by Calculated Risk on 4/27/2012 09:55:00 AM

Friday, April 27, 2012

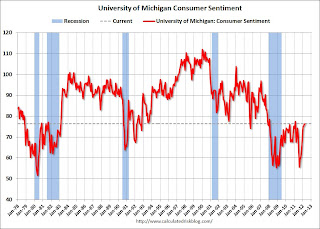

Consumer Sentiment increases slightly in April to 76.4

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for April increased slightly to 76.4, up from the preliminary reading of 75.7, and up from the March reading of 76.2.

This was above the consensus forecast of 75.7. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and sluggish economy - however sentiment has rebounded from the decline last summer.

Real GDP increased 2.2% annual rate in Q1

by Calculated Risk on 4/27/2012 08:44:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.2 percent in the first quarter of 2012 (that is, from the fourth quarter to the first quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, private inventory investment, and residential fixed investment that were partly offset by negative contributions from federal government spending, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the first quarter primarily reflected a deceleration in private inventory investment and a downturn in nonresidential fixed investment that were partly offset by accelerations in PCE and in exports.

Click on graph for larger image.

A few key numbers:

• Real personal consumption expenditures increased 2.9 percent in the first quarter, compared with an increase of 2.1 percent in the fourth.

• Investment growth slowed, except residential investment: "Real nonresidential fixed investment decreased 2.1 percent in the first quarter, in contrast to an increase of 5.2 percent in the fourth. Nonresidential structures decreased 12.0 percent, compared with a decrease of 0.9 percent. Equipment and software increased 1.7 percent, compared with an increase of 7.5 percent. Real residential fixed investment increased 19.1 percent, compared with an increase of 11.6 percent."

• Government spending continued to be a drag at all levels, but at a slower pace: "Real federal government consumption expenditures and gross investment decreased 5.6 percent in the first quarter, compared with a decrease of 6.9 percent in the fourth. ... Real state and local government consumption expenditures and gross investment decreased 1.2 percent, compared with a decrease of 2.2 percent."

This was below expectations. I'll have more on GDP later ...

Thursday, April 26, 2012

"Private money coming back into the housing finance market"

by Calculated Risk on 4/26/2012 09:17:00 PM

Mortgage broker Soylent Green is People sent me an example today of private money coming back into the mortgage market:

Second mortgage purchase mortgage lending above 80% loan to value has begun to creep back into the market. Prudent Underwriting standards and deep risk analysis have convinced some private money to come back into the housing finance market of late. We’ve added an 80 / 10 / 10 product recently that has no Private Mortgage Insurance.CR note: As I mentioned yesterday, when house prices stop falling, private lenders will become more confident and reenter the market. This is just the beginning.

700 FICO minimum.

SFD, and Condos - providing that the project has 75% Owner Occupancy ratios

90% CLTV to $750,000

Interest Only minimum payment HELOC, Prime + 1.99%. No prepayment penalty.

Qualifying at index, margin, plus .125, fully amortized.

45% Absolute debt to income ratio maximum.

Let’s take a $333,400 priced home. Most FHA buyers will put less down, but for comparison purposes assume a 10 percent down payment. An FHA 30 fixed borrower pays 1.75% for the FHA Up Front Mortgage Insurance Premium PLUS 1.20% per year in Mortgage Insurance. Assuming a 3.75% rate and a $300,000 balance, the payment plus MI runs $1,690. A similarly structured Conventional Conforming loan at 3.875% runs $1,532 An 80/10/10 combined payment comes in at $1,437, principal and interest.

That’s quite a payment spread for the typical home buyer to choose from. As more of these risk tolerant companies enter the market, the share of FHA loans will finally diminish.

Some expanded prudent private lending makes sense, but we never want to see Alt-A and stated income loans again!

Contest Question: Will real GDP be above or below consensus?

by Calculated Risk on 4/26/2012 07:17:00 PM

For those entering the monthly contest ...

From MarketWatch: Q1 GDP report to show economy 'plugging along'

Economists polled by MarketWatch expect a 2.7% growth rate in the first quarter, slightly slower than the 3.0% rate in the fourth quarter.Bloomberg is showing the consensus at 2.5%.

There was a wide range of forecasts, from just above a 2% growth rate up to a 3.2%.

Lawler: Builder Reports Exceed Expectations

by Calculated Risk on 4/26/2012 03:16:00 PM

From economist Tom Lawler:

The Ryland Group, the 8th largest US home builder in 2010, reported that net home orders (including discontinued operations) in the quarter ended March 31st totaled 1,357, up 40.5% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 18.0% last quarter, down from 18.2% year ago. Home closings totaled 848 last quarter, up 23.3% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 totaled 2,023, up 38.1% from last March. Ryland noted that sales incentives and price concessions totaled 10.9% last quarter, down from 11.7% a year ago.

PulteGroup, the 2nd largest US home builder in 2010, reported that net home orders in the quarter ended March 31st totaled 4,991, up 14.9% from the comparable quarter of 2011. The sales gain came despite a 6% decline in community count. The company’s sales cancellation rate, expressed as a % of gross orders, was 15% last quarter, down form 16% a year ago. Home closings last quarter totaled 3,117, down 0.8% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 totaled 5,798, up 11.8% from last March. Pulte noted that while “(w)e are only one quarter into the year, but the start has exceeded our internal estimates and has us cautiously optimistic that housing demand may have reached a positive inflection point."

Meritage Homes, the 10th largest US home builder in 2010, reported that net home orders in the quarter ended March 31st totaled 1,144, up 36.2% from the comparable quarter of 2011. Home closings last quarter totaled 759, up 11.9% from the comparable quarter of 2011. The company’s order backlog as of 3/31/12 totaled 1,300, up 38.3% from last March. Meritage noted that “(o)ur spring selling season got off to a strong start, as evidenced by our 36% increase in sales in the first quarter,” and that “(a)s demand has strengthened, we've begun to raise prices in most of our communities this year.”

M/I Homes, the 15th largest US home builder in 2010, reported that net home orders in the quarter ended March 31st totaled 764, up 16.8% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 14% last quarter, down from 16% a year ago. Home closings last quarter totaled 507, up 15.5% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 totaled 933, up 24.9% from last March. M/I noted that “(o)ur first quarter results reflect what we believe to be slowly improving housing condition.”

All of the publicly-traded builders who have reported results for the quarter ended 3/31/12 so have shown YOY increases in average home sales prices, though in many cases this reflected a change in the mix of homes sold as opposed to overall price increases. By the same token, however, pricing vs. a year ago appears to have been pretty stable, and there appears to have been less price discounting.

Below is a summary of selected stats for the six publicly-traded builders who have released results for the quarter ended in March.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | |

| D.R. Horton | 4,240 | 3,516 | 4,260 | 5,899 | 4,943 | 6,438 | 6,189 | 5,281 | 6,314 |

| NVR | 1,924 | 1,634 | 1,919 | 3,157 | 2,403 | 2,940 | 4,909 | 3,685 | 4,552 |

| PulteGroup | 3,117 | 3,141 | 3,795 | 4,991 | 4,345 | 4,320 | 5,798 | 5,188 | 6,456 |

| The Ryland Group | 848 | 688 | 984 | 1,357 | 966 | 1,167 | 2,023 | 1,465 | 1,915 |

| Meritage Homes | 759 | 678 | 808 | 1,144 | 840 | 1,064 | 1,300 | 940 | 1,351 |

| M/I Homes | 507 | 439 | 475 | 764 | 654 | 765 | 933 | 747 | 936 |

| Total | 11,395 | 10,096 | 12,241 | 17,312 | 14,151 | 16,694 | 21,152 | 17,306 | 21,524 |

| YOY % change | 12.9% | -17.5% | 22.3% | -15.2% | 22.2% | -19.6% | |||

On Tuesday the Commerce Department estimated that new SF home sales last quarter were up 16% (not seasonally adjusted) from the comparable quarter of last year. Recently, of course, there has been a pattern of upward revisions to preliminary, and historically during improving markets such revisions are commonplace (and in declining markets, downward revisions are common). I’d bet that when the April new home sales report is released, March’s sales estimate will be revised higher.

CR note: Net orders are above Q1 2010 too when sales average a 358,000 seasonally adjusted annual rate. There has been some consolidation, and cancellations are down, but I think Tom is correct about coming upward revisions.