by Calculated Risk on 11/04/2011 07:11:00 PM

Friday, November 04, 2011

Bank Failures #86 & 87: Utah and Nebraska

No E.U. to bail them out.

We are not Sparta!

by Soylent Green is People

From the FDIC: Purdum State Bank, Purdum, Nebraska, Assumes All of the Deposits of Mid City Bank, Inc., Omaha, Nebraska

As of September 30, 2011, Mid City Bank, Inc. had approximately $106.1 million in total assets and $105.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $12.7 million. ... Mid City Bank, Inc. is the 86th FDIC-insured institution to fail in the nation this year, and the first in Nebraska.From the FDIC: Cache Valley Bank, Logan, Utah, Assumes Deposits of SunFirst Bank, Saint George, Utah

As of September 30, 2011, SunFirst Bank had approximately $198.1 million in total assets and $169.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $49.7 million. ... SunFirst Bank is the 87th FDIC-insured institution to fail in the nation this year, and the first in UtahIt is Friday!

Report on Greece: Papandreou to Stand Down, Venizelos to Form Government, Elections in February

by Calculated Risk on 11/04/2011 06:34:00 PM

UPDATE via Athens News: 00.56am The voting has finished. Unconfirmed results on Twitter: Yes 153, No 143. Papandreou has won.

From Reuters: Greek Leaders Strike Deal for a New Government

Greek Prime Minister George Papandreou has struck a deal to stand down and let Finance Minister Evangelos Venizelos form a coalition government ... They said Venizelos had won the backing of leaders of some smaller parties to support the coalition, which would also aim to avert an immediate Greek bankruptcy, before calling early elections in a few months.And a comment from Venizelos via the Athens News: Live news blog – November 4

Finance Minister Evangelos Venizelos giving a speech. Says country needs effective government. Has just said that interim government should stay in power until February, then elections.Here are the earlier employment posts (with graphs):

• October Employment Report: 80,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Seasonal Retail Hiring, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• NEW Employment graph gallery (fast, no scripting)

Greek Confidence Vote Resources

by Calculated Risk on 11/04/2011 05:41:00 PM

A couple of resources:

From the Athens News: Live news blog – November 4 Most recent at top ...

11.40pm "I don't care if I'm not re-eelected."From the Telegraph: Debt crisis: live

11.39pm Papandreou: "It's time for cooperation." In June, I tried to set up govt of national cooperation.

11.37pm Mentions more achievements: methadone programme, fast track on developments, surge in tourist numbers, suspending dodgy doctors who take bribes, etc

Also mentioned football!

11.35pm Is reading out a list of things he would do if crossparty agreement can be achieved.

11.33pm Papandreou says all parties should support October 27 agreement.

11.32pm If elections took place, parliament would be out of action for weeks. Would be unable to vote on 2012 budget.

11.30pm Has now turned to subject of elections: he is against elections.

11.28pm With the referendum, he wanted to bypass Byzantium and go back to direct democracy Ancient Greece!

...

11.26pm Papandreou recounts some of his achievements. Mentions free radio, Open University, delegalising cannabis, allowing migrant children enter university, e-government etc

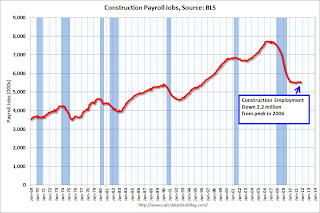

Construction Employment: Down in October, up slightly in 2011

by Calculated Risk on 11/04/2011 03:10:00 PM

The graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment declined by 20 thousand jobs in October, and is now down 2.2 million jobs from the peak in April 2006. However construction employment is up 27 thousand this year through the October BLS report.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Usually residential investment (and residential construction) lead the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions.

Construction employment is mostly moving sideways, but at least it is not a drag on employment and GDP this year - and that helps.

This table below shows the annual change in construction jobs (total, residential and non-residential) and through October for 2011.

| Annual Change in Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential Construction Jobs | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| Through October 2011 | 27 | 11 | 16 |

After five consecutive years of job losses for residential construction (and four years for total construction), it looks like construction employment will increase this year. However there will not be a strong increase in residential construction until the excess supply of housing is absorbed.

In addition residential investment has made a small positive contribution to GDP so far this year - for the first time since 2005.

Here are the earlier employment posts (with graphs):

• October Employment Report: 80,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Seasonal Retail Hiring, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• NEW Employment graph gallery (fast, no scripting)

Seasonal Retail Hiring, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 11/04/2011 12:21:00 PM

Here are the earlier employment posts (with graphs):

• October Employment Report: 80,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• NEW Employment graph gallery (fast, no scripting)

And a few more graphs ...

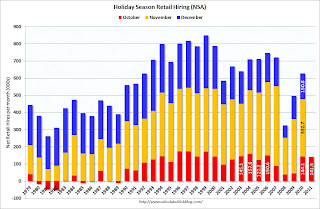

According to the BLS employment report, retailers hired seasonal workers at close to the pre-crisis pace in October.

Click on graph for larger image.

Click on graph for larger image.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This really shows the collapse in retail hiring in 2008, and the increases in 2009 and 2010.

Retailers hired 141.5 thousand workers (NSA) net in October. This is about the same level as in 2003 through 2006 and the same as in 2010. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season.

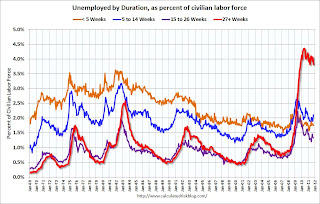

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Only one category increased in October: The 6 to 14 weeks. This is due to the increase in short term unemployment in August and September. A little bit of recent good news is that short term unemployment (less than 5 weeks) has declined.

The the long term unemployed declined to 3.8% of the labor force - the number (and percent) of long term unemployed remains very high.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 60.7 in October, up from 56.7 in September. For manufacturing, the diffusion index increased to 51,9, up from 50 in September.

This is a little more technical. The BLS diffusion index for total private employment was at 60.7 in October, up from 56.7 in September. For manufacturing, the diffusion index increased to 51,9, up from 50 in September. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth is spread across more industries in October, and that is a little bit of good news.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.