by Calculated Risk on 11/16/2011 02:58:00 PM

Wednesday, November 16, 2011

Rate of increase slows for Key Measures of Inflation in October

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.1 percent in October on a seasonally adjusted basis ... The index for all items less food and energy increased 0.1 percent in October; this was the same increase as last month and matches its smallest increase of the year.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.4% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for October here.

...

The CPI less food and energy increased 0.1% (1.6% annualized rate) on a seasonally adjusted basis. ... Over the last 12 months, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.5%, and the CPI less food and energy rose 2.1%.

On a year-over-year basis, these measures of inflation are increasing, and are slightly above the Fed's target. However, on a monthly basis, the rate of increase is mostly below the Fed's target.

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, the median Consumer Price Index increased 2.3% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.4% annualized, and core CPI increased 1.6% annualized.

These key price measures increased at a lower rate than in September.

Earlier:

• Industrial Production increased 0.7% in October, Capacity Utilization increased

• Residential Remodeling Index at new high in September

• AIA: Architecture Billings Index increased in October

• NAHB Builder Confidence index increases in November

AIA: Architecture Billings Index increased in October

by Calculated Risk on 11/16/2011 01:15:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Moves Upward

After a sharp dip in September, the Architecture Billings Index (ABI) climbed nearly three points in October. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 49.4, following a score of 46.9 in September. This score reflects an overall decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.3, up from a reading of 54.3 the previous month.

“An increase in the billings index is always an encouraging sign,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “We’re seeing some regions and some construction sectors move into positive territory. But there continues to be a high level of volatility in the marketplace with architecture firms reporting a wide range of conditions from improving to uncertain to poor. It’s likely we will see a similar state of affairs in the coming months.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index increased to 49.4 in October from 46.9 in September. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent surveys suggests further declines in CRE investment in 2012.

NAHB Builder Confidence index increases in November

by Calculated Risk on 11/16/2011 10:00:00 AM

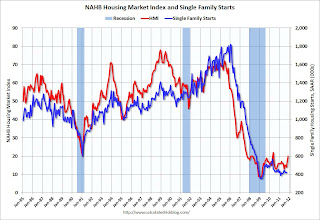

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in November to 20 from 17 in October. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Three Points in November

Builder confidence in the market for newly built, single-family homes rose by three points to 20 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for November, released today. The gain builds on a revised three-point increase in October, and brings the confidence gauge to its highest level since May of 2010.

...

“This second consecutive gain in the HMI is evidence that well-qualified buyers in select areas are being tempted back into the market by today’s extremely favorable mortgage rates and prices,” said NAHB Chief Economist David Crowe. “We are anticipating further, gradual gains in the builder confidence gauge heading into 2012 due to these pockets of improving conditions that are slowly spreading.”

...

Each of the HMI’s three component indexes continued to build on gains registered in the previous month in November. The component gauging current sales conditions rose three points to 20 – its highest level since May 2010 – while the component gauging future sales expectations rose two points to 25 – its highest level since March of 2011. The component gauging traffic of prospective buyers rose one point to 15, which was its highest point since May of 2010.

The HMI rose in three out of four regions in November, with a three-point gain to 17 registered in the Northeast, an eight-point gain to 23 registered in the Midwest, and a two-point gain to 21 registered in the South. After posting a big increase in October, the West returned to trend this month with a six-point decline to 15.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years. This is still very low, but this is the highest level since May 2010 - and that boost was due to the housing tax credit. Not counting the tax credit, the last time the index was above this level was in 2007.

Industrial Production increased 0.7% in October, Capacity Utilization increased

by Calculated Risk on 11/16/2011 09:30:00 AM

From the Fed: Industrial production and Capacity Utilization

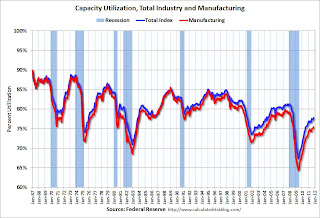

Industrial production expanded 0.7 percent in October after having declined 0.1 percent in September. Previously, industrial production was reported to have gained 0.2 percent in September; most of this revision resulted from lower estimated output for mining. Factory output increased 0.5 percent in October after having risen 0.3 percent in September. Production at mines climbed 2.3 percent in October, while the output of utilities edged down 0.1 percent. At 94.7 percent of its 2007 average, total industrial production for October was 3.9 percent above its year-earlier level. Capacity utilization for total industry stepped up to 77.8 percent, a rate 2.1 percentage points above its level from a year earlier but 2.6 percentage points below its long-run (1972--2010) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 94.7, however September was revised down.

The consensus was for a 0.4% increase in Industrial Production in October, and an increase to 77.6% for Capacity Utilization. Adjusting for the downward revision for September, this was about at consensus.

Residential Remodeling Index at new high in September

by Calculated Risk on 11/16/2011 06:00:00 AM

The BuildFax Residential Remodeling Index was at 141.4 in September, up from 138.6 in August. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax: Remodeling Activity Reaches Record Levels According to BuildFax Remodeling Index for September

Today, BuildFax®, unveiled its BuildFax Remodeling Index (BFRI) for September 2011, which shows that remodeling activity reached a record high during the month.

...

The latest BFRI showed that September 2011 became the month with the highest level of remodeling activity since the Index was introduced in 2004 and represented the 23rd consecutive month of increases. In addition, BuildFax data revealed the most popular permitted residential remodeling jobs since 2006 have been roof remodels/replacements, followed by deck and bathroom remodels.

...

“Mortgage rates continue to be near record lows, and as homeowners from coast to coast refinance, they are continuing to update their current home and invest in their properties,” said Joe Emison, Vice President of Research and Development at BuildFax. “The data from BuildFax show that homeowners are not only doing important ‘maintenance’ projects, such as fixing their roof, but also taking on projects that add to the ‘livability’ of their homes by adding decks, remodeling their bathrooms and updating their kitchens."

Click on graph for larger image.

Click on graph for larger image.This is the highest level for the index (started in 2004) - even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 34% from September 2010. This is the highest year-over-year increase in activity since the index started.

Even though new home construction is still moving sideways, two other components of residential investment will increase in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com