results for the quarter ended 3/31/12 tomorrow.

Here is a summary of some stats reported by publicly traded home builders for last quarter.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | |

| D.R. Horton | 4,240 | 3,516 | 4,260 | 5,899 | 4,943 | 6,438 | 6,189 | 5,281 | 6,314 |

| NVR | 1,924 | 1,634 | 1,919 | 3,157 | 2,403 | 2,940 | 4,909 | 3,685 | 4,552 |

| PulteGroup | 3,117 | 3,141 | 3,795 | 4,991 | 4,345 | 4,320 | 5,798 | 5,188 | 6,456 |

| The Ryland Group | 848 | 688 | 984 | 1,357 | 966 | 1,167 | 2,023 | 1,465 | 1,915 |

| Meritage Homes | 759 | 678 | 808 | 1,144 | 840 | 1,064 | 1,300 | 940 | 1,351 |

| M/I Homes | 507 | 439 | 475 | 764 | 654 | 765 | 933 | 747 | 936 |

| Beazer Homes | 854 | 583 | 852 | 1,511 | 1,199 | 1,673 | 1,975 | 1,416 | 1,781 |

| Standard Pacific | 642 | 439 | 537 | 934 | 652 | 759 | 973 | 627 | 821 |

| Total | 12,891 | 11,118 | 13,630 | 19,757 | 16,002 | 19,126 | 24,100 | 19,349 | 24,126 |

| YOY % change | 15.9% | -18.4% | 23.5% | -16.3% | 24.6% | -19.8% | |||

In the March New SF Home Sales Report, the Census Bureau’s preliminary estimate of new SF home sales in the quarter ended March 31st was up 16.0% (not seasonally adjusted) from the comparable quarter of 2011.

In looking at some history of Census new SF home sales and builder reports, it appears as if the timing of the “recording” of a sale by builders may be slightly ahead of the timing reported to Census as a sale. Stated another way, Census new SF home sales appear to be “correlated” to builder sales reported both in the current quarter and one quarter lagged.

While I’ll update this estimate following tomorrow’s MDC report, right now I estimate that revisions will lift Census’s estimates of new SF home sales last quarter from an average seasonally adjusted annual rate of 337,000 to a SAAR of 350,000.

CR Note: This was from housing economist Tom Lawler.

Over There: Euro zone unemployment rate rises to 10.9%

by Calculated Risk on 5/02/2012 12:32:00 PM

From Jack Ewing at the NY Times: Unemployment Reaches Record High in Euro Zone

Unemployment in the euro zone rose to a new high in March, according to figures released Wednesday, which come a few days before crucial elections in France and Greece, and which are likely to intensify calls for an easing of the region’s austerity drive.Here is the Eurostat data.

Unemployment in the 17 countries that belong to the euro zone rose to 10.9 percent in March from 10.8 percent in February, according to Eurostat, the European Union’s statistics agency. In March 2011, the rate was 9.9 percent, a number that illustrates the deterioration of the area’s economy during the past year.

Germany seems to be doing OK, but Atrios asks the key question: "I wonder who will buy German manufacturing goods when nobody else in Europe has any money."

This reminds me of a quote from someone at Volkswagen last year on the possible end of the euro: “The conclusion is that overall the impact would not be so negative to our company, as we are mainly an exporter ..."

My response was: Export to whom?

LPS: March Foreclosure Starts increase, Foreclosure Sales lowest since December 2010

by Calculated Risk on 5/02/2012 09:15:00 AM

Note: U.S. District Court Judge Collyer approved the consent orders for the mortgage servicer settlement on April 5th, so we still have to wait a little longer to see the impact of the agreement on delinquencies.

LPS released their Mortgage Monitor report for March today.

According to LPS, 7.09% of mortgages were delinquent in March, down from 7.57% in February, and down from 7.78% in March 2011.

LPS reports that 4.14% of mortgages were in the foreclosure process, up slightly from 4.13% in February, and down slightly from 4.15% in March 2011.

This gives a total of 11.23% delinquent or in foreclosure. It breaks down as:

• 1,888,000 loans less than 90 days delinquent.

• 1,643,000 loans 90+ days delinquent.

• 2,060,000 loans in foreclosure process.

For a total of 5,591,000 loans delinquent or in foreclosure in March. This is down from 6,333,000 in March 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquency rate has fallen to 7.09% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.14%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.06 million).

Every year some people fail to pay their mortgage during the holidays, and then they catch up by March. This graph shows the usual decline in the delinquency rate from December to March, and the decline in 2012 was about normal (in percentage terms).

The third graph shows the break down of loans "in foreclosure" by process (judicial vs. non-judicial).

The foreclosure inventory in non-judicial states is much lower and has been slowly declining.

The last graph (all provided by LPS Applied Analytics) shows foreclosure starts and sales.

Foreclosure sales were at their lowest point since December of 2010.

This was before the mortgage servicer settlement was approved in early April, so it is still too early to see the impact of the settlement.

There is much more in the Mortgage Monitor report.

ADP: Private Employment increased 119,000 in April

by Calculated Risk on 5/02/2012 08:18:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 119,000 from March to April on a seasonally adjusted basis. The estimated gain from February to March was revised down modestly, from the initial estimate of 209,000 to a revised estimate of 201,000.This was significantly below the consensus forecast of an increase of 178,000 private sector jobs in April. The BLS reports on Friday, and the consensus is for an increase of 165,000 payroll jobs in April, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 123,000 in April, after rising 158,000 in March. Employment in the private, goods-producing sector declined 4,000 jobs in April. Manufacturing employment dropped 5,000 jobs, the first loss since September of last year.

Note: ADP hasn't been very useful in predicting the BLS report, but this suggests a weaker than consensus report.