by Calculated Risk on 3/18/2012 03:14:00 PM

Sunday, March 18, 2012

Some humor from Jim the Realtor

Yesterday:

• Summary for Week ending March 16th

• Schedule for Week of March 18th

From Jim the Realtor:

"Here is another contender for the cover of curb appeal magazine"

"Thank you mister neighbor (about a boat in the neighbors backyard). Thankfully its for sale. I'm sure he won't have any trouble selling it while it sits right there in the backyard, because people flying over this property will be throwing money - suitcases of money - at him to buy that boat. So don't worry about that ..."

Hard to believe this one sold in 2 weeks ... enjoy.

Public and Private Sector Payroll Jobs: Bush and Obama

by Calculated Risk on 3/18/2012 10:34:00 AM

This is a followup to the previous post showing the year-over-year change in private and public sector payroll jobs. With public sector jobs down over the last few years (state and local layoffs), several readers have asked if I could compare public sector hiring / firing to the early '00s.

The following two graphs compare public and private sector job losses (or added) for President George W. Bush's first term (following the stock market bust), and for President Obama's current term (following the housing bust and financial crisis).

Important: There are many differences between the two periods. Both followed the bursting of a bubble (stock and housing), although the housing bust also led to a severe financial crisis. As Reinhart and Rogoff noted, recoveries from financial crisis are usually very sluggish. See: "The Aftermath of Financial Crises".

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the change in private sector payroll jobs from the beginning of Mr. Bush's first term compared to Mr. Obama's current term.

The employment recovery during Mr. Bush's first term was very sluggish, and private employment was down 913,000 jobs at the end of his first term. The recovery has been sluggish under Mr. Obama's presidency too, and there are still 247,000 fewer payroll jobs than when Mr. Obama's term started (although it appears this will turn positive in a couple of months).

A big difference between Mr. Bush's first term and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 900,000 jobs), but the public sector has declined since Obama took office (down 590,000 jobs). These job losses are at the state and local level, but they are still a significant drag on overall employment.

A big difference between Mr. Bush's first term and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 900,000 jobs), but the public sector has declined since Obama took office (down 590,000 jobs). These job losses are at the state and local level, but they are still a significant drag on overall employment.

It appears the public sector jobs losses are slowing, and it looks likely that the decline in public payrolls will probably end mid-year 2012.

Yesterday:

• Summary for Week ending March 16th

• Schedule for Week of March 18th

Saturday, March 17, 2012

Year-over-year Change in Public and Private Payroll Employment

by Calculated Risk on 3/17/2012 11:11:00 PM

Jon Lansner at the O.C. Register wrote about looking at year-over-year changes:

Forget the debate about the true oomph of February's 227,000 job gain from January.That requires a graph! Instead of just looking at the year-over-year increase in total nonfarm payrolls, I divided the data into changes in private and public payrolls.

Look at this same data on a year-over-year basis! What do you learn?

American bosses added 2.021 million jobs in the year ended in February. That's a 1.5 percent job growth pace. It's the fastest bout of hiring since January 2007.

Click on graph for larger image.

Click on graph for larger image.The red line is the year-over-year changes for private payrolls; the blue line is for public payrolls.

Whereas total payrolls are up 1.5 percent, private payrolls are up 2.0% year-over-year, the fastest rate of increase since early 2006.

However public payrolls are down 1.0%, and public payrolls have been falling since mid-2009 with the exception of the decennial Census hiring (note the spike every 10 years in public hiring).

Note: It looks likely that the decline in public payrolls will end mid-year 2012 (the year-over-year change will hit zero some time later).

Earlier:

• Summary for Week ending March 16th

• Schedule for Week of March 18th

Unofficial Problem Bank list declines to 952 Institutions

by Calculated Risk on 3/17/2012 04:25:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 16, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, the OCC release its actions through mid-February 2012 this week, which contributed to several changes to the Unofficial Problem Bank List.

In all, there were six removals and two additions, which leaves the list with 952 institutions with assets of $379.1 billion. Among the removals are one unassisted merger -- Mainline National Bank, Portage, PA ($235 million). The other removals are for action terminations including City National Bank of Florida, Miami, FL ($3.97 billion); Edgewater Bank, Saint Joseph, MI ($137 million); Bank of the Rio Grande, National Association, Las Cruces, NM ($102 million); First National Bank in Mahnomen, Mahnomen, MN ($72 million); and The First National Bank of Wayne, Wayne, NE ($35 million). The two additions this week were Lee County Bank & Trust, National Association, Fort Madison, IA ($163 million) and Mutual Federal Bank, Chicago, IL ($83 million).

Click on graph for larger image.

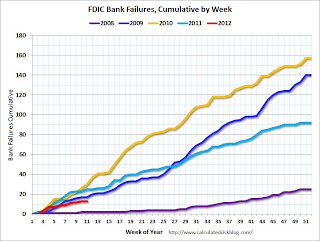

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 427 bank failures since the beginning of 2008, and so far closings this year are running at about half the rate of 2010 and 2011.

Earlier:

• Summary for Week ending March 16th

• Schedule for Week of March 18th

Schedule for Week of March 18th

by Calculated Risk on 3/17/2012 01:01:00 PM

Earlier:

• Summary for Week ending March 16th

The key reports this week are housing related. This includes the NAHB builder confidence survey on Monday, housing starts on Tuesday, existing home sales on Wednesday, and new home sales on Friday.

The AIA's Architecture Billings Index for January will also be released on Wednesday.

8:35 AM ET: NY Fed President Dudley speaks on regional and national economic conditions before the Long Island Association

9:30 AM: Testimony, Suzanne Killian, Senior Associate Director, Division of Consumer and Community Affairs, "Foreclosures and the Housing Market" Before the Committee on Government Oversight and Reform, U.S. House of Representatives, Brooklyn, New York

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 30, up slightly from 29 in February. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately after mostly moving sideways for about two years and a half years. Multi-family starts increased in 2011 - although from a very low level - and single family starts appear to be increasing lately.

The consensus is for total housing starts to be essentially unchanged at 700,000 (SAAR) in February.

12:45 PM: Fed Chairman Ben Bernanke's lecture series to college students, "The Federal Reserve and the Financial Crisis" Part 1 of 4

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 4.61 million on seasonally adjusted annual rate basis.

Economist Tom Lawler estimates the NAR will report sales of 4.63 million, up slightly from January’s pace. A key will be inventory and months-of-supply, and Lawler estimates inventory increased slightly in February.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 352,000 from 351,000 last week.

10:00 AM: FHFA House Price Index for January 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Conference Board Leading Indicators for February. The consensus is for a 0.6% increase in this index.

12:45 PM: Fed Chairman Ben Bernanke's lecture series to college students, "The Federal Reserve and the Financial Crisis" Part 2 of 4

10:00 AM ET: New Home Sales for February from the Census Bureau.

10:00 AM ET: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight increase in sales to 325 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 321 thousand in January. The consensus might be a little low based on the homebuilder confidence survey.