by Calculated Risk on 2/14/2012 01:16:00 PM

Tuesday, February 14, 2012

Report: Wednesday euro zone finance minister meeting cancelled

From the Financial Times: Euro ministers cancel Greece meeting

“It has appeared that further technical work between Greece and the troika is needed in a number of areas, including the closure of the fiscal gap of €325m in 2012 and the debt sustainability analysis,” [Jean-Claude Juncker] said in a statement that followed a preparatory meeting for the event.There will be conference call instead, and then the regular meeting next Monday.

“Furthermore, I did not yet receive the required political assurances from the leaders of the Greek coalition parties on the implementation of the programme,” he said.

The €200bn "Private Sector Involvement" restructuring needs to begin pretty soon to make the March deadline ...

Ceridian-UCLA: Diesel Fuel index declined 1.7% in January

by Calculated Risk on 2/14/2012 11:35:00 AM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Dropped 1.7 Percent in January; Compared with Prior Year, the PCI is Down 2.2 Percent

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, fell 1.7 percent in January following the 0.4 percent decrease in December. January’s data places the PCI 2.2 percent below year-ago levels with essentially no growth in the year-and-a-half since the summer of 2010.

“It seems difficult to square the behavior of the PCI with the evident improvement in a number of economic indicators, most notably the increase in payroll jobs and the decrease in initial claims for unemployment,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and Director of the UCLA Anderson Forecast. “The PCI also seems out-of-sync with Industrial Production and with Real Retail Sales, which continue to grow in a healthy manner while the PCI is stalled out.”

The year-over-year changes in the PCI, however, make it look very accurate – the three-month moving average peaked at 8 percent in July 2010 and has fallen steadily to essentially zero percent in January. “The PCI year-over-year peak in 2010 and the deterioration throughout 2011 have correctly anticipated the same movement of Industrial Production, Total Business Real Inventories, and Real Retail Sales. The weakness in the PCI is suggesting either further weakness in these indicators or a big gain in trucking in February, March and April,” said Leamer.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index has been weaker than other measures of transportation such as the ATA trucking index or the AAR rail traffic report. In the full report, Dr. Leamer looks at several possible explanations for the divergence - a shift to rail traffic, the difference between diesel fuel transaction (up for the year) and gallons (down for the year), and possible efficiency due to the high price of diesel fuel. There isn't a clear explanation.

Note: This index does appear to track Industrial Production over time (with plenty of noise). From Ceridian: "Based on the latest PCI data, the forecast for January Industrial Production is a 0.44 percent decrease when the government estimate is released on February 15."

Retail Sales increased 0.4% in January

by Calculated Risk on 2/14/2012 08:46:00 AM

On a monthly basis, retail sales were up 0.4% from December to January (seasonally adjusted, after revisions), and sales were up 5.8% from January 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $401.4 billion, an increase of 0.4 percent (±0.5%)* from the previous month and 5.8 percent (±0.7%) above January 2011. ... The November to December 2011 percent change was revised from 0.1 percent (±0.5)* to virtually unchanged (±0.3%)*.

Click on graph for larger image.

Click on graph for larger image.Sales for December were revised down from a 0.1% increase to "virtually unchanged".

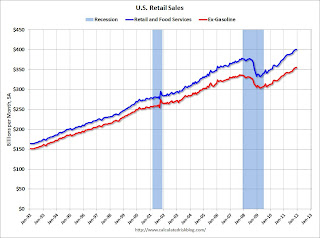

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.7% from the bottom, and now 6.1% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 17.3% from the bottom, and now 5.6% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 17.3% from the bottom, and now 5.6% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.6% on a YoY basis (5.8% for all retail sales). Retail sales ex-gasoline increased 0.3% in January.

This was below the consensus forecast for retail sales of a 0.7% increase in January, but above the consensus for a 0.5% increase ex-auto.

This was below the consensus forecast for retail sales of a 0.7% increase in January, but above the consensus for a 0.5% increase ex-auto. NFIB: Small Business Optimism Index increases slightly in January

by Calculated Risk on 2/14/2012 08:00:00 AM

From the National Federation of Independent Business (NFIB): Small Business Confidence in a Lull

Rising just one tenth of one percent in January, the Small-Business Optimism Index settled at 93.9, a slight increase from the December 2011 reading, according to the National Federation of Independent Business (NFIB). While the increase marks five consecutive months of improvement, the readings from January and February 2011 were higher, indicated no net gain for the calendar year. Historically, optimism remains at recession levels. While owners appeared less pessimistic about the outlook for business conditions and real sales growth, that optimism did not materialize in hiring or increased inventories plans.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“The most positive statement that can be made about January’s reading is that the Index did not go down; a change of 0.1 points is essentially no change and it is hardly indicative of a surge in economic activity,” said NFIB Chief Economist Bill Dunkelberg.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 93.9 in January from 93.8 in December. This is the fifth increase in a row after declining for six consecutive months.

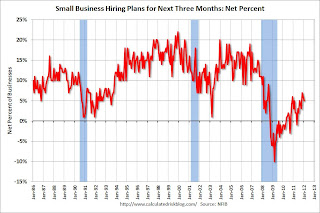

The second graph shows the net hiring plans for the next three months.

Hiring plans declined slightly in January, but the trend is up.

Hiring plans declined slightly in January, but the trend is up. According to NFIB: “Over the next three months, 13 percent plan to increase employment (up 4 points), and 7 percent plan to reduce their workforce (down 1 point), yielding a seasonally adjusted net 5 percent of owners planning to create new jobs, a 1 point decline from December. There is no surge in hiring indicated by these numbers..."

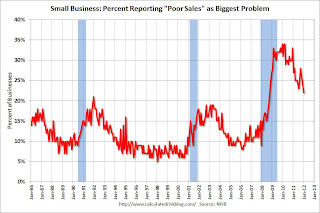

Twenty two percent of small business owners reported that weak sales continued to be their top business problem in January. Currently 18% are reporting taxes as the most important problem, and 20% are reporting regulations - just below the 23% reporting "poor sales".

In good times, small business owners usually report taxes and regulation as their biggest problems. This is another small sign of improvement for small businesses, but lack of demand is still the key problem.

In good times, small business owners usually report taxes and regulation as their biggest problems. This is another small sign of improvement for small businesses, but lack of demand is still the key problem.The optimism index declined sharply in August due to the debt ceiling debate and has now rebounded to about the same level as early in 2011. This index is still low - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.

Monday, February 13, 2012

SF Fed President Williams: "Vital that we keep the monetary policy throttle wide open"

by Calculated Risk on 2/13/2012 10:37:00 PM

From San Francisco Fed President John Williams: The Federal Reserve’s Mandate and Best Practice Monetary Policy. Excerpt:

What does this tell us about where monetary policy should be now? Inflation in 2012 and 2013 is likely to come in around 1½ percent, below the FOMC’s 2 percent target. And clearly, with unemployment at 8.3 percent, we are very far from maximum employment. At the San Francisco Fed, our forecast is that the unemployment rate will remain well over 7 percent for several more years.QE3 is coming.

This is a situation in which there’s no conflict between maximum employment and price stability. With regard to both of the Fed’s mandates, it’s vital that we keep the monetary policy throttle wide open. This will help lower unemployment and raise inflation back toward levels consistent with our mandates. And we want to do so quickly to minimize total economic damage. The longer we miss our objectives, the larger the cumulative loss to the economy.

Williams also provides an excellent discussion on "price stability":

What objective should we seek for the rate of increase of average prices? Should we strive for no change at all, that is, zero inflation? At first blush, that seems sensible. But, there are a number of reasons why aiming for zero inflation would be too low and inconsistent with our maximum employment mandate. Here I’ll mention two.

First, a small amount of inflation can help grease the wheels of the labor market. There is considerable evidence that nominal wages don’t easily fall even when demand is weak, something economists call downward wage rigidity. In other words, it’s unusual for workers to have the dollar value of their wages reduced. In this regard, wages are very different from, say, airline ticket prices, which are quickly discounted when seats can’t be filled. Weak labor demand may necessitate a reduction in real wages, that is, wages adjusted for inflation. Even if the nominal, or dollar value, of wages won’t budge, the real wage will fall as prices rise. As a result, a little bit of inflation can help the labor market adjust to negative shocks and, in this way, help keep employment closer to its maximum level.

Second, a small amount of inflation gives the Fed a little more maneuvering room to respond to negative shocks to the economy. The problem is that nominal interest rates can’t go below zero. Economists refer to that limit as the zero lower bound. Let me define terms. The nominal interest rate can be divided into its two components: the real, or inflation-adjusted, interest rate; and expected inflation. A little bit of inflation tends to raise nominal rates on average in order to provide a positive yield to investors. That gives the Fed more room to lower interest rates in a recession before hitting the zero lower bound.