by Calculated Risk on 2/04/2012 08:09:00 AM

Saturday, February 04, 2012

Summary for Week ending February 3rd

The data released last week was solid, with the exception of house prices. Both the Case-Shiller index for November, and the CoreLogic index for December showed additional house price declines and new post bubble lows.

The employment report was well above expectations. There were 243,000 payroll jobs added in January, with 257,000 private sector jobs added. Government employment declined by 14,000 jobs. The unemployment rate fell to 8.3% from 8.5% in December. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 15.1%. This remains very high - U-6 was in the 8% range in 2007.

The annual benchmark revision indicated 165,000 more payroll jobs in March 2011; the first positive benchmark revision since 2006. The BLS also adjusted the population control using the Census 2010 data, and this led to some data distortions – but overall the report was positive.

Unfortunately there are still 12.8 million Americans unemployed, and 5.5 million who have been unemployed for more than 6 months. Those are very grim unemployment numbers.

Other positive data included auto sales, and the ISM manufacturing and service indexes. Also the apartment tightness index indicated that rental markets continued to tighten (good for multifamily construction and spillover to the single family market). Overall a solid week.

Here is a summary in graphs:

• January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

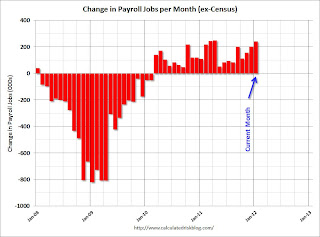

This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

Click on graph for larger image.

Click on graph for larger image.

Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and now it appears job growth is picking up again.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

The unemployment rate declined to 8.3% (red line).

The unemployment rate declined to 8.3% (red line).

The Labor Force Participation Rate declined to 63.7% in January (blue line). However the decline was related to the change in population control, and not people leaving the work force.

The Employment-Population ratio was unchanged at 58.5% in January (black line). This would have increased 0.3 with the change in population control.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was a relatively strong report and well above consensus expectations.

• ISM Manufacturing index indicates faster expansion in January

PMI was at 54.1% in January, up from a revised 53.1% in December. The employment index was at 54.3%, down from a revised 54.8%, and new orders index was at 57.6%, up from a revised 54.8%.

PMI was at 54.1% in January, up from a revised 53.1% in December. The employment index was at 54.3%, down from a revised 54.8%, and new orders index was at 57.6%, up from a revised 54.8%. From the Institute for Supply Management: January 2012 Manufacturing ISM Report On Business® Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.5%, but the consensus was before the revisions. This suggests manufacturing expanded at a faster rate in January than in December. It appears manufacturing employment expanded in January with the employment index at 54.3%.

• U.S. Light Vehicle Sales at 14.18 million annual rate in January

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.18 million SAAR in January. That is up 12.1% from January 2011, and up 5.1% from the sales rate last month (13.5 million SAAR in Dec 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.18 million SAAR in January. That is up 12.1% from January 2011, and up 5.1% from the sales rate last month (13.5 million SAAR in Dec 2011).The second graph shows light vehicle sales since the BEA started keeping data in 1967. This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

This was well above the consensus forecast of 13.6 million SAAR. Note: dashed line is current estimated sales rate.

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

From S&P: Home Prices Continued to Decline in November 2011 According to the S&P/Case-Shiller Home Price Indices

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 10 is at a new post bubble low (Seasonally adjusted), but still above the low NSA.

The Composite 20 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 20 is also at a new post-bubble low.

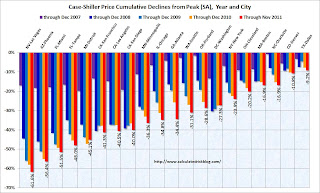

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.The NSA indexes are around 1% above the March 2011 lows - and these indexes will hit new lows in the next month or two since prices are falling again. Using the SA data, the Case-Shiller indexes are now at new post-bubble lows.

• CoreLogic: House Price Index declined 1.4% in December to new post-bubble low

From CoreLogic: CoreLogic® Prices fell by 4.7 percent nationally in 2011

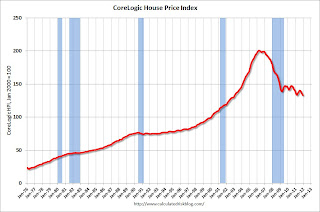

From CoreLogic: CoreLogic® Prices fell by 4.7 percent nationally in 2011This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.4% in December, and is down 4.7% over the last year.

The index is off 33.7% from the peak - and is now at a new post-bubble low.

Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March 2012. Last year prices fell about 4% from December 2010 to March 2011, and there will probably be a similar decline this year.

• NMHC Apartment Survey: Market Conditions Tighten in Recent Survey

From the National Multi Housing Council (NMHC): Apartment Industry Continues Recovery, Survey Says

From the National Multi Housing Council (NMHC): Apartment Industry Continues Recovery, Survey SaysThis graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last eight quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q4 2011 to 5.2%, down from 5.6% in Q3 2011, and 9.0% at the end of 2009.

• ISM Non-Manufacturing Index indicates faster expansion in January

The January ISM Non-manufacturing index was at 56.8%, up sharply from 53.0% in December. The employment index increased in January to 57.4%, up from 49.8% in December. Note: Above 50 indicates expansion, below 50 contraction.

The January ISM Non-manufacturing index was at 56.8%, up sharply from 53.0% in December. The employment index increased in January to 57.4%, up from 49.8% in December. Note: Above 50 indicates expansion, below 50 contraction. From the Institute for Supply Management: December 2011 Non-Manufacturing ISM Report On Business®

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 53.3% and indicates faster expansion in January than in December.

• Weekly Initial Unemployment Claims decline to 367,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 375,750.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 375,750.Weekly claims have been bouncing around lately - January is a period with large seasonal adjustments and that can lead to some large swings. The 4-week average of weekly claims has been moving sideways this year after trending down over the last few months of 2011.

• Other Economic Stories ...

• Restaurant Performance Index highest in almost six years in December

• A few policies I expect soon

• Fed Senior Loan Officer Survey: Lending standards "little changed", "somewhat stronger loan demand"

• From the Dallas Fed: Texas Manufacturing Activity Picks Up

• Personal Income increased 0.5% in December, Spending decreased slightly

• Fannie Mae Serious Delinquency rate declines, Freddie Mac rate increases

• Q4 2011 GDP Details: Investment in Office, Mall, and Lodging, Residential Components

Friday, February 03, 2012

Unofficial Problem Bank list unchanged at 958 Institutions

by Calculated Risk on 2/03/2012 10:14:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 3, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Quiet week for the Unofficial Bank List with no closings, one voluntary liquidation, and one addition. The list is unchanged at 958 institutions but assets increased by nearly $600 million to $389.6 billion. The First National Bank of Ordway, Ordway, CO ($45 million) underwent a voluntary liquidation in late January. The sole addition was Community West Bank, National Association, Goleta, CA ($643 million Ticker: CWBC) after the OCC issued a Consent Order against the bank. The only other change was a Prompt Corrective Action order issued by the Federal Reserve against Bank of Bartlett, Bartlett, TN ($371 million). Next week will likely be quiet as well.Earlier Employment posts:

• January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

• Graphs: Unemployment Rate, Participation Rate, Jobs added

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Employment Graphs

Employment: The "Not in Labor Force" actually declined in January

by Calculated Risk on 2/03/2012 06:23:00 PM

Some readers sent me a link to some terrible analysis that argued over 1 million people left the labor force in January. I pointed out the error. Apparently Rick Santelli at CNBC made the same mistake and reads the wrong blogs!

The Bonddad blog points out the error: No Rick Santelli and Zero Hedge, One Million People Did Not Drop Out of the Labor Force Last Month (CR note: I never read zero).

This does bring up an important point: The BLS updated the population estimates today based on the 2010 Census. I mentioned this in the preview yesterday and in the posts this morning. For whatever reason, the Census Bureau doesn't go back and revise the earlier population estimates, but they do provide analysis of the changes in several key numbers if the population estimate hadn't been changed.

Below is the table from the BLS:

With the 2010 population controls, the "not in labor force" appeared to have increased by 1.2 million in January, and the working age population jumped 1.7 million. That didn't happen last month; the numbers changed because of the new population estimate. This does suggests there are 1.2 million more people out of the labor force than we originally thought, but that is because the working age population is larger than previously estimated.

As the BLS points out, without the population change the "not in labor force" actually declined.

A couple other key points:

1) The decline in the participation rate was entirely due to the population change.

2) The employment-population ration would have increased 0.3 (good news) without the population change.

| Category | Dec.-Jan. change, as published | 2012 population control effect | Dec.-Jan. change, after removing the population control effect1 |

|---|---|---|---|

| Civilian noninstitutional population | 1,685 | 1,510 | 175 |

| Civilian labor force | 508 | 258 | 250 |

| Participation rate | -0.3 | -0.3 | 0 |

| Employed | 847 | 216 | 631 |

| Employment-population ratio | 0 | -0.3 | 0.3 |

| Unemployed | -339 | 42 | -381 |

| Unemployment rate | -0.2 | 0 | -0.2 |

| Not in labor force | 1,177 | 1,252 | -75 |

| 1This Dec.-Jan. change is calculated by subtracting the population control effect from the over-the-month change in the published seasonally adjusted estimates. | |||

Earlier Employment posts:

• January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

• Graphs: Unemployment Rate, Participation Rate, Jobs added

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Employment Graphs

Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 2/03/2012 03:28:00 PM

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment increased by 21 thousand jobs in January, after increasing by 74 thousand jobs in all of 2011. Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Usually residential investment (and residential construction) leads the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course there was no pickup for residential construction this time because of the large excess supply of vacant homes.

Click on graph for larger image.

Click on graph for larger image.

Construction employment is now increasing and construction will add to both GDP and employment growth in 2012.

As I've noted for years, there are usually two bottoms for housing following a bubble: 1) when housing starts, new home sales, and residential construction bottoms, and 2) when house prices bottom. The bottom is in for construction and we are getting close on prices.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are moving down (the less than 5 week category is back to normal levels). The other categories are still high.

The the long term unemployed declined to 3.6% of the labor force - this is still very high, but the lowest since September 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 64.1 in January, up from 62.4 in December. For manufacturing, the diffusion index increased to 69.1, up from 64.2 in December.

This is a little more technical. The BLS diffusion index for total private employment was at 64.1 in January, up from 62.4 in December. For manufacturing, the diffusion index increased to 69.1, up from 64.2 in December. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth was spread across more industries in January (good news).

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Earlier Employment posts:

• January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

• Graphs: Unemployment Rate, Participation Rate, Jobs added

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• All Employment Graphs

ISM Non-Manufacturing Index indicates faster expansion in January

by Calculated Risk on 2/03/2012 12:56:00 PM

Catching up: The January ISM Non-manufacturing index was at 56.8%, up sharply from 53.0% in December. The employment index increased in January to 57.4%, up from 49.8% in December. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 25th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 56.8 percent in January, 3.8 percentage points higher than the seasonally adjusted 53 percent registered in December, and indicating continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 59.5 percent, which is 3.6 percentage points higher than the seasonally adjusted 55.9 percent reported in December, reflecting growth for the 30th consecutive month. The New Orders Index increased by 4.8 percentage points to 59.4 percent, and the Employment Index increased by 7.6 percentage points to 57.4 percent, indicating substantial growth in employment after one month of contraction. The Prices Index increased 1.5 percentage points to 63.5 percent, indicating prices increased at a slightly faster rate in January when compared to December. According to the NMI, 12 non-manufacturing industries reported growth in January. Respondents' comments are mostly positive about business conditions. There is concern about cost pressures and the sustainability of the recent spike in activity.

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 53.3% and indicates faster expansion in January than in December.

Earlier Employment posts:

• January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

• Graphs: Unemployment Rate, Participation Rate, Jobs added

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• All Employment Graphs