by Calculated Risk on 2/09/2012 01:07:00 PM

Thursday, February 09, 2012

Hotels: RevPAR increases 8.7% compared to same week in 2011

From HotelNewsNow.com: STR: Upper-midscale hotels top weekly gains

Overall, the U.S. hotel industry’s occupancy was up 5.5% to 51.7%, its ADR increased 3.1% to US$100.45 and RevPAR was up 8.7% to US$51.98.This is the weak season for hotel occupancy, but this is solid improvement over the same week last year. Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

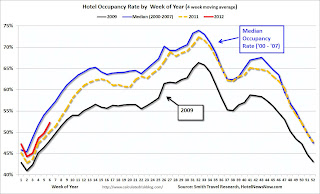

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Hotel occupancy is running above 2011, but the 4-week average of the occupancy rate is still below normal. Looking forward, business travel usually increases in the March to May period, and it will be interesting to see if the occupancy rate gets close to 64% for that period.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Policy Updates: Mortgage Settlement Reached, Greek politicians agree on Debt Deal

by Calculated Risk on 2/09/2012 10:28:00 AM

Back in January I listed several policies and agreements that were expected soon.

There were several key announcements today:

• From the WSJ: U.S., Banks Agree on Foreclosure Pact

The agreement covers five banks: Ally Financial Inc., Bank of America Corp.,Citigroup Inc., J.P. Morgan Chase & Co., and Wells Fargo & Co. Together, the five handle payments on 55% of all outstanding home loans ...Following this agreement, I expect the lenders to start reducing the foreclosure backlog. This will be a combination of more modifications (with principal reductions) and more foreclosures. In some states - especially judicial states like New York and Florida - this will probably lead to more REO sales (lender Real Estate Owned), but overall I don't think there will be a large flood of REOs on the market.

The agreement will include at least 49 states, and officials were finalizing a separate accord with one remaining holdout, Oklahoma.

Here is the press release from the Dept of Justice: Federal Government and State Attorneys General Reach $25 Billion Agreement with Five Largest Mortgage Servicers to Address Mortgage Loan Servicing and Foreclosure Abuses

• From the WSJ: Greek Political Leaders Reach Austerity Deal

Leaders of political parties backing Greece's caretaker government agreed Thursday on an austerity package to comply with demands set by international creditors for another bailout deal ... Euro-zone finance ministers were set to meet here late Thursday to take stock of the latest political talks in Athens to decide whether to push ahead with new aid for Greece.It seems likely that Greece will receive another round of financing.

• And on the ECB's 3 year Long Term Refinancing Operation (LTRO) from the Financial Times Alphaville: Here be Draghi, on ECB collateral

RTRS-DRAGHI-NEW COLLATERAL RULES WILL BE MORE RISKYThis means more collateral will be acceptable for the second LTRO on Feb 29th. The first 3 year LTRO was for €489 billion, and the second one could be over €1 trillion.

RTRS-DRAGHI=BUT RISK IS BEING MANAGED VERY WELL

RTRS-ECB’S DRAGHI – HAIRCUTS WILL REDUCE NEW COLLATERAL BY TWO-THIRDS

RTRS-ECB’s DRAGHI – EXPECT SUBSTANTIAL TAKEUP IN SECOND 3-YR TENDER, AROUND SAME AS DEC ONE

A few other policies to come:

• A surge in refinance activity in March. Not a new policy - this was announced last October when the FHFA made changes to Home Affordable Refinance Program (HARP) to allow more homeowners with GSE loans and with negative or near negative equity - and who are current on their mortgages - to refinance into lower interest rate loans. But as I mentioned in the January post, the elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until March.

• Extension of payroll tax cut and extended unemployment benefits: The two month extension expires Feb 29th, and I expect these two programs will be extended through the end of the year.

Weekly Initial Unemployment Claims decline to 358,000

by Calculated Risk on 2/09/2012 08:30:00 AM

The DOL reports:

In the week ending February 4, the advance figure for seasonally adjusted initial claims was 358,000, a decrease of 15,000 from the previous week's revised figure of 373,000. The 4-week moving average was 366,250, a decrease of 11,000 from the previous week's revised average of 377,250.The previous week was revised up to 373,000 from 367,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 366,250.

The 4-week moving average is at the lowest level since May 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down and is now well below 400 thousand.

Zillow: House prices declined 4.7% in 2011, Forecasts 3.7% decline in 2012

by Calculated Risk on 2/09/2012 12:01:00 AM

Another view on house prices from Zillow: Home Value Declines Pick Up in Fourth Quarter, But Zillow Forecasts Smaller Declines in 2012

The Zillow Real Estate Market Reports, released today, show home values decreased 1.1 percent from the third to the fourth quarter of 2011 to $146,900. On an annual basis, this represents a 4.7 percent decline. December’s data show that sequential improvements in year-over-year numbers have stopped, and the pace of monthly depreciation has once again picked up, with December’s monthly depreciation rate at 0.6 percent.And from a press release:

...

[W] believe 2012 will be a transitional year for real estate. Positive developments will include markets showing organic growth, and home sales increasing as the year proceeds. However, we maintain our forecast that home values will continue to fall in 2012, with the Zillow Home Value Forecast showing a 3.7 percent decline through December 2012.

...

Based on these forecasts, we expect more home value declines nationally in 2012. However, most markets will see improved trends over the course of the year.

“While it may be disconcerting for homeowners to see values nationally fell at a fairly rapid clip at the end of last year, that trend won’t last through 2012,” said Zillow Chief Economist Dr. Stan Humphries. “The fourth quarter’s weak performance proves that pronouncements of a bottom in home values have been premature, but the good news is that 2012 will prove to be a better year than 2011. In fact, many markets show signs of a bottom this year, although a bottom may continue to elude the nation as a whole in 2012. Fortunately, against a backdrop of modest further declines in home values, we expect that home sales will pick up briskly this year as affordable prices bring more buyers to the table – especially investors and second-home buyers.”

Wednesday, February 08, 2012

WSJ: Mortgage Settlement could be announced Thursday, to include Florida, California, New York

by Calculated Risk on 2/08/2012 07:20:00 PM

From the WSJ: Banks Near $25 Billion Pact on Foreclosure Probe

Government officials are on the verge of an agreement worth as much as $25 billion with five major banks ... Federal officials were planning to announce the accord Thursday morning, but the timing could yet be pushed back as some details had yet to be ironed out. Among them: the precise size of the agreement and the number and identity of participating states.

...

The Obama administration made a full-court press over the past four days to secure the support of key state attorneys general, including those from Florida, California and New York.

All three overcame misgivings about the plan in recent days, people familiar with the situation said.